كتاب روابط اجتياز لـ C. CVA Capital Calculation

C. CVA Capital Calculation

C 52/2017 STA يسري تنفيذه من تاريخ 1/4/20218.The bank must calculate the discounted counterparty exposure for each counterparty by multiplying the total EAD for the counterparty as calculated under these Standards by a supervisory discount factor (DF) for each netting set that reflects notional weighted-average maturity of the counterparty exposures:

![]()

where

is the sum of the EADs for all of the exposures to counterparty “i” within the netting set,

![]()

Mi is the weighted average maturity for the netting set for counterparty “i”, using notional values for the weighting.

If the bank has more than one netting set with a counterparty, the bank should perform this calculation for each netting set with that counterparty separately, and sum across the netting sets.

9.For any eligible single-name hedges for the counterparty, the bank computes the discounted value of the hedges, again using a supervisory discount factor that depends on the maturity of the hedge:

![]()

where

Hi is the notional value of a purchased eligible single-name hedge referencing counterparty ‘i’ and used to hedge the CVA risk,

![]()

Mh is the maturity of that hedge instrument.

If the bank has more than one instrument hedging single-name CVA risk for the counterparty, the bank should sum the discounted values of the individual hedges within each netting set.

10.For each counterparty, the bank should calculate single-name exposure (SNE) as the discounted counterparty exposure minus the discounted value of eligible single-name CVA hedges. With a single netting set and single hedge instrument, this calculation is:

![]()

11.With multiple netting sets for the counterparty (for EAD) or multiple-single name hedge instruments (for H), the corresponding terms in the SNE calculation would be the summations for the given counterparty as required above.

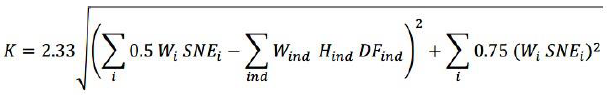

12.If the bank uses single-name hedging only, the bank must use SNE for its counterparties to calculate CVA capital using the following formula:

where Wi is the risk weight applicable to counterparty "i" from Table 1.

13.Each counterparty must be assigned to one of the seven rating categories in Table 1, based on the external credit rating of the counterparty. When a counterparty does not have an external rating, the bank should follow the approach used in the CCR Standard for credit derivatives that reference unrated entities. A bank should map alternative rating scales to the ratings in Table 1 based on an analysis of historical loss experience for each rating grade.

Table 1: Risk Weights for CVA Capital Calculation

| Rating | Risk Weight |

| AAA | 0.7% |

| AA | 0.7% |

| A | 0.8% |

| BBB | 1.0% |

| BB | 2.0% |

| B | 3.0% |

| CCC | 10.0% |

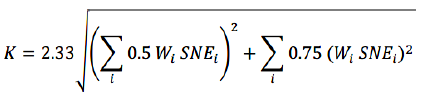

14.If the bank also uses index hedges for CVA risk management, the CVA capital calculation is modified to include an additional reduction in systematic risk according to the following formula:

where

Hind is the notional of an eligible index hedge instrument used to hedge CVA risk,

![]()

Mind is the maturity of that index hedge, and

other variables are as defined above in this Standard.

The summation is taken across all index hedges. To determine the applicable risk weight for any index hedge, the bank should determine the risk weight from Table 1 that would apply to each component of the index, and use the weighted-average of these risk weights as Wind, with weights based on the notional composition of the index.

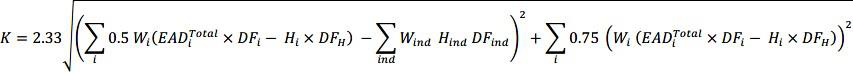

15.An alternative version of the full calculation (including index hedges) that gives the same result, but without the intermediate step of calculating SNE, is the following:

16.For any counterparty that is also a constituent of an index referenced by a CDS used for hedging CVA risk, the bank may, with supervisory approval, subtract the notional amount attributable to that single name within the index CDS (as based on its reference entity weight) from the index CDS notional amount (Hind), and treat that amount within the CVA capital calculation as a single-name hedge (Hi) of the individual counterparty with maturity equal to the maturity of the index.