كتاب روابط اجتياز لـ Appendix 5: Threshold Deduction

Appendix 5: Threshold Deduction

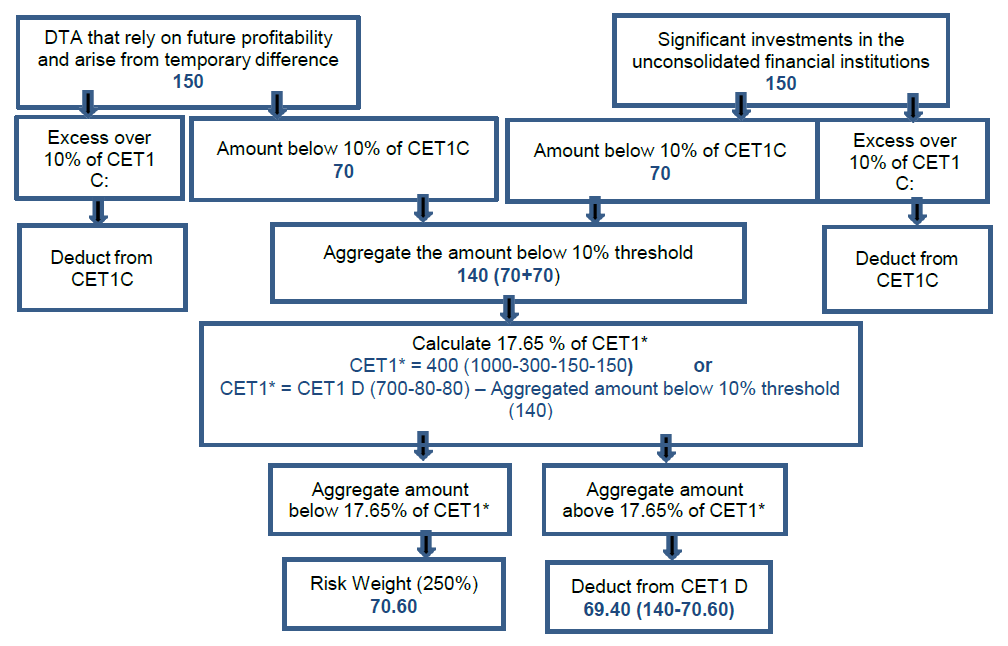

C 52/2017 GUI يسري تنفيذه من تاريخ 1/4/2021This Appendix is meant to clarify the reporting of threshold deduction and calculation of the 10% limit on significant investments in the common shares of unconsolidated financial institutions (banks, insurance and other financial entities); and the 10% limit on deferred tax assets arising from temporary differences.

| CET1 Capital (prior to regulatory deductions) | 1000 |

| Regulatory deductions: | 300 |

| Total CET1 after the regulatory adjustments above (CET1C) | 700 |

| Total amount of significant investments in the common share of banking, financial and insurance entities | 150 |

| Total amount of Deferred tax assets arising from temporary differences | 150 |

*This is a “hypothetical” amount of CET1 that is used only for the purpose of determining the deduction of above two items for the aggregate limit. Amount of CET1 = Total CET1 (prior to deduction) – All the deduction except the threshold deduction (i.e. all deduction outlined in para 44 to 68 of the Tier Capital Supply Standards) minus the total amount of both DTA that rely on future profitability and arise from temporary difference and significant investments in the unconsolidated financial institutions.