6.3 Liquidity Coverage Ratio

- a.LCR is the ratio of the stock of High Quality Liquid Assets (“HQLA”) to total net cash outflows over the next 30 days. It represents a 30 days stress scenario with combined assumptions covering both bank specific and market wide stresses.

- b.The objective of the LCR is to promote IBs’ resilience against short-term liquidity shocks. To meet this requirement, an IB is obliged to have an adequate stock of unencumbered HQLA that can be converted easily and immediately into cash with no or little loss of value, in order to meet its liquidity needs for a 30-calendar-day period under a liquidity stress scenario. This is based on the assumption that, if the requirement is met, the IB could survive for the 30 days of the given stress scenario. This period allows the IB an adequate time to make necessary arrangements and undertake corrective actions to resolve internal liquidity problems.

- c.Therefore, the LCR is based on the assumption that a combined set of idiosyncratic and market-wide shocks may trigger the run-off of a proportion of retail deposits, including investment accounts, and a partial loss of unsecured wholesale funding capacity. The LCR is also developed based on the possibility that stressed market conditions would result in a partial loss of secured, short-term financing with certain collateral and counterparties, and an increase in market volatilities that impact the quality and solvency of the collateral, given that many IB’s transactions are backed by physical assets. In volatile market conditions, an IB may encounter additional contractual outflows and unscheduled drawdowns of committed but unused credit and liquidity facilities. Similarly, IB could find itself compelled to honor non-contractual obligations for the sake of avoiding the reputational risk that would arise from a perception by the market that the IB was, for example, allowing a related entity to become insolvent.

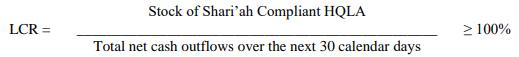

6.3.1 Formula for Calculating LCR

- a. The LCR consists of two components:

HQLA (Shari’ah-compliant) as the numerator and net cash outflows over the next 30 days as the denominator, both in a stress scenario. The HQLA are the assets that can be easily and immediately converted into cash, with no or little loss of value, during a time of stress.

The total net cash outflows will be calculated as the total expected cash outflows minus total expected cash inflows in the specified stress scenario for the subsequent 30 calendar days. - b. The formula for calculating LCR, therefore, is as follows:

- c. Total expected cash inflows are calculated by multiplying the outstanding balances of various categories of contractual receivables by the rates at which they are expected to flow in under the specified scenario up to an aggregate cap of 75% of total expected cash outflows. There is a cap applied on total cash inflows in order to prevent IBs from relying solely on anticipated inflows to meet their liquidity requirements, and also to ensure a minimum level of HQLA holdings. Accordingly, the amount of inflows that can offset outflows is capped at 75% of total expected cash outflows. Therefore, by applying this cap, the IB is required to hold a minimum amount of stock of HQLA equal to 25% of the total net cash outflows.

- d.

Total net cash outflows over the next 30 calendar days = Total gross expected cash outflows - Lesser of (total expected cash inflows; 75% of total expected cash outflows) - e. The LCR requirement is based on a scenario that entails a combination of idiosyncratic and market-wide shocks; nevertheless, IBs must develop its own scenarios based on liquidity stress testing of their portfolio. IBs must hold more HQLA if the results of their stress tests indicate that this is necessary. Such internal stress tests must incorporate longer time horizons than that mandated by this Standard. IB is expected to share the results of these additional stress tests with the Central Bank.

- a. The LCR consists of two components:

6.3.2 Components of High-Quality Liquid Assets (HQLA)

- a.The HQLA are defined as assets unencumbered by liens and other restrictions on transfer which can be converted into cash easily and immediately, with little or no loss of value, including under the stress scenario.

- b.HQLA are to be determined on the basis of the eligibility criteria for different categories of HQLA and must be subject to the limits applicable to each category. These eligibility criteria for HQLA and composition limits are intended to ensure that an IB’s HQLA stock provides it with the ability to generate liquidity in fairly short order, through sale or secured funding in a stress scenario. The assets are required to meet fundamental and market-related characteristics, particularly in terms of low risk, ease and certainty of valuation, and low volatility. HQLA is also eligible for intraday and overnight liquidity facilities offered by the Central Bank.

- c.To be considered as HQLA, an asset must also have a low correlation with risky assets, an active and sizeable market, and low volatility. This requirement has to be fulfilled at all times, including during an underlying stress scenario. These factors assist the Central Bank to determine which assets qualify as HQLA. The Central Bank also will consider risk components of HQLA, such as liquidity risk, market risk, credit risk, and operational risk. For Shari’ah-compliant assets, the risk of Shari’ah non-compliance and associated reputational problems could significantly limit liquidity for these assets – both sale and interbank trading – in the secondary market.

- d.HQLA (except Level 2B assets, as defined below) is eligible for use as collateral when seeking short- to medium-term liquidity facilities from the Central Bank.

- e.To meet HQLA requirements, the assets must possess the following characteristics:

i.Fundamental characteristics:

The assets must be low risk, as reflected in the high credit rating of the issuer or the instruments. The assets must be easy to value, have a homogeneous and relatively simple structure, and not be subject to wrong-way (highly correlated) risk. Shari’ah compliance of the structure and contracts underlying the liquid assets is another critical criterion of HQLA for IBs. Ideally, the asset must be listed on a national, regional or international stock exchange to ensure that sufficient information on pricing and trading is available to the public.ii.Market-related characteristics

The assets are expected to be liquefiable at any time. Thus, as far as possible, there must be historical evidence of market breadth and depth. This could be demonstrated by low bid–ask spreads, high trading volumes, and a large and diverse number of market participants. Availability of market-makers is another factor for consideration. The asset prices are expected to have remained relatively stable and be less prone to sharp price declines over time, including during stress conditions.

Assets must be tested through sale or Shari’ah-compliant alternatives of repurchase (repo) transactions to ascertain whether the liquid assets meet the criteria of “high quality” and fulfil the fundamental and market-related characteristics mentioned above. It is required that the liquidity-generating capacity of HQLA remains unchanged in periods of severe idiosyncratic and market stress. Lower-quality assets typically fail to meet that test. It must be noted that, in severe market conditions, if IBs attempt to raise liquidity from lower-quality assets, this will lead to significantly discounted prices. This may not only worsen the market’s confidence in the Islamic Banks but also may generate mark-to-market losses for its similar assets and put pressure on its liquidity position. In these conditions, market liquidity for lower-quality assets is likely to disappear quickly.

6.3.3 Categorisation of HQLA

- a.Level 1 Assets:

HQLA are divided into two main categories or levels: Level 1 and Level 2. Level 1 assets can constitute an unlimited share of the pool and are not normally subject to a haircut under the LCR. - b.Level 1 assets are limited to:

- a.Coins and Banknotes;

- b.Reserves and account balances held at the Central Bank;

- c.Central Bank’s Islamic CDs;

- d.Sukuk and other Shari’ah-compliant marketable securities issued or guaranteed by UAE Federal Government or Local Governments;

- e.Sukuk and other Shari’ah-compliant marketable securities issued or guaranteed by multilateral development banks (MDBs) which are assigned a 0% risk weight;

- f.Sukuk and other Shari’ah-compliant marketable securities issued by foreign sovereign or foreign central banks that have a 0% risk weight; and

- g.Sukuk and other Shari’ah-compliant marketable securities issued by UAE Public Sector Entities’ (PSE or GRE) that have a non-0% risk weight.

- c.Those assets that are 0% risk weighted and unrated are unlikely to have the same depth of market as those that are rated above investment grade in a stress scenario. IBs must take this into account when assessing an asset’s suitability and a liquidity premium charged. In any case, 0% risk weighted assets that are not rated cannot exceed 25% of the total Level 1 HQLA.

- d.Level 2A Assets:

Level 2 assets compromise Level 2A and Level 2B assets as permitted by the Central Bank. Level 2A assets are limited to the following, subject to a 15% haircut applied to the current market value of each asset:- a.Shari’ah-compliant marketable securities/Sukuk issued or guaranteed by sovereigns, central banks, PSEs, MDBs, which are assigned a 20% risk weight;

b.Shari’ah-compliant securities (including Shari’ah-compliant commercial paper) and Sukuk that satisfy all of the following conditions:

- i.not issued by an IB /financial institution or any of its affiliated entities;

- ii.either: (a) have a long-term credit rating from a recognised external credit assessment institution (ECAI) of at least AA- or, in the absence of a long-term rating, a short-term rating equivalent in quality to the long-term rating; or (b) do not have a credit assessment by a recognised ECAI but are internally rated as having a probability of default corresponding to a credit rating of at least AA-.

These assets must be:

a) traded in a market characterised by a low level of concentration; and

b) able to be regarded as a reliable source of liquidity at all times (i.e. maximum decline of price must not exceed volatility targets over a 30 day period during a relevant period of significant liquidity stress).

- e.Level 2B Assets:

The Level 2B assets are limited to the following:- 1)Sukuk and other Shari’ah-compliant securities backed by commodity(ies) and other real asset(s) that satisfy all of the following conditions, subject to a 25% haircut:

- i.not issued by the IB, and the underlying assets have not been originated by, the IB itself or any of its affiliated entities;

- ii.have a long-term credit rating from a recognised ECAI of AA or higher, or in the absence of a long-term rating, a short-term rating equivalent in quality to the long-term rating;

- iii.being traded in a market characterised by a low level of concentration and being regarded as a reliable source of liquidity at all times – that is, a maximum decline of price must not exceed volatility targets over a 30 day period during a relevant period of significant liquidity stress; and

- iv.the underlying asset pool is restricted to Shari’ah-compliant (residential) mortgages and cannot contain structured products.

- 2)Sukuk and other Shari’ah-compliant securities that satisfy all of the following conditions may be included in Level 2B, subject to a 50% haircut:

- i.not issued by a financial institution or any of its affiliated entities;

- ii.either: (a) have a long-term credit rating from a recognised ECAI of between A+ and BBB- or, in the absence of a long-term rating, a short-term rating equivalent in quality to the long-term rating; or (b) do not have a credit assessment by a recognised ECAI and are internally rated as having a probability of default corresponding to a credit rating of between A+ and BBB-; and

- iii.being traded in a market characterised by a low level of concentration and being regarded as a reliable source of liquidity at all times – that is, a maximum decline in price not exceeding 20% or an increase in a haircut over a 30-day period not exceeding 20 percentage points during a relevant period of significant liquidity stress.

- 3)Shari’ah-compliant equity shares that satisfy all of the following conditions may be included in Level 2B, subject to a 50% haircut:

- i.not issued by a financial institution or any of its affiliated entities;

- ii.exchange traded and centrally cleared;

- iii.a constituent of the major stock index in the UAE or where the liquidity risk is taken, as decided by the Central Bank of the UAE where the index is located;

- iv.denominated in the UAE dirhams or in the currency of the jurisdiction where its liquidity risk is taken; and

- v.being traded in a capital market characterised by a low level of concentration and being regarded as a reliable source of liquidity at all times – that is, a maximum decline in share price not exceeding 40% or an increase in a haircut not exceeding 40 percentage points over a 30-day period during a relevant period of significant liquidity stress.

- 4)Other Shari’ah-compliant instruments or Sukuk that are widely recognised in the UAE may be included in Level 2B, subject to a minimum 50% haircut if they meet the following conditions:

- i.not issued by a financial institution or any of its affiliated entities; and

- ii.being traded in a market characterised by a low level of concentration and being regarded as a reliable source of liquidity at all times.

- 5)Sukuk and other Shari’ah-compliant marketable securities issued by sovereign or central banks rated BBB+ to BBB- that are not included in Level 1 assets may be included in Level 2B assets with a 50% haircut.

- 1)Sukuk and other Shari’ah-compliant securities backed by commodity(ies) and other real asset(s) that satisfy all of the following conditions, subject to a 25% haircut:

- f.A cap will be applicable to the use of Level 2 assets, up to 40% of the total stock of HQLA, after the application of required haircuts. Specific to the Level 2B assets, the total assets under this category must comprise no more than 15% of the total stock of HQLA after the application of required haircuts and must be included within the overall 40% cap on Level 2 assets.

- g.Given that the UAE Dirham is pegged to the US Dollar, for the sake of flexibility US$/AED currency mismatches can be offset. It must be noted though that it is required that liquid assets be held in the currency of the net outflow, including both the US$ and AED individually, and IBs are expected to comply where possible. However, net outflows in other GCC currencies pegged to the US$ that exceed 15% of the total LCR net outflows must be matched. Other pegged and free floating currencies must be matched if they exceed 10% of total net LCR outflows.

- a.Level 1 Assets:

6.3.4 Operational Considerations for HQLA

- a.Assets meeting the fundamental and market-related characteristics cannot automatically be recognised as HQLA. The assets are subject to operational requirements that are designed to ensure that the stock of HQLA is managed in such a way that an IB can, and is able to demonstrate that it can, immediately use the stock of assets as a source of contingent funds that is available to the IB to convert into cash through Shari’ah-compliant mechanisms – that is, outright sale or the use of Shari’ah-compliant alternatives to repurchase (repo) transactions – to fill funding gaps between cash inflows and outflows at any time during the 30-day stress period, with no restriction on the use of the liquidity generated. IBs may follow the internationally accepted operational requirements for the asset to be recognised as HQLA.

- b.In particular, the assets must fulfil the following operational requirements:

- i.All assets included in HQLA must meet the requirement to be unencumbered, which means free of legal, regulatory, contractual or other restrictions on the ability of the IBs to liquidate, sell, transfer or assign the asset. However, assets which qualify as HQLA that have been pre-positioned or deposited with, or pledged to, the Central Bank or a PSE, but have not been used to generate liquidity, may be included in the stock.

- ii.The assets must be under the control of the IB’s liquidity risk management function. IBs may segregate the HQLA from other assets with the sole intent to use HQLA as a source of liquidity. IBs must undertake the necessary initiatives to ensure the assets are accessible to the market, to minimise the risk that they cannot be transferred and liquidated during a period of actual stress. To ensure the liquidity of the HQLA in a stress period, IBs must periodically liquidate a sample of HQLA to test their access to the market, the effectiveness of their processes of liquidation, and the availability of the assets.

- iii.IBs must mitigate market and rate of return risk associated with ownership of the stock of HQLA in accordance with the Shari’ah rules and principles. IBs must also consider the impact of early settlement on the mitigation technique, if applicable, as well as other risks that may occur due to such transactions. If an IB chooses to mitigate some underlying risk by hedging it in a Shari’ah-compliant manner, the IB must include in its total cash outflows those that would result from the termination of any specific hedging transaction against the HQLA.

- iv.Any surplus of HQLA held by a legal entity within a group can be included at the consolidated level only if those assets would also be freely available to the consolidated (parent) entity in times of stress.

- v.A bank must develop and implement procedures, systems and controls that enable it to determine the stock of HQLA in terms of composition and various characteristics. Such procedures and systems enable the IBs to:

- •confirm the eligibility of an asset for inclusion as a HQLA;

- •ensure that its HQLA are appropriately diversified across asset type, issuer, currency and other factors associated with liquidity risk;

- •identify the location of HQLA; and

- •confirm that the amounts of HQLA held in foreign markets are adequate to meet its LCR in those markets.

- vi.IBs must periodically monetise a representative proportion of the assets in its stock of HQLA through sale and Shari’ah-compliant alternatives of repurchase (repo) transactions in order to test its access to the market, the effectiveness of its processes for liquidation and the availability of the assets, and to minimise the risk of negative signaling during a period of actual stress.

- c.The stock of HQLA must be well diversified within the asset classes (except for instruments issued by the sovereign government of the UAE or from the jurisdiction in which the IB operates, Central Bank reserves, Central Bank securities and cash). IB must therefore have policies and limits in place in order to avoid concentration with respect to asset types, issue and issuer types, and currency (consistent with the distribution of net cash outflows by currency) within asset classes.

- d.IBs must endeavour to hold eligible liquid assets in the currencies that match the currencies of the net cash outflow. Liquid asset portfolios must be well diversified in terms of counterparties and tenor and held for the sole purpose of managing liquidity risk.

6.3.5 Components of Total Net Cash Outflows

- a.The term “total net cash outflows” is defined as the total expected cash outflows minus total expected cash inflows in the specified stress scenario for the subsequent 30 calendar days. Total expected cash outflows are calculated by multiplying the outstanding balances of various categories or types of liabilities and IA, and off-balance sheet (OBS) commitments by the rates at which they are expected to run off or be drawn down.

- b.Total expected cash inflows are calculated by multiplying the outstanding balances of various categories of contractual receivables by the rates at which they are expected to flow in under the scenario up to an aggregate cap of 75% of total expected cash outflows.

- c.To avoid double counting, for assets that are included as part of the stock of HQLA (i.e. the numerator of the LCR), the associated cash inflows cannot also be counted as cash inflows in calculating net cash outflows. Therefore, instruments that are utilised for intraday liquidity facilities must be excluded from the components of HQLA. Obligations arising from the assets will remain recorded as components of total net cash outflows.

6.3.6 Cash Outflows

- a.IB shall calculate total cash outflows based on the categories of cash outflows as listed below. Each category consists of various types of liabilities or IA, which have their own run-off factors tied to their behavioral characteristics.

- b.Treatment of IAs

Income-earning deposits with IB, whether retail or wholesale, typically take the form of IA, which are categorised as follows:

a) Restricted IA (RIA), and

b) Unrestricted IA (UIA). - c.The applicable run-off factor for IA depends on the withdrawal rights of the IAH and whether they are retail or wholesale accounts. Whether the IA are reported on-or off-balance sheet is not relevant. In the case of RIA, IAH may or may not have the right to withdraw funds before the contractual maturity date. For RIA with no withdrawal rights prior to maturity, the IB managing the RIA is not exposed to run-off for LCR purposes, unless the contract maturity date falls within the next 30 days. Alternatively, IAH may have withdrawal rights subject to giving at least 30 days’ notice. In this case, also, the IBs managing these RIA is not exposed to run-off from them for LCR purposes (except for those accounts for which notice of withdrawal has been given and the withdrawal date falls within the next 30 days, or those which mature within the next 30 days). Only in the case of RIA from which the IAH may withdraw funds at less than 30 days’ notice without any “significant reduction of profit” is the IB exposed to run-off for LCR purposes. To be “significant”, a reduction of profit must be considerably more than a mere loss of accrued income. Where an IB offers such RIA, it would be expected to retain a proportion of HQLA in the relevant RIA fund in order to meet withdrawals, in which case the HQLA would be netted off the amount of the run-off in calculating the total net cash outflows. However, it must be noted that if an IB has voluntarily waived such restrictions and permitted withdrawals to be made at short notice (i.e. less than 30 days) without any significant reduction of profit, such restrictions will have to be ignored subsequently in determining the applicable run-off factor. The run-off factor applied to the RIA is based on the aforementioned minimum ratios. Where the funds of RIA are invested in assets with a liquid secondary market, such that under normal conditions the assets may be monetised rapidly in time to meet a demand for withdrawal, there is a risk that under stressed conditions it may not be possible to monetise the assets so readily. Hence, there is a potential exposure to a (net) run-off for LCR purposes. The amount of the run-off for LCR purposes must therefore be reduced only in respect of cash and HQLA held in the RIA fund.

- d.For UIA, in some cases withdrawals will be permitted either on demand or at less than 30 days’ notice. The run-off factor applied to UIA depends on the contractual withdrawal rights of the IAH.

- e.Retail Deposits and IAs

Retail deposits are separated into stable and less stable deposits. Stable retail deposits receive 5% run off and less stable receive 10% run off. - f.Current retail deposits/IA are considered stable if:

- i.They are resident deposits and,

- ii.A relationship with the customer has been well established, for example the customer has been dealing with the bank for over 1 year; or

- iii.The customer uses the account for transactions such as salary being deposited in the account, paying bills and standing order payments.

- g.Retail term deposits/IA which are maturing within the 30 day period are classified as stable if:

- i.They are resident deposits, and

- ii.A relationship with the customer has been well established, for example, the term deposit has a history of being rolled over at maturity with the IB, or the relationship has been established for over 1 year with the customer.

- h.Deposits from small and medium sized entities (SMEs) can be treated as retail deposits (as per the clauses above), if their deposit amount is less than AED 20 Million.

- i.Unsecured deposits from non-financial corporates – 40% run off for Non- operational and 25% run off for operational.

- j.Unsecured Wholesale Funding

Unsecured wholesale funding is defined as those liabilities and general obligations of the IBs that are raised from non-natural persons such as legal entities, including sole proprietorships and partnerships and are not collateralised by legal rights to specifically designated assets owned by the funding institution in the case of bankruptcy, insolvency, liquidation or resolution. The wholesale funding included in the LCR includes funding that is callable within the LCR’s horizon of 30 days or that has its earliest possible contractual maturity date situated within this horizon, as well as funding with an undetermined maturity. Wholesale funding that is callable by the funds provider subject to a contractually defined and binding notice period surpassing the 30-day horizon is not included. - k.The outflows to unsecured wholesale funding are further categorised into five categories. First are current and term accounts (less than 30 days’ maturity) provided by small business customers. As with the categorisation of retail deposits, these types of current and term accounts are further divided into stable and less stable deposits. Treatment of the current and term accounts provided by small business customers is also similar to the treatment of the retail deposits. Stable deposits are assigned a 5% run-off factor, while less stable deposits are assigned run-off factors based on the different buckets that are determined according to the risk profiles of each group, with a minimum run-off factor of 10%. As indicated above, in the case of IBs that do not practice “smoothing” of profit payouts to IAH, a higher run-off factor must be applied. Categorisation of the buckets and their run-off factors shall be similar to that of the buckets of less stable current and term accounts in the retail category.

- l.The second category is operational accounts generated by clearing, custody and cash management activities. These deposits are defined as deposits placed by financial and non-financial customers in order to facilitate their access to and ability to use payment and settlement systems and otherwise make payments. These funds are assigned a 25% run-off factor. However, this factor is only applicable if the customer has a substantive dependency on the IBs and the deposit required for such activities, and meets the international definition and qualifying criteria for funds to be recognised as operational accounts.

- m.In order to ensure consistent and effective implementation of operational accounts, one or more of the following criteria for determining the eligibility of any account as an operational account must be met:

- i.used for providing cash management, custody or clearing products only;

- ii.must be provided under a legally binding agreement to institutional customers;

- iii.termination of these accounts shall be subject to either a notice period of at least 30 days or a significant reduction of profit for closing these accounts; and

- iv.returns on these accounts are determined without giving any economic incentive to the customer to leave any excess funds in the accounts.

- n.Any excess balances that could be withdrawn and would still leave enough funds to fulfil the clearing, custody and cash management activities do not qualify for the 25% factor. In other words, only that part of the deposit balance with the service provider that is proven to serve a customer’s operational needs can qualify as stable. Excess balances must be treated in the appropriate category for non-operational accounts. If the IB is unable to determine the amount of the excess balance, then the entire deposit must be assumed to be excess to requirements and, therefore, considered non-operational. The IB must determine the methodology for identifying excess deposits that are excluded from this treatment. This assessment must be conducted at a sufficiently granular level to adequately assess the risk of withdrawal in an idiosyncratic stress scenario.

- o.The third category includes funds from an institutional network of cooperative IB. In some jurisdictions, there are IBs that act as “central institutions” or central service providers for lower-tier IBs, such as Islamic cooperatives. A 25% run-off rate can be applied by such an IBs to the amount of deposits member institutions place with it as their central institution or specialised central service provider that are placed (a) due to statutory minimum deposit requirements, and which are registered at regulatory authorities, or (b) in the context of common task-sharing and legal, statutory or contractual arrangements. As with other operational accounts, these deposits would receive a 0% inflow assumption for the IBs. Supervisory approval would be needed in each case to ensure that IBs utilising this treatment actually are the central institutions or central service providers (e.g. to a cooperative network).

- p.The fourth category is unsecured wholesale funding provided by non-financial corporates and sovereigns, the Central Bank, MDBs and PSEs. A 40% run-off factor is applicable to funds from such sources that are not specifically held for operational purposes.

- q.The last category is “other entities”. This category consists of all deposits and funding from other institutions including, among others, banks, IBs, securities firms, insurance or Islamic insurance (Takaful) companies, etc., fiduciaries and beneficiaries, conduits and special purpose vehicles, affiliated entities of the IBs, and any other entities that are not specifically held for operational purposes and are not included in the prior categories. The run-off factor for these funds is 100%.

- r.Secured Funds

Secured funding is defined as liabilities and general obligations with maturities of less than 30 days that are collateralised by legal rights to specifically designated assets owned by the counterparty in the case of bankruptcy, insolvency, liquidation or resolution. Various run-off factors are assigned to these funds, depending on the type of collateral. The secured funding transactions with a central bank counterparty or backed by Level 1 assets with any counterparty are assigned a 0% run-off factor. A 15% run-off factor is assigned to secured funding transactions backed by Level 2A assets with any counterparty. - s.Higher run-off factors are assigned to secured funding not backed by Level 1 or Level 2A assets. Secured funding transactions backed by assets that are neither Level 1 nor Level 2A, with domestic sovereign, MDBs or domestic PSEs as a counterparty, as well as secured funding backed by commodity or real assets eligible for inclusion in Level 2B, may receive 25% run-off factors. On the other hand, secured funding backed by other Level 2B assets and all other secured funding transactions that do not fall within the above categorisations shall be assigned 50% and 100% run-off factors, respectively.

- t.For all other maturing transactions, the run-off factor is 100%, including transactions where IB has met customers’ short positions with its own long inventory. Table below summarises the applicable standards.

- u.For all other maturing transactions, the run-off factor is 100%, including transactions where IB has met customers’ short positions with its own long inventory. Table below summarises the applicable standards.

- Amount to Add to Cash Outflows:

Categories for outstanding maturing secured funding transactions Amount to add to cash outflows Backed by Level 1 assets or with central banks 0% Backed by Level 2A assets 15% Secured funding transactions with domestic sovereign, PSEs or MDBs that are not backed by Level 1 or 2A assets. PSEs that receive this treatment are limited to those that have a risk weight of 20% or lower.

Backed by Shari’ah-compliant residential mortgage-backed securities (RMBS)28 eligible for inclusion in Level 2B

25% Backed by other Level 2B assets 50% All others 100% Additional Requirements:

- v.Some instruments under this category could include Shari’ah-compliant hedging (Tahawwut) instruments, which are assigned a 100% run-off factor; undrawn credit and liquidity facilities to retail and small business customers, which are assigned a 5% run-off factor; undrawn financing facilities to non-financial corporates as well as sovereigns, central banks, PSEs and MDBs, which are assigned a 10% run-off factor for credit and a 30% run-off factor for liquidity; as well as other contractual obligations extended to financial institutions/IBs, which are assigned a 100% run-off factor.

- w.Some instruments under this category could include Shari’ah-compliant hedging (Tahawwut) instruments, which are assigned a 100% run-off factor; undrawn credit and liquidity facilities to retail and small business customers, which are assigned a 5% run-off factor; undrawn financing facilities to non-financial corporates as well as sovereigns, central banks, PSEs and MDBs, which are assigned a 10% run-off factor for credit and a 30% run-off factor for liquidity; as well as other contractual obligations extended to financial institutions/IBs, which are assigned a 100% run-off factor.

- x.Shari’ah-compliant Interbank Contracts

The instruments traded in the conventional interbank market are usually short-term and liquid in nature, and their maturities range from one day up to a year. The trading is wholesale and mostly conducted over the counter. An Islamic interbank money market would essentially perform similar functions with the exception that the instruments used must comply with Shari’ah principles. Widely used Shari’ah-compliant instruments used by IBs for interbank liquidity management are based on Mudarabah, commodity Murabahah or Wakalah arrangements. All these contracts are structured as unsecured wholesale funding. The run-off rate applied to these transactions, maturing in the next 30 calendar days, is 100%.

6.3.7 Cash Inflows

- a.Cash Inflows – 100% in the normal course of business inflows with a cap of 75% of outflows

- b.When considering its cash inflows, an IB must include only contractual inflows from outstanding exposures that are fully performing and for which the IB has no reason to expect a default within the 30-day time horizon. Contingent inflows (such as returns on profit-sharing instruments) are not included in total net cash inflows. IB need to monitor the concentration of expected inflows across wholesale counterparties. In order to prevent IB from placing too much reliance on expected inflows to meet their liquidity requirement, and to ensure a minimum level of HQLA holdings, the amount of inflows that can offset outflows is capped at 75% of total expected cash outflows as defined in this standard.

- c.The first category of cash inflows is secured financing, including Shari’ah-compliant alternatives to reverse repos and securities borrowing. Unless stated otherwise, the run-off rates mentioned in the following can be applied.

- d.IB must assume that the maturity of financing secured by Level 1 assets will be rolled over and will not give rise to any cash inflows. Therefore, an inflow factor of 0% will be applied to this kind of transaction. Maturing financing secured by Level 2 assets will lead to cash inflows equivalent to the relevant haircut for the specific assets. For instance, a 15% inflow factor is assigned if the transaction is secured by Level 2A assets; and an inflow factor of 25–50% is assigned if it is secured by Level 2B assets. IB is assumed not to roll over maturing secured financing covered by non-HQLA assets, and can assume that it will receive back 100% of the cash related to those agreements (i.e. an inflow factor of 100%).

- e.The second category of IB cash inflows is committed facilities. No financing facilities, liquidity facilities or other contingent funding facilities that the IB holds at other institutions for its own purposes will be assumed to be drawn. Such facilities receive a 0% inflow rate, meaning that this scenario does not consider inflows from committed financing or liquidity facilities.

- f.The third category of cash inflows is inflows from various counterparties, for which the inflow rate is determined by the type of counterparty. This category of inflows takes into account cash inflows from either secured or unsecured transactions from various counterparties, which are categorised as: (a) retail customers and small business customers and (b) wholesale inflows, including non-financial corporates, as well as financial institutions/IBs and other entities. The inflow rate will be determined based on the type of counterparty. Non-financial wholesale counterparties, as well as retail customers, may be assigned a 50% inflow factor, while financial institutions/IBs and central bank counterparties may be assigned a 100% inflow factor.

- g.Inflows from financing that have no specific maturity (i.e. have undefined or open maturity) must not be included. Therefore, no assumptions must be applied as to when maturity of such financing would occur. An exception to this would be minimum payments of principal, fee or profit associated with an open maturity financing, provided that such payments are contractually due within 30 days. These minimum payment amounts must be captured as inflows, at the rates prescribed in (d), to these transactions.

- h.Inflows from securities maturing within 30 days that are not included in the stock of HQLA must be placed in the same category as inflows from financial institutions (i.e. 100% inflow). IBs may also recognise in this category inflows from the release of balances held in segregated accounts in accordance with regulatory requirements for the protection of customer trading assets, provided that these segregated balances are maintained in HQLA. These inflows must be calculated in line with the treatment of other related outflows and inflows covered in this standard. Level 1 and Level 2 securities maturing within 30 days must be included in the stock of HQLA rather than being counted as inflows, provided that they meet all operational and definitional requirements.

- i.Deposits held at other IBs for operational purposes which fall under the category of operational accounts are assumed to stay at the counterparties. Thus, no inflows can be counted for these funds (0% inflow rate). The same treatment applies for deposits held at the centralised institution in a cooperative banking network, as such funds are assumed to stay at the centralised institution.

- j.The last category is other cash inflows – that is, inflows that are not categorised under the above categories. This category includes Shari’ah-compliant hedging to which an inflow rate of 100% is assigned. Cash inflows related to non-financial revenues, however, are not taken into account in the calculation of the net cash outflows for the purposes of the LCR.