Part Two: Quantitative Requirements

A. Eligible Liquid Assets Ratio (ELAR)

This is a ratio all banks must comply with. Eligibility is limited as follows:

- a. Account balances at the Central Bank

- b. Physical cash at the bank

- c. Central Bank CDs

- d. UAE Federal Government bonds and sukuks

- e. Reserve requirements

- f. UAE local government and PSE’s publicly traded debt securities that are assigned 0% credit risk weighting under Basel II Standardized approach (limited to a maximum of 20% of eligible liquid assets)

- g. Foreign, Sovereign debt instruments or instruments issued by their central banks, also multilateral development banks all of which receive 0% credit risk weighting under Basel II Standardized approach (limited to a maximum of 15% of eligible liquid assets)

Banks must hold an amount equivalent to at least 10% (or some other percentage as set by the Central Bank) of their total on balance sheet liabilities at all times in the above assets. This ratio will be subject to upward revisions from time to time either as a result of Central Bank policy or as a result of a recalibration exercise when assessing the impact of the LCR.

B. Advances to Stable Resources Ratio (ASRR)

This measure detailed in the current Central Bank reporting (BRF7) continues to be in effect until an individual bank is permitted to apply the NSFR under the Basel III rules.

The NSFR will come into effect on 1 January 2018.In the meantime all banks must comply with the ASRR.

C. Liquidity Coverage Ratio (LCR)

- 90) The LCR ratio comes directly from the BCBS recommendations mentioned at the beginning of this manual. It is therefore recommended that banks familiarize themselves with the BCBS final recommendations on liquidity titled “Basel III: The Liquidity Coverage Ratio and liquidity risk monitoring tools' issued January 2013. This guidance manual concentrates on the more common factors that affect the liquidity of banks in the UAE. There will undoubtedly be some specific issues that will affect individual banks but are not detailed in this manual. The manual also attempts to simplify some of these factors for the sake of brevity as well as exercise national discretion where warranted and the possibility for such discretion exists. In the event that any confusion is created as a result then the BCBS document referred to above takes precedence.

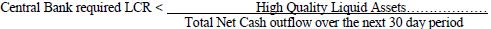

- 91) LCR is a coverage ratio of liquid assets to net cash outflows. It represents a 30 days stress scenario with combined assumptions covering both bank specific and market wide stresses. Therefore, the LCR aims to promote short-term resilience of a bank’s liquidity risk profile by ensuring that it has sufficient high-quality liquid assets to survive a significant stress scenario lasting for one month.

- 92) The LCR assumptions are applied to contractual data representing the main liquidity risk drivers (liabilities and contingent liabilities) at banks to determine the total cash outflows within the 30 days stress period.

- 93) Total cash inflow is also calculated based on assumptions applied to contractual inflows during the 30 day period. The total cash outflow is then reduced by the total cash inflow to arrive at the net cash outflow in 30 days. A cap on the amount of inflows that can be used to offset outflows is set at 75% of the outflows2.

- Total net cash outflows over the next 30 calendar days = Outflows – Inflows (restricted to 75% of outflows)

- 94) Banks should always be able to cover the net cash outflow with high quality liquid assets at the minimum LCR determined by the Central Bank.

2 The 75% max reduction limit is to ensure that the banks always have a net cash outflow of at least 25% which they are required to hold liquid assets against.

Current LCR and Expected Glide Path

- 95) Compliance with the LCR will be on a glide path basis. This starts in January 2016 with a compliance level of 70% and banks are expected to be at the minimum compliance level of 100% by January 2019. The table below sets out the timetable for compliance:

Table 1 Glide Path

1 January 2016 1 January 2017 1 January 2018 1 January 2019 Minimum LCR 70% 80% 90% 100% The Central Bank will set up a liquidity task force to ensure a smooth implementation of the LCR by its implementation date. Banks wishing to move to the Basel III liquidity framework must apply in writing to the Central Bank for approval to do so. Prior to approval, banks will be required to provide the Central Bank with suitable validation of adequate governance, systems and controls in place to demonstrate the bank’s ability to comply with the requirements of the Basel III liquidity framework in full.

The Central Bank task force team will engage closely with these banks as part of the on–boarding process. Banks must provide the Central Bank team with a “road map” setting out clear milestones explaining how the bank will meet the LCR and the NSFR by their respective due dates. The team will then assess the plan and provide guidance. The team will also monitor the progress of the bank against its internally set milestones.

High Quality Liquid Assets

- 96) High quality liquid assets are strictly defined in the LCR to ensure that these assets remain liquid3 under severe stress scenarios both firm specific and market wide. It is worth mentioning that the asset that is usually liquid under normal conditions might not be liquid under a severe stress scenario. Therefore, these assets must fulfill certain pre-defined criteria before they can be considered eligible, they must be:

- • traded in large, deep and active repo or cash markets characterized by a low level of concentration;

- • have a proven record as a reliable source of liquidity in the markets (repo or sale) even during stressed market conditions. Level 2A and 2B must meet a predefined test that the maximum decline of price must not exceed volatility targets over a 30 day period during a relevant period of significant liquidity stress;

- • not an obligation of a financial institution or any of its affiliated entities

- 97) High quality liquid assets are separated into two categories, Level 1 and Level 2 liquid assets. Level 1 liquid assets must only be those assigned a 0% risk weight under Basel II Standardized Approach for credit risk and are allowed with no haircuts and no cap applied to them. These assets are:

- • Cash at Central Bank and physical cash at the bank.

- • Reserves and account balances held at the Central Bank

- • Central Bank CDs and all debt issued or explicitly guaranteed by UAE Federal Government or Local Governments.

- • Debt issued by multilateral development banks and the IMF.

- • Foreign Sovereign or Central Bank debt or guaranteed debt receiving 0% Risk Weight under Basel II standardized approach.

- • UAE Public Sector Entities’ (PSE or GRE) debt securities which receive 0% Risk Weight under Basel II Standardized approach

- Those assets that are 0% risk weighted and unrated are unlikely to have the same depth of market as those that are rated above investment grade in a stress scenario. Banks must take this into account when assessing an asset’s suitability and a liquidity premium charged. In any case, 0% risk weighted assets that are not rated cannot exceed 25% of the total Level 1 HQLA.

- 98) Level 2 liquid assets (comprising Level 2A and Level2B) are also classified as highly liquid assets. However, the realizable market value under a liquidity stress might be lower than the normal market value. Level 2 assets are allowed up to 40% in total of high quality liquid assets. The following assets, after being reduced by the corresponding haircuts, are eligible as Level 2A liquid assets (‘Corporate’ in this sense may include Sovereign securities).

Table 2 Level 2 A Liquid Assests

Level 2B assets (subject to a 15% ceiling of the total) consist of residential mortgage backed securities, lower rated debt securities and common equity shares. The qualifying tests for these types of assets are to be strictly applied as per the Basel rules and it is unlikely that many domestic assets will qualify, if any. (‘Corporate’ in this sense may include Sovereign securities).

Table 3 Level 2B Liquid Assets

Level 2 B liquid assets Value Residential Mortgage Backed Securities (RMBS) 75% Corporate bonds holding a rating of between A+ and BBB-. 50% Common equity shares (strict qualifying conditions) 50% - 99) Only unencumbered liquid assets that meet the above criteria are eligible for the LCR.

- 100) Banks should endeavor to hold eligible liquid assets in the currencies that match the currencies of the net cash outflow.

- 101) Liquid asset portfolio should be well diversified in terms of counterparties and tenor and held for the sole purpose of managing liquidity risk.

- The Central Bank recognizes that given the nascent debt markets that exist in the UAE, the qualitative requirements placed by Basel around the robustness of markets that underpins the liquidity and pricing of these assets may require a less strict interpretation – except in the case of Level 2 B assets. However, banks must be able to demonstrate to the Central Bank that assets held in the LCR are liquid.

- Unrated UAE domiciled GRE or PSE issuers that do not receive a 0% risk weighting can be included in Level 2A liquid assets with a 30% haircut, for the time being at least.

- Given that the UAE Dirham is pegged to the US Dollar, for the sake of flexibility US$/AED currency mismatches can be offset. It should be noted though that Basel III requires that liquid assets be held in the currency of the net outflow, including both the US$ and AED individually, and banks are expected to comply where possible. However, net outflows in other GCC currencies pegged to the US$ that exceed 15% of the total LCR net outflows must be matched. Other pegged and free floating currencies must be matched if they exceed 10% of total net LCR outflows.

- Where no suitable HQLA exists in the currency of the net outflow O/N placements, in that currency, with either the relevant Central Bank or a bank rated at A or better will suffice.

3 Liquidity is the ability to convert the asset immediately into cash at little or no loss in market value under a liquidity stress.

- 96) High quality liquid assets are strictly defined in the LCR to ensure that these assets remain liquid3 under severe stress scenarios both firm specific and market wide. It is worth mentioning that the asset that is usually liquid under normal conditions might not be liquid under a severe stress scenario. Therefore, these assets must fulfill certain pre-defined criteria before they can be considered eligible, they must be:

Cash Outflows

- 102) Cash outflows are calculated by assigned run off assumptions against various liabilities both on and off balance sheet.

- Liabilities maturing outside the 30 days stress period - 0% run off

- 103) All liabilities that have a contractual maturity over 30 days and where the bank is not contractually obliged to pay the customer before the maturity date receive 0% run off.

- 104) Where the bank has guaranteed payment to the customer prior to maturity upon request, the liability is treated as being contractually due immediately and is subject to the applicable run off assumptions listed below.

Retail Deposits4

- 105) Retail deposits include both term deposits (maturity over 1 day) and current/savings/at call deposits which banks are under contractual obligation to pay immediately.

- 106) Retail deposits are separated into stable and less stable deposits.

Stable retail deposits receives 5% run off & less stable receives 10% run off - 107) Current retail deposits are considered stable if:

- ▪ They are resident deposits and,

- ▪ A relationship with the customer has been well established, for example the customer has been dealing with the bank for over 1 year; or

- ▪ The customer uses the account for transactions such as salary being deposited in the account, paying bills and standing orders.

- 108) Retail term deposits which are maturing within the 30 day period are classified as stable if:

- ▪ They are resident deposits and,

- ▪ A relationship with the customer has been well established, for example the term deposit has a history of being rolled over at maturity with the bank or the relationship has been established for over 1 year with the customer.

- 109) No more than 60% of retail deposits maturing within 30 days can be classified as stable. This cap will only be applicable during the transition period until 1 January 2019 after which all banks are expected to be in a position to comply with the Basel III requirements in full.

- 110) All other retail deposits that do not meet the criteria for classification as “stable” are considered less stable retail deposit and receive 10% run off factor against them.

- 111) Deposits from small and medium size entities (SMEs)5 can be treated as retail deposits (and sections (107) to 110) apply to them), if their deposit amount is less than AED 206 Million.

- Unsecured deposits from non-financial corporates – 40% run off for Non-operational & 25% run off for operational.

- 112) Unsecured wholesale deposits (current and term) are deposits from legal entities7 that are not collateralized by assets owned by the bank and are not sourced from a financial institution8. It includes deposits sourced from Sovereigns, Public Sector or Government Related entities. Obligations related to derivative contracts are explicitly excluded.

- 113) It includes all funding that is callable within the 30 day horizon according to its earliest possible contractual maturity date, including those that are exercisable at the investor's discretion.

- 114) Unsecured wholesale deposits from non-financial institutions are separated into operational and non-operational wholesale deposits. Operational wholesale deposits have one or more of the following characteristics:

- ▪ The customer is reliant on the bank to perform payments, clearing, collections, custody, cash management (and) or payroll supported by a legally binding contractual agreement. The bank will have to prove reliance.

- ▪ The deposits are by-products of the underlying services provided by the banking organization and not sought out in the wholesale market in the sole interest of offering interest income.

- ▪ The deposits are held in specifically designated accounts and priced without giving an economic incentive to the customer to leave any excess funds.

- 115) It is understood that exact segregation of operational and non-operational accounts is operationally challenging for banks. The Central Bank expects banks to use their best endeavors and sound judgment in the process. Banks must also undertake a continuous upgrading/improvement of systems and MIS to ensure that by the final implementation date of 1 January 2019 they can fully comply with the requirements of Basel III in this respect. Any deliberate manipulation of the classification will result in all wholesale deposits being classified as non-operational. For example, banks would be expected to ascertain the ‘normal’ balance in these accounts for operational purposes and exclude those balances that are in excess.

- 116) No more than 40% of total wholesale deposits maturing in one month can be classified as operational.

Banks who operate the LCR will be expected to adjust their liability products over time, both retail and corporate, so that they can more directly reflect the characteristics of the Basel III requirements. Once this is achieved the 40% ceiling will be lifted. - 117) All other deposits from legal entities, including those from SMEs in excess of AED 20 million are non-operational and attract a run-off factor of 40%.

Unsecured wholesale funding from financial institutions – Operational 25% run off, Non-operational at 100% run off - 118) This category includes non-collateralized deposit sourced from banks, insurance companies, brokers, securities firms (and the affiliates of these companies) as well as NCDs, Bonds, MTNs, CPs and other unsecured debt instruments issued by the bank and are maturing within the 30 day stress period. These are also separated into operational and non-operational deposits depending on their characteristics.

- 119) Operational deposits from financial institutions receive 25% run off against them and have the all following characteristics:

- ▪ The criteria is met as prescribed above for deposits from non-financial operational accounts

- ▪ The deposits do not arise from correspondent banking, or from the provision of prime brokerage services.

- ▪ If the deposit placed by a bank receives a 25% run off against it, the depositing bank receives 0% inflow for it. The Central Bank will ensure this treatment is applied when conducting its onsite and offsite reviews.

- 120) A run off factor of 100% is assigned to all non-operational financial services deposits maturing within 30 days and that do not meet the above characteristics.

4 Defined as deposits from individuals (natural persons)

5 Small and medium enterprises refer to legal entities that have an annual turnover of less than AED 75 million

6 The AED 20 million limit is to be determined on a relationship level.

7 Excludes SME deposits that fall under 111)

8 Financial institution includes banks, insurance companies, brokers and their affiliates.Secured Wholesale Funding

- 121) Wholesale funding, that is secured by giving rights to an asset in insolvency, are assumed to be relatively more stable as the counterparts are likely to renew the funding upon maturity in a stress given the more secured position they enjoy.

- 122) It is important to note that the stability of this funding source depends on the quality of the asset pledged as collateral. The below table shows the run off assumptions applied to wholesale deposits depending on the type of Collateral used.

Table 4 Collateral for maturing wholesale funding

Collateral securing the maturing wholesale funding Run off Factor Level 1 Liquid Asset 0% Level 2A Liquid Assets 15% Transactions with sovereigns, central banks, PSEs, GREs that are not backed by Level 1 or Level 2A assets.

(PSEs and GREs that receive this treatment should have a risk weight of 20% or lower under Basel II Standardized approach).

25% Level 2B assets 50% All other types of collateral 100% Off Balance Sheet Facilities

Credit lines9 and liquidity facilities provided to retail customers - 5% draw down

- 123) Credit lines and liquidity facilities provided to retail customers and retail SMEs (as per section 111) will have 5% draw down assumption applied to the undrawn amount of the advised limit whether revocable or not.

Credit lines and liquidity facilities provided to non-financial corporate customers - 10% draw down for committed credit lines and 30% for liquidity facilities - 124) Credit lines provided to non-financial corporate customers are assumed to draw down at 10%, liquidity facilities assume 30% draw down. This takes into account the difficulty in replacing these lines from other banks in a market wide stress and the potential actions by corporates to secure cash to ensure no interruption to their business.

Credit lines and liquidity facilities to banks subject to UAE prudential supervision - 125) Banks should assume a 40% drawdown of the undrawn portion of these facilities.

Credit lines and liquidity facilities provided to financial corporate customers - 40% draw down for committed credit lines and 100% for liquidity facilities - 126) Credit lines provided to other financial institutions receive 40% draw down to reflect the likelihood that they will be drawn upon in a market crisis. Similarly, liquidity facilities are assumed to be 100% fully drawn.

Liquidity facilities provided to all other entities (including embedded in transactions)-100% - 127) A liquidity facility is defined by the BCBS as a committed undrawn back up facility put in place expressly for the purpose of refinancing debt of a customer where the customer is unable to obtain funding from the financial markets.

9 Credit lines include undrawn portion of overdrafts, credit cards, bill discounting facilities and other commitments to provide credit.

- 123) Credit lines and liquidity facilities provided to retail customers and retail SMEs (as per section 111) will have 5% draw down assumption applied to the undrawn amount of the advised limit whether revocable or not.

Letters of Guarantee, Letters of Credit and Trade Finance Facilities

- 128) LGs and LCs that are not trade finance related will be assessed based upon the nature of the beneficiary of the guarantee and the draw down assumptions as relates to credit lines, as above, will apply. However, if by the nature of the transaction 100% of the guarantee is likely to be drawn down at once then it must be assumed to be a liquidity facility and treated accordingly.

- 129) LCs and other trade finance facilities receive 5% draw down on the outstanding amount.

Derivative Contracts

Derivative contracts – assumed 3 notch downgrade to credit rating– 100% outflow

- 130) Some banks might have derivative contracts that include Credit Support Annex (CSA) which requires the bank to post collateral against its MTM position depending on its credit rating.

- 131) Banks should assume a three notch downgrade to their credit rating and determine the cash outflow required to obtain the additional collateral required under the CSA as a result of the downgrade. The cash outflow will be treated as 100% outflow in the 30 day stress period under the LCR.

Derivative contracts –Net outflow under the contract within 30 days – 100% outflow - 132) Known amounts to be paid on derivative contracts less known amounts to be received from derivative contracts within 30 days should be included in the LCR outflows at 100%. Cash flows may be calculated on a net basis by counterparty only where a valid netting agreement exists or when the inflow and outflow occurs within the same business day. Derivative cash flows in different currencies from the same counterparty when the inflow and outflow occurs on the same business day may be offset against each other.

Cash Inflows

Cash Inflows – 100% in the normal course of business inflows with a cap of 75% of outflows

- 133) Contractual cash inflows from assets that are expected to come in within the 30 day stress period under normal business conditions (see details below) are allowed to be included in the LCR up to 75% of cash outflows (see paragraph 93).

- 134) Cash inflows from the principal and interest repayment of loans and advances to retail, SMEs and non-financial corporates are included at 50% cash inflow. This assumes that the bank will continue to extend new loans at 50% of the contractual inflows. However, because of the self-liquidating nature of trade finance transactions these may be included as a 100% cash inflow provided there is no obligation on the bank to extend further credit to the customer once the transaction has been settled. The bank must prove to the Central Bank’s satisfaction that it has exercised this option before applying the 100%.

- 135) No Credit card and overdraft repayments are allowed as a cash inflow.

- 136) Contractual cash inflows that are generated from financial institutions maturing within 30 days are assumed to be received in full (100% inflow). Similarly, all debt instruments that are maturing within the 30 day period will receive 100% cash inflow.

- 137) No lines of credit, liquidity facilities, and contingent funding facilities given to the bank are allowed to be included in the cash flows (0% inflow).

- 138) Derivative cash flows can be shown as 100% of all the net cash inflows. The methodology is the same as for outflows.

- 139) No operational deposits made to financial institutions should be allowed as a cash inflow (0% cash inflow).

Maturing secured lending transactions-Run offs depending on quality of collateral - 140) Transactions backed by Level 1 assets 0% inflow

- 141) Transactions secured by Level 2A assets 15% inflow (0% if the collateral is used to cover a short position)

- 142) Margin lending backed by all other collateral (including Level2B assets) 50% inflow (0% if the collateral is used to cover a short position)

- 143) Transactions backed by other collateral 100% inflow (0% if the collateral is used to cover a short position)

D. NSFR (Net Stable Funding Ratio)

A more detailed description of the NSFR is contained in the BCBS document “Basel III: the net stable funding ratio” dated October 2014. If there is any ambiguity between this guidance manual and this document the BCBS document takes precedent. Banks are expected to meet the NSFR on an ongoing basis.

- 144) The NSFR standard is derived from the BCBS document ‘Basel III: the net stable funding ratio’ and will come into effect on 1 January 2018. There will no requirement to comply with the standard until that date although reporting will start beforehand and only for those banks who qualify for the LCR as their liquidity ratio will be affected. It is meant to compliment the LCR by limiting the cliff effects associated with a stacking up of liability maturities within a short period of time. It is designed to ensure that banks fund their activities with sufficiently stable sources of funding to mitigate the risk of future funding stress.

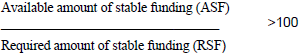

- 145) The NSFR is defined as the amount of available stable funding relative to the amount of required stable funding. This ratio should be equal to at least 100% on an ongoing basis.

- 146) Available stable funding’ is defined as the portion of capital and liabilities expected to be reliable over a 1 year time horizon. The amount of stable funding required is a function of the liquidity characteristics and residual maturities of the various assets held by an institution including off-balance sheet exposure

- 147) To simplify the NSFR is:

Definition of Available Stable Funding (ASF)

- 148) The ASF is determined by assigning weighted values to various funding sources depending on the nature of the source, its contractual maturity and the propensity of funding providers to withdraw their funding. This includes such things as call options and the ability of the bank to refuse the exercising of the call. Only those proportions of the cash flow actually maturing beyond the maturity thresholds as prescribed by the ratio can be included.

- 149) The cash flows for derivative contracts will be assessed at the replacement cost where the contract has a negative value. If a netting agreement exists then this can be taken into account and the netted position can be used. Collateral posted as variation margin can also be allowed for.

- 150) Liabilities and capital receiving a 100% ASF factor are:

- a) The total amount of regulatory capital excluding the proportion of Tier 2 instruments with a residual maturity of less than one year

- b) Any capital instrument not included in (a) that has an effective residual maturity of one year or more (excludes those with explicit or embedded option that negates this condition)

- c) The total amount of secured and unsecured borrowings and liabilities with effective residual maturities of one year or more.

- 151) Liabilities receiving a 95% ASF factor:

- These comprise ‘stable’ demand deposits as per the LCR (paragraphs 107 and 108) as well as retail term deposits as per the LCR with residual maturities of less than one year.

- 152) Liabilities receiving a 90% ASF factor

- These comprise ‘less stable’ demand deposits as defined in the LCR (paragraph 109) as well as retail term deposits as per the LCR with residual maturities of less than one year

- 153) Liabilities receiving a 50% ASF factor

- a) Funding (secured and unsecured) with a residual maturity of less than one year provided by non-financial corporate customers

- b) Operational deposits (as defined in the LCR paragraph 114)

- c) Funding with a residual maturity of less than one year from sovereigns, public sector entities and multilateral and development banks and

- d) Funding from other sources not included above with a residual maturity between 6 months and one year.

- 154) Liabilities receiving a 0% ASF factor

These comprise everything else with a few technical exceptions including net derivative liabilities (refer BCBS document paragraph 25 and paragraph 149 above)

Definitions of Required Stable Funding (RSF)

- 155) The amount of required stable funding is measured based on the broad characteristics of the liquidity risk profile of an institutions assets and OBS exposures. The calculation first assigns a carrying value of the asset to the prescribed categories and then multiplies this by the required RSF factor. The total RSF is the sum of the weighted amounts for both on and off balance sheet exposures.

- 156) The rationale behind the RSF factors is that they approximate the amount of a particular asset that would have to be funded, either because it will (or is likely to be) rolled over and could not be monetized either by sale or as collateral, over the course of one year without significant expense. These amounts have to be supported by stable funding.

- 157) Assets are allocated to the appropriate RSF factor based on their residual maturity or liquidity value. Residual maturity has to take into account any options either explicit or implied that may extend the maturity of the asset (or OBS exposure). Amortized loans can be adjusted for that portion falling due within the one year time horizon.

- 158) Encumbered assets are assessed as per the period they are encumbered for at the highest applicable RSF factor if that period is greater than 6 months. Where the encumbrance period is less that 6 months the factor will be the same as unencumbered assets.

- 159) Banks should exclude from their assets securities which they have borrowed in financing transactions such as reverse repos and collateral swaps where they do not have beneficial ownership. Banks should include securities they have lent where they retain beneficial ownership. Securities received through collateral swaps should not be included if they do not appear on the balance sheet. Generally, if the bank retains beneficial ownership and the security appears on the balance sheet it should be assigned a RSF factor.

- 160) Netting can be accommodated provided there is a valid netting agreement. Likewise cash collateral can be taken into account.

- 161) Derivative assets are firstly based on replacement cost where the contract has a positive value.

- 162) Assets assigned a 0% RSF factor

- a) Coins and bank notes

- b) Central Bank Reserves

- c) All claims on Central Banks with residual maturities of less than 6 months

- d) ‘trade date receivables’ as per BCBS document paragraph 30 and 36 (d)

- 163) Assets assigned a 5% RSF factor

- a) Unencumbered Level 1 high quality liquid assets as defined in the LCR excluding those receiving a 0% RSF as above

- b) Marketable securities representing claims or guaranteed by those entities prescribed a 0% risk weight by the Basel II standardized approach for credit risk.

- 164) Assets assigned a 10% RSF factor

- a) Unencumbered loans to financial institutions with residual maturities of less than 6 months where the loan is secured against Level 1 assets as defined by the LCR and where the bank can freely use the collateral for the life of the loan.

- 165) Assets assigned a 15% RSF factor

- a) Unencumbered Level 2A assets as defined in the LCR

- b) All other unencumbered loans to financial institutions with residual maturities of less than 6 months not included in 164

- 166) Assets assigned a 50% RSF factor

- a) Unencumbered Level 2B assets as per the LCR (when allowed)

- b) HQLA (as per the LCR) that are unencumbered for a period of between six months and one year

- c) Loans to financial institutions and central banks with a residual maturity of between six months and one year

- d) Deposits held at other financial institutions for operational purposes

- e) All other assets not included in the above categories that have a residual maturity of less than one year including loans to non-financial corporate clients, retail and SME loans as well as loans to sovereigns and PSEs. (GREs included).

- f) Overdrafts that are core are to be assessed on a case by case basis and will be assumed to have a maturity greater than one year.

- 167) Assets assigned a 65% RSF factor

- a) Unencumbered residential mortgages with a residual maturity of one year or more providing they qualify for a 35% or lower risk weight under Basel II standardized approach for credit risk.

- b) Other unencumbered loans not included in the above categories, excluding loans to financial institutions, with a residual maturity of one year or more that would qualify for a 35% or lower risk weight under Basel II standardized approach.

- 168) Assets assigned an 85% RSF factor

- a) Cash, securities or other assets posted as initial margin for derivative contracts or assets provided to contribute to the default fund of a central counterparty.

- b) Other unencumbered performing loans that do not qualify for the 35% or lower risk weight requirements in 167) and have residual maturities of one year or more, excluding loans to financial institutions

- c) Unencumbered securities with a remaining maturity of one year or more as well as exchange traded equities that are not in default and do not qualify as HQLA under the LCR.

- d) Physical traded commodities such as gold

- 169) Assets assigned a 100% RSF factor

- a) All assets that are encumbered for a period of one year or more

- b) NSFR derivative assets as calculated subject to paragraph 160 and 161 net of NSFR derivative liabilities calculated as per paragraph 149, if the NSFR derivatives assets are greater than liabilities.

- c) All other assets not included in the above categories including non-performing loans, loans to FIs with a residual maturity of one year or more, non-exchange traded equities, fixed assets, items deducted from regulatory capital, subsidiary interests and defaulted securities

- d) 20% of derivative liabilities as calculated according to paragraph 149

Off-Balance Sheet Exposures

- 170) 5% RSF factor of the currently undrawn portion

- a) Irrevocable and conditionally revocable credit and liquidity facilities for any client

- b) Trade finance related obligations (including guarantees and letters of credit)

- 171) 10% RSF factor

- a) Non-contractual obligations such as potential requests for debt repurchases of the banks own debt, structured products where the bank has to maintain liquidity and managed funds where there is a commitment to maintain stability

- 172) 20% RSF factor

- a) Guarantees and letters of credit unrelated to trade finance obligations

- 170) 5% RSF factor of the currently undrawn portion