V. Counterparty Credit Risk

I. Introduction and Scope

1.This Standard articulates specific requirements for the calculation of risk-weighted assets (RWA) to recognize exposure amounts for Counterparty Credit Risk (CCR) for banks in the UAE. It replaces any and all previous approaches to assessment of counterparty credit risk for purposes of regulatory capital calculations. The Standard is based closely on requirements of the framework for capital adequacy developed by the Basel Committee on Banking Supervision, specifically the Standardized Approach for CCR as articulated in The standardized approach for measuring counterparty credit risk exposures, March 2014 (rev. April 2014), and subsequent clarifications thereto by the Basel Committee.

2.This Standard applies to all derivatives transactions, whether exchange-traded or over-the-counter, and also applies to long-settlement transactions (the “in-scope” transactions). In this Standard, references to “derivatives” should be understood to apply to all in-scope transactions.

3.This Standard formulates capital adequacy requirements that needs to be applied to all banks in UAE on a consolidated basis.

4.The Standards follow the calibration developed by the Basel Committee, which includes a maximum risk weight of 1250%, calibrated on a total capital adequacy requirement of 8%. The UAE instituted a higher minimum capital requirement of 10.5% (excluding capital buffers), applicable to all licensed banks. Consequently, the maximum capital charge for a single exposure will be the lesser of the value of the exposure after applying valid credit risk mitigation, netting and haircuts, and the capital resulting from applying a risk weight of 952% (reciprocal of 10.5%) to this exposure.

II. Definitions

In general, terms in this Standard have the meanings defined in other Regulations and Standards issued by the Central Bank. In addition, for this Standard, the following terms have the meanings defined in this section.

- •A basis transaction is a non-foreign-exchange (that is, denominated in a single currency) transaction in which the cash flows due to one counterparty depend on a risk factor that differs from the risk factor (from the same asset class) that determines payments due to the other counterparty.

- •A central counterparty (CCP) is an entity that interposes itself between counterparties to contracts traded within one or more financial markets, becoming the legal counterparty such that it is the buyer to every seller and the seller to every buyer.

- •A centrally cleared derivative transaction is a derivatives transaction that is cleared though a central counterparty.

- •A clearing member is an entity that conducts transactions through a central counterparty as a member of that central counterparty.

- •A commodity type is a set of commodities that have broadly similar risk drivers, such that the prices or volatilities of commodities of the same commodity type may reasonably be expected to move with similar direction and timing and to bear predictable relationships to one another.

- •Counterparty credit risk is the risk of loss due to a failure by a counterparty to an in-scope transaction to deliver to the bank according to contractual terms at settlement.

- •A hedging set is a set of transactions within a single netting set exposed to similar risk factors, and for which partial or full offsetting may be recognized in the calculation of the potential future exposure add-on.

- •The independent collateral amount (ICA) is collateral posted by a counterparty that the bank may seize upon default of the counterparty. ICA may be defined by the Independent Amount parameter in standard industry documentation. ICA may change in response to factors such as the value of the collateral or a change in the number of transactions in the netting set, but (unlike variation margin) not in response to the value of the transactions it secures.

- •A long settlement transaction is one in which a counterparty undertakes to deliver a security, commodity, or foreign exchange amount against cash, other financial instruments, or commodities at a contractually specified settlement or delivery date that exceeds the market standards for settlement or delivery of the particular instrument, or if that settlement date is more than five business days from the date the transaction is initiated.

- •The margin period of risk for a derivatives contract is the length of time from the last exchange of collateral covering a netting set until transactions with a defaulting counterparty can be closed out and the resulting risk re-hedged.

- •Margined transactions are those in which variation margin is exchanged between counterparties; other transactions are un-margined.

- •Net Current Value (NCV) for a netting set is the total current market value of all transactions (which may be negative) minus the net value of any collateral held by a bank, after application of any collateral haircuts.

- •The net independent collateral amount (NICA) is the difference between the ICA posted by a counterparty and any ICA posted by the bank for that counterparty, excluding any collateral that the bank has posted to a segregated, bankruptcy remote account.

- •Netting by novation refers to a netting arrangement in which any obligation between two counterparties to deliver a given currency on a given value date is automatically combined with all other obligations for the same currency and value date, legally substituting one single amount for the previous gross obligations.

- •A netting set is a group of contracts with a single counterparty subject to a legally enforceable agreement for net settlement, and satisfying all of the conditions for netting sets specified in this Standard.

- •Potential Future Exposure (PFE) is an estimate of the potential increase in exposure to counterparty credit risk against which regulatory capital must be held.

- •A Qualifying Central Counterparty (QCCP) is a CCP that meets certain qualification requirements articulated in this Standard.

- •The remaining maturity of a derivative transaction is the time remaining until the latest date at which the contract may still be active. If a derivative contract has another derivative contract as its underlying (for example, a swaption) and may be physically exercised into the underlying contract (that is, a bank would assume a position in the underlying contract in the event of exercise), then the remaining maturity of the contract is the time until the final settlement date of the underlying derivative contract. For a derivative contract that is structured such that any outstanding exposure is settled on specified dates and the terms are reset so that the fair value of the contract is zero, the remaining maturity equals the time until the next reset date.

- •Variation margin (VM) means margin in the form of cash or financial assets exchanged on a periodic basis between counterparties to recognize changes in contract value due to changes in market factors.

- •A volatility transaction is one in which the settlement amount of the contract depends on the level of volatility of a risk factor.

- •A bank’s position in a particular trade or transaction is long or long in the primary risk factor if the market value of the transaction increases when the value of the primary risk factor increases; alternatively, the position is short or short in the primary risk factor if the market value of the transaction decreases when the value of the primary risk factor increases.

III. Requirements for Counterparty Credit Risk (CCR)

Netting Sets

5.Banks must calculate RWA for CCR at the level of nettings sets for derivatives. Accordingly, a bank must group all exposures for each counterparty into one or more netting sets. In every such case where netting is applied, a bank must satisfy the Central Bank that it has:

- •A contract with the counterparty or other agreement that creates a single legal obligation, covering all included transactions, such that the bank would have either a claim to receive or obligation to pay only the net sum of the positive and negative mark-to-market values of included individual transactions in the event a counterparty fails to perform due to default, bankruptcy, liquidation, or similar circumstances.

- •Written and reasoned legal reviews that in the event of a legal challenge, the relevant courts and administrative authorities would find the bank’s exposure to be such a net amount under:

- •The law of the jurisdiction in which the counterparty is chartered and, if the foreign branch of a counterparty is involved, then also under the law of the jurisdiction in which the branch is located;

- •The law that governs the individual transactions; and

- •The law that governs any contract or agreement necessary to affect the netting.

- •Procedures in place to ensure that the legal characteristics of netting arrangements are kept under review in light of the possible changes in relevant law.

6.The Central Bank, after consultation when necessary with other relevant supervisors, must be satisfied that the netting is enforceable under the laws of each of the relevant jurisdictions.

Exposure at Default and Risk-Weighted Assets

7.A bank must calculate RWA for CCR by (i) calculating the Exposure At Default (EAD) for each netting set associated with a counterparty, (ii) summing EAD across netting sets for that counterparty, (iii) calculating risk-weighted EAD by multiplying the total EAD for a counterparty by the risk-weight corresponding to the exposure class to which that counterparty belongs under general risk-based capital requirements, (iv) summing the resulting risk-weighted EAD across all counterparties within a given exposure class and (v) summing across exposure classes.

8.Banks must calculate EAD separately for each netting set, as the sum of the Replacement Cost (RC) of the netting set plus the calculated Potential Future Exposure (PFE) for the netting set, with the sum of the two multiplied by a factor of 1.4:

9.Margined and un-margined netting sets require different calculation methods for RC and PFE. The EAD for a margined netting set is capped at the EAD of the same netting set calculated on an un-margined basis. That is, for a netting set covered by a margin agreement, the bank may calculate EAD as if the netting set is un-margined, and may use that value as the EAD if it is lower than the EAD calculation considering margin.

10.The time-period for the haircut applicable to non-cash collateral for the RC calculation should be one year for un-margined trades, and the relevant margin period of risk for margined trades.

Replacement Cost

11.Banks must calculate replacement cost at the netting set level. Calculations for margined and un-margined transactions differ.

12.Banks first must calculate the total current market value of the derivative contracts in the netting set. Banks may net transactions within a netting set that are subject to any legally valid form of bilateral netting, including netting by novation. Banks must then subtract from that total current market value the net value of collateral (after application of collateral haircuts) held by the bank for the netting set. The result is the Net Current Value (NCV) of the transactions in the netting set.

13.For un-margined transactions, RC for a netting set is equal to the NCV, provided the NCV is greater than zero. If that value is not greater than zero, RC equals zero.

14.For margined transactions, RC depends on the greatest exposure that would not trigger a call for variation margin, taking into account the mechanics of collateral exchanges in the margining agreements. That critical exposure level is equal to the threshold level of variation that would require a transfer of collateral, plus the minimum transfer amount of the collateral. The bank should subtract from that exposure amount the NICA, if any, to calculate the RC for margined transactions. However, the resulting RC may be no less than the RC if the netting set were un-margined. That is, for a margined netting set the RC is equal to the larger of the amount calculated according to this paragraph, or the RC for the same netting set if un-margined.

15.Bilateral transactions with a one-way margining agreement in favor of the bank’s counterparty (that is, where the bank posts margin but the counterparty does not) must be treated as un-margined transactions.

16.If multiple margin agreements apply to a single netting set, the bank must divide the netting set into sub-netting sets that align with each respective margin agreement, and calculate RC for each sub-netting set separately.

Potential Future Exposure

17.Calculation of PFE relies on computation of various “add-on” amounts, which are intermediate measures of exposure that are combined in various ways to compute PFE. The bank must calculate PFE for each netting set as a simple summation of the add-ons computed for each of the various asset classes within that netting set, multiplied by a multiplier that allows for recognition of excess collateral or negative mark-to-market value for the transactions. Requirements for calculation of the multiplier and the add-ons for each asset class are described below in this Standard.

18.The bank must allocate all derivatives transactions to one or more of the following asset classes based on the primary risk driver of the transaction:

- •Interest Rate Derivatives

- •Foreign Exchange Derivatives

- •Credit Derivatives

- •Equity Derivatives

- •Commodity Derivatives

19.As described in more detail below in this Standard, trades within each of these asset classes are further divided into hedging sets, and an aggregation method is applied to aggregate trade-level inputs at the hedging set level and finally at the asset class level. For derivative transactions within the credit, equity, and commodity asset classes, this aggregation involves a supervisory correlation parameter to capture important aspects of basis risk and diversification.

20.For trades that may have more than one risk driver (e.g. multi-asset or hybrid derivatives), banks must apply an analysis based on risk-driver sensitivities and volatility of the underlying reference price or rate to determine the existence of a dominant risk driver, and make the asset class allocation accordingly. When a derivative is materially exposed to risk drivers spanning more than one asset class, a bank must assign the position to each relevant asset class rather than to a single asset class, with appropriate delta adjustment. The Central Bank may direct banks to assign complex derivatives to multiple asset classes, regardless of analysis that the bank may or may not have conducted.

21.As is the case with Replacement Cost, if multiple margin agreements apply to a single netting set, the bank must divide the netting set into sub-netting sets that align with each respective margin agreement, and calculate the PFE for each sub-netting set separately.

Adjusted Notional Amount

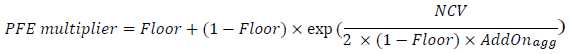

22.Banks must calculate adjusted notional amounts from trade-level notional amounts for each transaction as described in this Standard.

23.For foreign exchange derivatives, the adjusted notional is defined as the notional of the foreign currency leg of the contract, converted to the domestic currency. If both legs of a foreign exchange derivative are denominated in currencies other than the domestic currency, the notional amount of each leg should be converted to the domestic currency, and the adjusted notional amount is equal to the value of the leg with the larger domestic currency value.

24.For equity and commodity derivatives, the adjusted notional is equal to the product of the current price of one unit of the stock or commodity and the number of units referenced by the trade. For equity and commodity volatility transactions, adjusted notional is equal to the product of the underlying volatility and the notional value of the transaction.

25.For interest rate derivatives and credit derivatives, the trade-level adjusted notional in units of domestic currency must be multiplied by a supervisory duration (SD) measure as follows:

- a)First, the bank must determine the start date of the time period referenced by the interest rate or credit contract, and time that remains until that start date, measured in years; this is “S.” If the derivative references the value of another interest rate or credit instrument (as with a swaption or bond option), the time period is that of the underlying instrument. If the time-period referenced by the derivative has already started, the bank must set S to zero.

- b)Next, the bank must determine the end date of the time period referenced by the interest rate or credit contract, and the time remaining until that end date, measured in years; this is “E.” If the derivative references the value of another interest rate or credit instrument (as with a swaption or bond option), the time period is that of the underlying instrument.

- c)The bank then must compute SD for the transaction using the following formula, with the identified values of S and E based on the terms of the contract (where “exp” denotes the exponential function):

- d)Finally, the bank calculates the adjusted notional amount for the transaction by multiplying the trade notional amount by the supervisory duration SD.

26.Banks also must apply the following rules when determining trade notional amounts, for transaction covered by the cases noted below:

- a)For transactions with payoffs that are state contingent such as digital options or target redemption forwards, a bank must calculate the trade notional amount for each state, and use the largest resulting calculation.

- b)If the notional is based on a formula that depends on market values, the bank must enter the current market values to determine the trade notional amount to be used in computing adjusted notional amount.

- c)For variable notional swaps such as amortizing and accreting swaps, banks must use the average notional over the remaining life of the swap as the trade notional amount.

- d)For leveraged swaps in which rates are multiplied by a factor, the bank must multiply the stated notional by the same factor to determine the trade notional amount.

- e)For a derivative contract with multiple exchanges of principle, the bank must multiply the notional by the number of exchanges of principle in the derivative contract to determine the trade notional amount.

Supervisory Delta Adjustment and Effective Notional Amount

27.Banks must determine a supervisory delta adjustment for each transaction for use in calculations of effective notional amounts. Banks must apply supervisory delta adjustments at the trade level that reflect the direction of the transaction - that is, whether the position is long or short in the primary risk driver - and on whether the transaction is an option, CDO tranche, or neither. Supervisory delta adjustments are provided in Table 1.

Table 1: Supervisory Delta Adjustments

Type of Derivative Transaction Supervisory Delta Adjustment Purchased Call Option F Purchased Put Option F-1 Sold Call Option -F Sold Put Option 1-F Purchased CDO Tranche (Long Protection) G Sold CDO Tranche (Short Protection) -G Any Other Derivative Type, Long in the Primary Risk Factor +1 Any Other Derivative Type, Short in the Primary Risk Factor -1 Definitions for Table 1

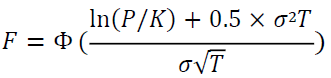

For options:

In this expression, P is the current forward value of the underlying price or rate, K is the exercise or strike price of the option, T is the time to the latest contractual exercise date of the option, a is the appropriate supervisory volatility from Table 2, and 0 is the standard normal cumulative density function. A supervisory volatility of 50% should be used on swaptions for all currencies.

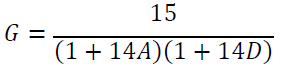

For CDO tranches:

In this expression, A is the attachment point of the CDO tranche and D is the detachment point of the CDO tranche.

Maturity Factor

28.Banks must determine a maturity factor (MF) for each transaction for use in calculations of effective notional amounts, with the specific calculation method for MF depending on whether the derivative transaction is margined or un-margined.

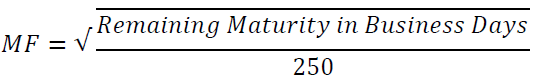

29.For un-margined transactions, the maturity factor must be set equal to 1.0, unless the remaining maturity of the derivative transaction is less than one year. If the remaining maturity is less than one year, the maturity factor for an un-margined transaction is computed as the square root of the remaining maturity expressed in years, on a business-day-count basis, as follows:

30.If an un-margined transaction has a remaining maturity of 10 business days or less, the bank must set the maturity factor equal to the square root of (10/250).

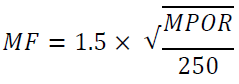

31.For margined transactions, the maturity factor MF must be based on the margin period of risk (MPOR) appropriate for the margining agreement containing the transaction, measured in days, and computed as follows:

32.The bank must determine MPOR based on the terms of the margined transaction, subject to the following minimums:

- a)At least ten business days for non-centrally-cleared derivative transactions subject to daily margin agreements.

- b)At least five business days for centrally cleared derivative transactions subject to daily margin agreements that clearing members have with their clients.

- c)At least twenty business days for netting sets consisting of 5000 or more transactions that are not centrally cleared.

33.The bank must double the MPOR for netting sets that have experienced more than two margin call disputes over the previous two calendar quarters if those disputes were not resolved within a period corresponding to the MPOR that would otherwise be applicable.

Allocation of Transactions to Hedging Sets

34.Banks must allocate every transaction within each netting set to a hedging set according to the following rules for each asset class:

- a)Interest Rate Derivatives: A hedging set must be created for each set of interest rate derivatives that reference interest rates of the same currency. Interest rate derivative hedging sets are further subdivided into maturity categories, as described below. In interest rate hedging sets, full offset is recognized between long and short positions within one maturity category, and partial offset across maturity categories. Note that the number of interest rate hedging sets may differ between different netting sets, depending on the number of distinct currencies.

- b)Foreign Exchange Derivatives: A hedging set consists of derivatives that reference the same currency pair. Full offset is recognized between long and short positions in any currency pair. Note that the number of foreign exchange hedging sets may vary between different netting sets.

- c)Credit Derivatives: All credit derivatives should be allocated to a single hedging set. Full offset is recognized between long and short positions referencing the same entity (name or index) within the hedging set.

- d)Equity Derivatives: All equity derivatives should be allocated to a single hedging set. Full offset is recognized between long and short positions referencing the same entity (name or index) within the hedging set.

- e)Commodity Derivatives: In the commodity asset class, separate hedging sets are used for energy, metals, agriculture, and other commodities. Full offset of long and short positions is recognized between derivatives referencing the same commodity type, while PFE add-on calculations provide partial offset between different commodity types within the same commodity hedging set.

35.Basis transactions and volatility transactions must form separate hedging sets within their respective asset classes.

- a)All basis transactions in a netting set that belong to the same asset class and reference the same pair of risk factors form a single hedging set, and follow the hedging set aggregation rules for the relevant asset class. The bank must treat each pair of risk factors as a separate hedging set.

- b)The bank must place all volatility transactions in a netting set into a distinct hedging set within the corresponding asset class, according to the rules of that asset class. For example, all equity volatility transactions within a netting set form a single volatility hedging set within that netting set.

Add-on for Interest Rate Derivatives

36.For interest rate derivatives, banks must assign each contract to one of three maturity categories based on the remaining life of the contract:

- •Maturity Category 1: Less than one year

- •Maturity Category 2: From one year to five years

- •Maturity Category 3: Greater than five years

37.The bank must then calculate the effective notional amount for each interest rate derivative hedging set (that is, for the set of interest rate derivatives in any single currency) by summing across transactions within a maturity category the product of the adjusted notional amount of the transaction, the maturity factor for the transaction, and the supervisory delta adjustment. That is, for each individual interest rate derivative within a maturity category in a single hedging set, the bank must calculate:

and then sum that product across all interest rate derivatives in one maturity category in that hedging set to get the effective notional amount.

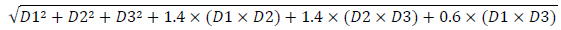

38.For each interest rate hedging set, the result will be three effective notional amounts, one for each maturity category: D1 for Category 1, D2 for Category 2, and D3 for Category 3. The bank may then combine these effective notional amounts from each maturity category using the following formula:

39.As an alternative, the bank may choose to combine the effective notional values as the simple sum of the absolute values for each of the three maturity categories within a hedging set, which has the effect of ignoring potential offsets. That is, as an alternative to the calculation above, the bank may calculate:

40.Regardless of the approach used to combine the effective notional amounts, the bank must multiply the result of the calculation by the supervisory factor for the interest rate asset class from Table 2, and sum across all interest rate hedging sets to calculate the aggregate add-on for the interest rate asset class.

Add-on for Foreign Exchange Derivatives

41.For foreign exchange derivatives, banks must calculate the effective notional amount for each hedging set (that is, for the set of foreign exchange derivatives referencing a single currency pair) by summing across transactions within a hedging set the product of the adjusted notional amount of the transaction, the maturity factor for the transaction, and the supervisory delta adjustment. That is, for each individual foreign exchange derivative in a single hedging set (that is, referencing a single currency pair), the bank must calculate:

and then sum that product across all foreign exchange derivatives in that hedging set to get the effective notional amount for the hedging set.

42.The bank must multiply the absolute value of the resulting effective notional amount for each hedging set (each currency pair) by the supervisory factor for the foreign exchange asset class from Table 2, and sum across all foreign exchange hedging sets to calculate the aggregate add-on for the foreign exchange asset class.

Add-on for Credit Derivatives

43.For credit derivatives, banks must calculate the effective notional amount for each entity (that is, for each set of credit derivatives referencing a single name or credit index) by summing, across all credit derivative transactions that reference that entity, the product of the adjusted notional amount of the transaction, the maturity factor for the transaction, and the supervisory delta adjustment. That is, for each individual credit derivative referencing any single entity, the bank must calculate:

for each transaction and then sum that product across all credit derivatives that reference that entity to get the effective notional amount for the entity.

44.The bank must calculate the entity-level add-on by multiplying the result of this calculation by the appropriate supervisory factor from Table 2, depending on the rating of the entity (for single-name derivatives) or depending on whether the index is investment grade or speculative grade (for index derivatives).

45.For credit derivatives that reference unrated single-name entities, the bank should use the Supervisory Factor corresponding to BBB rated entities. However, where the entity has an elevated risk of default, banks should use the Supervisory Factor corresponding to BB rated entities. For credit index entities, the classification into investment grade or speculative grade should be determined based on the credit quality of the majority of the individual components of the index.

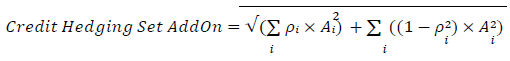

46.The bank must use the entity-level add-ons to calculate the add-on for the credit derivative hedging set. This is done through a calculation based on the use of supervisory correlation factors from Table 2. Specifically, the bank must calculate the add-on for the credit derivative hedging set by calculating:

where Ai is the entity-level add-on for one entity (each “i” is a different entity, either single-name or index), and

ρi is the supervisory correlation (either 0.5 or 0.8) for that entity.

47.Note that credit derivatives that are basis or volatility transactions must be treated in separate hedging sets within the credit derivatives asset class, with adjustments to supervisory factors as required under this Standard. In that case, the add-on for the credit derivatives asset class is the sum of the hedging set add-on calculated above, plus add-ons for any basis or volatility hedging sets.

Add-on for Equity Derivatives

48.For equity derivatives, banks must calculate the effective notional amount for each entity (that is, for each set of equity derivatives referencing a single name or equity index) by summing, across all equity derivatives transactions that reference that entity, the product of the adjusted notional amount of the transaction, the maturity factor for the transaction, and the supervisory delta adjustment. That is, for each individual equity derivative referencing any single entity, the bank must calculate:

for each transaction and then sum that product across all equity derivatives that reference that entity to get the effective notional amount for the entity.

49.The bank must calculate the entity-level add-on by multiplying the result of this calculation by the appropriate supervisory factor from Table 2.

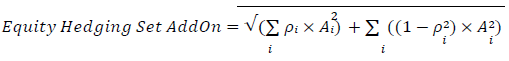

50.The bank must use the entity-level add-ons to calculate the add-on for the equity derivative hedging set. This is done through a calculation based on the use of supervisory correlation factors from Table 2 for single-name equities and equity indexes. Specifically, the bank must calculate the add-on for the equity derivative hedging set by calculating:

where,

Ai is the entity-level add-on for one entity (each “i” is a different entity, either single-name or index), and

ρi is the supervisory correlation for that entity from Table 2.

51.Note that equity derivatives that are basis or volatility transactions must be treated in separate hedging sets within the equity derivatives asset class, with adjustments to supervisory factors as required under this Standard. In that case, the add-on for the equity derivatives asset class is the sum of the hedging set add-on calculated above, plus add-ons for any basis or volatility hedging sets.

Add-on for Commodity Derivatives

52.For the commodity asset class, a bank must assign each commodity derivative to one of the four hedging sets: energy, metals, agriculture, or other. The bank should also define one or more commodity types within each hedging set, and assign each derivative transaction to one of those commodity types. Long and short trades within a single commodity type can be fully offset.

53.The bank must establish appropriate governance processes for the creation and maintenance of the list of defined commodity types that are used for CCR calculations. These types should have clear definitions stated in written policies, and independent internal review or validation processes should ensure that the commodity types are applied properly. Internal review and validation processes also should determine that commodities grouped as a single type are in fact reasonably similar. Only commodity types established through adequately controlled internal processes may be used.

54.Banks must calculate the effective notional amount for each commodity type (that is, for each set of commodity derivatives that reference commodities of the same type) by summing, across all transactions that reference that commodity type, the product of the adjusted notional amount of the transaction, the maturity factor for the transaction, and the supervisory delta adjustment. That is, for each individual commodity derivative referencing any single commodity type, the bank must calculate:

for each transaction and then sum that product across all commodity derivatives that reference that commodity type to get the effective notional amount for the commodity type.

55.The bank must calculate the add-on for each commodity type by multiplying the result of this calculation by the appropriate supervisory factor from Table 2.

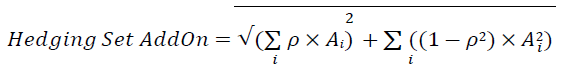

56.The bank must use the add-ons for each commodity type to calculate the add-on for each hedging set (energy, metals, agriculture, and other). This is done through a calculation using the supervisory correlation factor for commodity derivatives. Specifically, the bank must calculate the add-on for each of the four commodity derivative hedging sets by calculating:

where ρ is the supervisory correlation factor for commodity derivatives,

and Ai is the add-on for one commodity type within the hedging set (each “i” is a different commodity type within a given hedging set).

57.Note that commodity derivatives that are basis or volatility transactions must be treated in separate hedging sets within the commodity derivatives asset class, with adjustments to supervisory factors as required under this Standard.

58.The add-on for the commodity derivatives asset class is the sum of the four hedging set add-ons as calculated above (some of which may be zero if the bank has no derivatives within one of the four hedging sets), plus corresponding add-ons for any basis or volatility hedging sets.

59.Commodity hedging sets have been defined in this Standard without regard to other potentially important characteristics of commodities, such as location and quality. For example, the energy hedging set contains commodity types such as crude oil, electricity, natural gas, and coal. The Central Bank may require a bank to use more refined definitions of commodity types if the Central Bank determines that the bank is significantly exposed to the basis risk of different products within any bank-defined commodity type.

Supervisory Factors, Correlations, and Volatilities

60.Table 2 provides the values of Supervisory Factors, correlations, and supervisory option volatilities for use with each asset class and subclass.

61.For any basis transaction hedging set, the Supervisory Factor applicable to its relevant asset class or sub-class must be multiplied by 0.5.

62.For any volatility transaction hedging set, the Supervisory Factor applicable to its relevant asset class or sub-class must be multiplied by 5.0.

Table 2: Supervisory Factors, Correlations, and Volatilities

Asset Class Hedging Sets Subclass Supervisory Factor Correlation Supervisory Option Volatility Interest Rate One hedging set for each currency 0.50% N/A 50% Foreign Exchange One hedging set for each currency pair 4.00% N/A 15% Credit, Single Name One hedging set for all credit derivatives AAA

AA

A

BBB

BB

B

CCC0.38%

0.38%

0.42%

0.54%

1.06%

1.60%

6.00%50% 100% Credit, Index Investment Grade

Speculative Grade0.38%

1.06%80% 80% Equity, Single Name One hedging set for all equity derivatives Single Name 32.00% 50% 120% Equity, Index Index 20.00% 80% 75% Commodity Energy Electricity

Other Energy40.00%

18.00%

18.00%

18.00%

18.00%40% 150%

70%

70%

70%

70%Metals Metals Agriculture Agriculture All other All other PFE Multiplier

63.For each netting set, the bank must compute a PFE multiplier and multiply the sum of the asset class add-ons for the netting set by that multiplier. The bank must calculate the PFE multiplier using the NCV and the aggregate add-on for the netting set (AddOnagg) according to the following formula (where “exp” denotes the exponential function):

64.Consistent with international regulatory standards, the Floor for this calculation is established at the level of 0.05 (5%) under this Standard.

65.If the PFE multiplier for a netting set is greater than 1.0 when calculated according to the formula above (which generally occurs when NCV>0), the bank should set the PFE multiplier equal to 1.0 when calculating PFE. Note that NCV is the same as the calculation of RC for un-margined transactions, but without the limitation of a lower bound of zero (that is, NCV can be negative).

Margin Agreements Covering Multiple Netting Sets

66.If a single margin agreement applies to several netting sets, so that collateral is exchanged based on mark-to-market values that are netted across all transactions covered under the margin agreement irrespective of netting sets, calculations of both RC and PFE are affected as described in this Standard. Special treatment is necessary because it is problematic to allocate the common collateral to individual netting sets.

67.A bank must compute a single combined RC for all netting sets covered by the margin agreement. Combined RC is the sum of two elements, each of which must be no less than zero. The first element is equal to the un-margined current exposure the bank has to the counterparty, aggregated across all netting sets covered by the margin agreement, less the cash equivalent value of any collateral available to the bank at the time (including both VM and NICA) if the bank is a net holder of collateral. The second term is added only when the bank is a net provider of collateral, and is equal to the current net value of the posted collateral, reduced by the un-margined current exposure of the counterparty to the bank aggregated across all netting sets covered by the margin agreement.

68.The bank must calculate PFE for transactions subject to a single margin agreement covering multiple netting sets as if those transactions were un-margined, with the resulting calculations of PFE for each netting set then aggregated through summation. Both the multiplier and the PFE add-on should be calculated as if the transactions were un-margined.

IV. Requirements for Bank Exposures to Central Counterparties

69.The Financial Stability Board has determined that central clearing of over-the-counter derivatives reduces global systemic risk. Accordingly, the Central Bank assigns lower risk weights to bank exposures to central counterparties (CCPs) that meet certain standards for qualification, as described below for Qualifying Central Counterparties (QCCPs).

70.Banks must treat exposures to non-qualifying CCPs as they would treat exposures to any other non-qualifying counterparty. If a CCP being treated as a QCCP ceases to qualify as a QCCP, exposures to that former QCCP may continue to be treated as though they were QCCP exposures for a period of three months, unless the Central Bank requires otherwise. After the three-month period, the bank’s exposures to such a CCP must be treated as bilateral counterparty credit exposures.

Qualifying Central Counterparties

71.For a counterparty entity to be considered a QCCP for purposes of this Standard, the entity must meet the following conditions:

- •Be licensed to operate as a CCP and permitted to operate as such by the appropriate regulator or overseer with respect to the products that are centrally cleared.

- •Provide UAE banks with the information required to calculate RWA for any default fund exposures to the CCP according to the requirements stated in this Standard.

- •Be based and prudentially supervised in a jurisdiction where the relevant regulator or overseer has established and publicly indicated that domestic rules and regulations consistent with the CPMI-IOSCO Principles for Financial Market Infrastructures apply to the CCP on an ongoing basis. For CCPs in jurisdictions that do not have a CCP regulator applying the Principles to the CCP, the Central Bank may make a determination regarding whether the CCP meets the requirements for treatment as a QCCP.

72.A bank must have robust internal procedures to identify specific CCPs that qualify for treatment as QCCPs under this Standard. The internal identification process should reflect the conditions stated above in this Standard, and produce evidence the bank then provides to the Central Bank to demonstrate that a specific CCP meets the conditions for qualification. A bank may not treat any CCP as a QCCP for capital purposes unless and until the Central Bank reviews the bank’s determination and indicates no objection.

Exposures to QCCPs

73.A bank must calculate RWA for exposures to QCCPs to reflect credit risk due to trade exposures (either as a clearing member of the QCCP or as a client of a clearing member), posted collateral, and default fund contributions. If a bank’s combined RWA for trade exposures to a QCCP and default fund contribution for that QCCP is higher than would apply for those same exposures if the QCCP were a non-qualifying CCP, the bank may treat the exposures as if the QCCP was non-qualifying.

Trade exposures to the QCCP

74.A risk weight of 2% applies to a bank’s trade exposure to the QCCP where the bank as a clearing member of the QCCP trades for its own account. The risk weight of 2% also applies to trade exposures to the QCCP arising from clearing services the bank provides to clients where the bank is obligated to reimburse those clients for losses in the event that the QCCP defaults.

75.In general, a bank must calculate exposure amounts for trade exposures to QCCPs as for other derivatives exposure under this Standard. Banks must use a minimum MPOR of 10 days for the calculation of trade exposures to QCCPs on over-the-counter derivatives. Where QCCPs retain variation margin against certain trades and the member collateral is not protected against the insolvency of the QCCP, the minimum horizon applied to the bank’s QCCP trade exposures must be the lesser of one year and the remaining maturity of the transaction, with a floor of 10 business days.

Treatment of posted collateral

76.Any assets or collateral posted to the QCCP by the bank must receive the banking book or trading book treatment it would receive under the capital adequacy framework, regardless of the fact that such assets have been posted as collateral. Where the entity holding such assets or collateral is the QCCP, a risk-weight of 2% applies to collateral included in the definition of trade exposures. The relevant risk-weight of the QCCP will apply to assets or collateral posted for other purposes.

77.A risk weight of zero applies to all collateral (including cash, securities, other pledged assets, and excess initial or variation margin) posted by the clearing member that is held by a custodian and is bankruptcy remote from the QCCP. Collateral posted by a client that is held by a custodian and is bankruptcy remote from the QCCP, the bank, and other clients of the bank is not subject to a CCR capital requirement.

78.Where a bank posts assets or collateral (either as a clearing member or on behalf of a client) with a QCCP or a clearing member, and the assets or collateral is not held in a bankruptcy remote manner, the bank must recognize credit risk based upon the creditworthiness of the entity holding such assets or collateral. Posted collateral not held in a bankruptcy remote manner must be accounted for in the NICA term for CCR calculations.

Default fund exposures

79.A bank’s default fund contributions as a clearing member of a QCCP must be included in the bank’s calculation of risk-weighted assets. Certain inputs required for the RWA calculation must be provided to the bank by the QCCP, its supervisor, or some other body with access to the required data, as described below. Provision of the necessary inputs is a condition for CCP qualification.

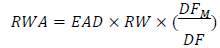

80.Risk-weighted assets for the bank’s default fund contributions should be calculated as:

where

- •RW is a risk weight of 20% unless the Central Bank determines that banks must apply a higher risk weight, for example to reflect a QCCP membership composed of relatively high-risk members;

- •DFM is the bank’s total pre-funded contributions to the QCCP’s default fund;

- •DF is the total value of the QCCP’s default fund, including its own funds and the prefunded contributions from members; and

- •EAD is the sum of the QCCP’s exposure to all clearing members accounts, including clearing members’ own transactions, client transactions guaranteed by clearing members, and the value of all collateral held by the QCCP against those transactions (including clearing members’ prefunded default fund contributions) prior to exchange of margin in the final margin call on the date of the calculation. This exposure should include the exposure arising from client sub-accounts to the clearing member’s proprietary business where clearing members provide client-clearing services and the client transactions and collateral are held in separate (individual or omnibus) subaccounts.

81.However, if the RWA from the calculation above is less than 2% of the amount of the bank’s pre-funded contributions to the default fund, then the bank must set RWA equal to 2% of its pre-funded contributions to the default fund, which is 2%×DFM.

82.Exposure to each clearing member for the QCCP’s EAD calculation is the bilateral CCR trade exposure the QCCP has to the clearing member as calculated under this Standard, using MPOR of 10 days. All collateral held by a QCCP to which that QCCP has a legal claim in the event of the default of the member or client, including default fund contributions of that member, is used to offset the QCCP’s exposure to that member or client for the PFE multiplier. If the default fund contributions of the member are not split with regard to client and sub-accounts, they must be allocated to sub-accounts according to the initial margin of that sub-account as a fraction of the total initial margin posted by or for the account of the clearing member.

83.If clearing member default fund contributions are segregated by product types and only accessible for specific product types, the RWA calculation must be performed for each specific product giving rise to counterparty credit risk. Any contributions by the bank to prepaid default funds covering settlement-risk-only products should be risk-weighted at 0%. If the QCCP’s own prefunded resources cover multiple product types, the QCCP must allocate those funds to each of the calculations, in proportion to the respective product-specific EAD.

84.However, where a default fund is shared between products or types of business with settlement risk only (such as equities and bonds) and products or types of business which give rise to counterparty credit risk, all of the default fund contributions receive the risk weight determined above, without apportioning to different classes or types of business or products.

85.Banks must apply a risk weight of 1250% to default fund contributions to a non-qualifying CCP. For the purposes of this paragraph, the default fund contributions of such banks will include both the funded contributions and any unfunded contributions for which the bank could be liable upon demand by the CCP.

86.As a requirement for QCCP qualification, the CCP, its supervisor, or another body with access to the required data must calculate and provide values for EAD, DFM, and DF in such a way to permit the supervisor of the CCP to oversee those calculations, and must share sufficient information about the calculation results to permit banks to calculate capital requirements for their exposures to the default fund, as well as to permit the Central Bank to review and confirm such calculations. The information must be provided at least quarterly, although the Central Bank may require more frequent calculations in the event of material changes, such as material changes to the number or size of cleared transactions, material changes to the financial resources of the QCCP, or initiation by the QCCP of clearing of a new product.

Clearing member exposures to clients

87.A bank as a clearing member of a QCCP must treat its exposure to clients as bilateral trades, irrespective of whether the bank as clearing member guarantees the trade or acts as an intermediary between the client and the QCCP.

88.If a bank as a clearing member of a QCCP collects collateral from a client and passes this collateral on to the QCCP, the bank may recognize this collateral for both the exposure to the QCCP and the exposure to the client.

89.If a bank as a clearing member conducts an exchange-traded derivatives transaction on a bilateral basis with a client, it is treated as a bilateral counterparty credit risk exposure rather than a QCCP exposure. In this case, the bank can compute the exposure to the client using a margin period of risk, subject to a minimum MPOR of at least five days.

90.These requirements also apply to transactions between lower-level clients and higher-level clients in a multi-level client structure. (A multi-level client structure is one in which banks can centrally clear as an indirect client of a clearing member; that is, when clearing services are provided to the bank by an institution that is not a direct clearing member, but is itself a client of a clearing member or another clearing client.)

Bank exposures as a client of clearing members

91.Where a bank is a client of a clearing member, and enters into a transaction with a clearing member who completes an offsetting transaction with the QCCP, of if a clearing member guarantees QCCP performance to the bank as a client, the bank’s exposures to the clearing member may be treated as trade exposures to the QCCP with a risk weight of 2% if the conditions below are met. (This also applies to exposures of lower-level clients to higher- level clients in a multi-level client structure, provided that for all intermediate client levels the two conditions below are met.)

- •Condition 1: Relevant laws, regulation, rules, contractual, or administrative arrangements make it highly likely that, in the event that the clearing member defaults or becomes insolvent, the offsetting transactions with the defaulted or insolvent clearing member would continue to be indirectly transacted through or by the QCCP, and that client positions and collateral with the QCCP would be transferred or closed out at market value.

- •Condition 2: Offsetting transactions are identified by the QCCP as client transactions, and collateral to support them is held by the QCCP and/or the clearing member under arrangements that prevent any losses to the client due to the default or insolvency of either the clearing member or other clients of the clearing member, or of a joint default or insolvency of the clearing member and any of its other clients.

92.Where a bank is a client of the clearing member and the two conditions above are not met, the bank must treat its exposures to the clearing member as an ordinary bilateral exposure under this Standard, not a QCCP exposure. If the two conditions above are met with the exception of the requirement regarding joint default or insolvency of the clearing member and any of its other clients, a 4% risk weight must be applied instead of 2%.

93.A bank must have conducted sufficient legal review (and undertake such further review as necessary to ensure continuing enforceability) and have a well-founded basis to conclude that, in the event of legal challenge, the relevant courts and administrative authorities would find that such arrangements mentioned above would be legal, valid, binding and enforceable under the relevant laws of the relevant jurisdictions. Upon the insolvency of the clearing member, there should be no legal impediment (other than the need to obtain an appropriate court order) to the transfer of the bank’s collateral to one or more surviving clearing members or to the bank or the bank’s nominee.

94.The treatment described here also applies to exposures resulting from posting of collateral by the bank as a client of a clearing member that is held by the QCCP on the bank’s behalf but not on a bankruptcy remote basis.

95.If a bank conducts an exchange-traded derivatives transaction on a bilateral basis with a clearing member as a client of that clearing member, the transaction is treated as a bilateral counterparty credit risk exposure, not a QCCP exposure. The same applies to transactions between lower-level clients and higher-level clients in a multi-level client structure.

Requirements for Bank Risk Management Related to QCCPs

96.The fact that a CCP qualifies as a QCCP does not relieve a bank of the responsibility to ensure that it maintains adequate capital to cover the risk of its exposures. Where the bank is acting as a clearing member, the bank should assess whether the level of capital held against exposures to a QCCP adequately addresses the inherent risks of those transactions through appropriate scenario analysis and stress testing.

97.A bank must monitor and report to its senior management and Board, or an appropriate committee of the Board, on a regular basis all of its exposures to QCCPs, including exposures arising from trading through a QCCP and exposures arising from QCCP membership obligations such as default fund contributions.

V. Review Requirements

98.Bank calculations for Counterparty Credit Risk under this Standard and associated bank processes must be subject to appropriate levels of independent review and challenge. Reviews must cover material aspects of the calculations under this Standard, including but not limited to the determination of netting sets, the assignment of individual transactions to asset classes and hedging sets, the application of supervisory parameters, the definition of commodity types, the treatment of complex derivatives transactions, and the identification of QCCPs.

VI. Shari’ah Implementation

99.Banks offering Islamic financial services that use Shari’ah Compliant alternatives to derivatives approved by their internal Shari’ah control committees should calculate the risk weighted asset (RWA) to recognize the exposure amounts for counterparty credit risk (CCR) as a result of obligations arising from terms and conditions of contracts and documents of those Shari’ah compliant alternatives in accordance with provisions set out in this standard/guidance and in the manner acceptable by Shari’ah. This is applicable until relevant standards and/or guidance in respect of these transactions are issued specifically for banks offering Islamic financial services.