III. Requirements

Banks are required to calculate RWA for CVA as a multiple of capital for CVA risk calculated as specified in these Standards. The calculation relies on regulatory measures of counterparty credit risk exposure, and recognizes the impact of differences in maturity, as well as adjustments to reflect certain common hedging activities that banks use to manage CVA risk. The relevant requirements are described in this Standard.

A. Counterparty Exposure for CVA Calculations

4.A bank must use a measure of exposure at default (EAD) for each counterparty to calculate CVA capital for the CVA portfolio. For derivatives exposures, the bank must use the EAD for each counterparty as calculated under the Central Bank's Counterparty Credit Risk Standard (the CCR Standard), including any effects of collateral or offsets per that Standards.

5.For SFTs, the bank must use the measure of counterparty exposure as calculated for the leverage ratio exposure measure. For that measure, the EAD for SFTs is calculated as current exposure without an add-on for potential future exposure, with current exposure calculated as follows:

- (a)Where a qualifying master netting agreement (MNA) is in place, the current exposure (E*) is the greater of zero and the total fair value of securities and cash lent to a counterparty for all transactions included in the qualifying MNA (>Ei), less the total fair value of cash and securities received from the counterparty for those transactions (>Ci). This is illustrated in the following formula:

E* = max {0, [∑Ei − ∑Ci]}

where E* = current exposure,

∑Ei = total fair value of securities and cash lent to counterparty “i” and

∑Ci = total fair value of securities and cash received from “i”.

- (b)Where no qualifying MNA is in place, the current exposure for transactions with a counterparty must be calculated on a transaction-by-transaction basis – that is, each transaction is treated as its own netting set, as shown in the following formula:

E* = max {0, [E − C]}

where E* = current exposure,

E = total fair value of securities and cash lent in the transaction, and

C = total fair value of securities and cash received in the transaction.

- (a)Where a qualifying master netting agreement (MNA) is in place, the current exposure (E*) is the greater of zero and the total fair value of securities and cash lent to a counterparty for all transactions included in the qualifying MNA (>Ei), less the total fair value of cash and securities received from the counterparty for those transactions (>Ci). This is illustrated in the following formula:

B. CVA Hedges

6.To qualify as an eligible CVA hedge for purposes of the CVA capital calculation, hedge transactions must meet the eligibility requirements stated here:

- (a)The hedge instrument must be an index CDS, or a single-name CDS, single-name contingent CDS, or equivalent hedging instrument that directly references the counterparty being hedged; and

- (b)The transaction must be a component of the bank's CVA risk management program, entered into with the intent to mitigate the counterparty credit spread component of CVA risk and managed by the bank in a manner consistent with that intent.

7.Eligible hedges that are included in the CVA calculation as CVA hedges are excluded from a bank's market risk capital calculations. A bank must treat transactions that are not eligible as CVA hedges as they would any other similar instrument for regulatory capital purposes.

C. CVA Capital Calculation

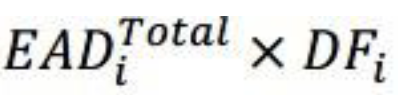

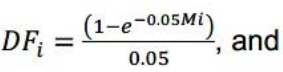

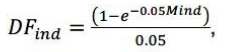

8.The bank must calculate the discounted counterparty exposure for each counterparty by multiplying the total EAD for the counterparty as calculated under these Standards by a supervisory discount factor (DF) for each netting set that reflects notional weighted-average maturity of the counterparty exposures:

where

is the sum of the EADs for all of the exposures to counterparty “i” within the netting set,

Mi is the weighted average maturity for the netting set for counterparty “i”, using notional values for the weighting.

If the bank has more than one netting set with a counterparty, the bank should perform this calculation for each netting set with that counterparty separately, and sum across the netting sets.

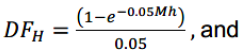

9.For any eligible single-name hedges for the counterparty, the bank computes the discounted value of the hedges, again using a supervisory discount factor that depends on the maturity of the hedge:

where

Hi is the notional value of a purchased eligible single-name hedge referencing counterparty ‘i’ and used to hedge the CVA risk,

Mh is the maturity of that hedge instrument.

If the bank has more than one instrument hedging single-name CVA risk for the counterparty, the bank should sum the discounted values of the individual hedges within each netting set.

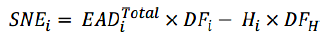

10.For each counterparty, the bank should calculate single-name exposure (SNE) as the discounted counterparty exposure minus the discounted value of eligible single-name CVA hedges. With a single netting set and single hedge instrument, this calculation is:

11.With multiple netting sets for the counterparty (for EAD) or multiple-single name hedge instruments (for H), the corresponding terms in the SNE calculation would be the summations for the given counterparty as required above.

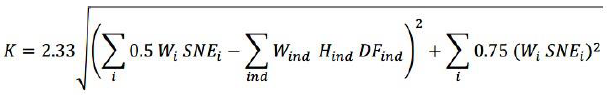

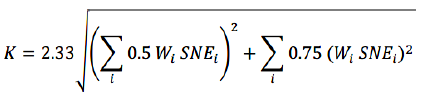

12.If the bank uses single-name hedging only, the bank must use SNE for its counterparties to calculate CVA capital using the following formula:

where Wi is the risk weight applicable to counterparty "i" from Table 1.

13.Each counterparty must be assigned to one of the seven rating categories in Table 1, based on the external credit rating of the counterparty. When a counterparty does not have an external rating, the bank should follow the approach used in the CCR Standard for credit derivatives that reference unrated entities. A bank should map alternative rating scales to the ratings in Table 1 based on an analysis of historical loss experience for each rating grade.

Table 1: Risk Weights for CVA Capital Calculation

Rating Risk Weight AAA 0.7% AA 0.7% A 0.8% BBB 1.0% BB 2.0% B 3.0% CCC 10.0% 14.If the bank also uses index hedges for CVA risk management, the CVA capital calculation is modified to include an additional reduction in systematic risk according to the following formula:

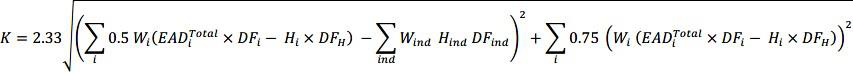

where

Hind is the notional of an eligible index hedge instrument used to hedge CVA risk,

Mind is the maturity of that index hedge, and

other variables are as defined above in this Standard.

The summation is taken across all index hedges. To determine the applicable risk weight for any index hedge, the bank should determine the risk weight from Table 1 that would apply to each component of the index, and use the weighted-average of these risk weights as Wind, with weights based on the notional composition of the index.

15.An alternative version of the full calculation (including index hedges) that gives the same result, but without the intermediate step of calculating SNE, is the following:

16.For any counterparty that is also a constituent of an index referenced by a CDS used for hedging CVA risk, the bank may, with supervisory approval, subtract the notional amount attributable to that single name within the index CDS (as based on its reference entity weight) from the index CDS notional amount (Hind), and treat that amount within the CVA capital calculation as a single-name hedge (Hi) of the individual counterparty with maturity equal to the maturity of the index.

D. Risk-Weighted Assets

17.A bank must determine the RWA for CVA by multiplying K as calculated above by the factor 12.5:

E. Simple Alternative Approach

18.Any bank with aggregate notional amount of covered transactions less than or equal to AED 400 billion may choose to set the bank's CVA RWA equal to its RWA for counterparty credit risk as computed under the CCR Standard. If the bank chooses this approach, it must be applied to all of the bank's covered transactions. In addition, a bank adopting this simple approach may not recognize the risk-reducing effects of CVA hedges. A bank meeting the requirements for using the Simple Alternative may choose to use either the Simple Alternative or the general CVA requirements, and may change that choice at any time with the approval of the Central Bank.