III. Credit Risk

I. Introduction

1. This section provides the guidance for the computation of Credit Risk Weighted Assets (CRWAs) under the Standardised Approach (SA). This guidance should be read in conjunction with the Central Bank’s Standard on Credit Risk.

2. A bank must apply risk weights to its on-balance-sheet and off-balance-sheet items using the risk- weighted assets approach. Risk weights are based on credit ratings or fixed risk weights and are broadly aligned with the likelihood of obligor or counterparty default.

3. A bank may use the ratings determined by an External Credit Assessment Institution (ECAI) for credit ratings. In general, banks should only use solicited ratings from recognised ECAIs for the purposes of calculating capital requirement under the SA. However, in exceptional cases, the bank may use unsolicited ratings with the Central Bank approval.

4. Note that all exposures subject to the SA should be risk weighted net of specific allowances and interest in suspense. The guidance must be read in conjunction with Securitisation, Equity Investments in Funds, Counterparty Credit Risk and Credit Valuation Guidance.

5. The guidance set out in this section applies to all exposures in the banking book. Exposures in the trading book should be captured as part of a bank’s market risk capital calculations.

II. Clarification and Guiding Principles

A. Claims on Sovereigns

6. UAE Sovereigns: The UAE Sovereign asset class consists of exposures to Federal Government and Emirates governments.

7. Federal Government includes all the UAE Federal entities and Central Bank of the UAE (Central Bank). Banks have transition period of 7 years from the date of implementation for exposures to Federal Government that receive a 0% RW, if such exposures are denominated in AED or USD and funded in AED or USD. However, any claim on UAE Federal Government in foreign currency other than USD should be risk weighted according to the published credit risk rating of UAE Federal Government. In the absence of solicited rating for UAE Federal Government, unsolicited ratings are permissible for assigning risk weights for UAE Federal Government exposures.

8. Emirates Governments’ exposures include exposures to the Ruler and the Crown Prince of each emirate acting in the capacity as ruler and crown prince, as well as exposures to the ministries, municipalities and other Emirates government departments. Banks have transition period of 7 years from the date of implementation for exposures to Emirates Governments that receive a 0% RW, if such exposures are denominated in AED or USD and funded in AED or USD. Any claim on Emirates governments in a foreign currency other than USD should be risk weighted according to the rating of the Emirate Government.

9. GCC Sovereigns: If the regulators in GCC exercise their discretion to permit banks in their jurisdiction to allocate a lower risk weight to claims on that jurisdiction’s sovereign, denominated in the domestic currency of that jurisdiction and funded in that currency, the same, lower risk weight may be allocated to such claims (e.g. 0% assigned to the Government of Saudi Arabia if the exposure is denominated and funded in SAR). This is limited only to GCC sovereign exposures and this lower risk weight may be extended to the risk weighting of collateral and guarantees (refer to section on credit risk mitigation).

10. All other exposures to sovereigns should be risk weighted according to the sovereign rating even if the national supervisory authority adopts preferential risk weights.

B. Claims on Public Sector Entities (PSEs)

Non-Commercial PSEs

11. Non-Commercial PSEs include administrative bodies responsible to the UAE Federal Government, to the Emirates Governments, or to local authorities and other non-commercial undertakings owned by the Federal governments, Emirates Governments or local authorities. These non-commercial PSEs do not have specific revenue- raising powers or specific institutional arrangements the effect of which is to reduce their risks of default. The risk of non-commercial PSE exposures is not equivalent to the risk of sovereign exposures and hence the treatment of claims on sovereigns cannot be applied to non-commercial PSE. However, in exceptional cases, a Non-Commercial PSE may receive the same treatment as its sovereign, if the entity has proven formal arrangements in place to the effect that there is no distinction between the risk of the entity and the risk of its sovereign. The Central Bank's GRE List would reflect this accordingly.

12. If the UAE borrower satisfies the criteria in paragraph 13, the risk weight shall be the same as that for claims on banks. However, the preferential treatment for short-term claims on banks may not be applied. In particular, unrated non-commercial PSE qualify for 50% risk weight. The criteria are based on the principle that non-commercial PSEs qualify for lower risk weights because they have significantly lower risk than a commercial company does. In addition, banks are specifically required to ensure compliance with other aspects of the banking regulations when lending to these entities, for example, but not limited to, the Central Bank large exposure regulations.

13. The alternative criteria listed are to be applied in determining whether an entity qualifies for treatment as a non-commercial PSE. The Central Bank provides a list (so-called GRE List) to all the banks in the UAE which includes non-commercial PSEs.

i. Direct government (Federal or Emirate) ownership >50% directly or through a qualifying PSE that itself is majority owned by government.

ii. An entity whose complete activities are functions of a government.

iii. Its services are of public benefit including when services are sold directly to the public (e.g. electricity and water). The service provided should be of substantial public benefit and the entity should have a monopolistic nature and there should be a significant likelihood that the government would not let the entity go bankrupt.

iv. Not listed on any stock exchange.

v. Provides internal services to parent or sister companies only, and the parent company is itself a non-commercial PSE.

vi. The function of the company is of a non-commercial nature and does not operate in a competitive market.

vii. Does not operate overseas. 14. In the case of a UAE sovereign guarantee given to a non-commercial PSE, with the Central Bank approval, the guarantee may be treated as eligible credit risk mitigation (CRM) to reduce the exposure provided the bank ensures compliance with the entire minimum regulatory requirements and operational requirements stated in the credit risk standard.

Government Related Entities (GRE)

15. These are commercial undertakings that are fully owned or more than 50% in ownership by Federal governments, or by Emirates governments. As these entities function as a corporate in the competitive markets even though the government is the major shareholder, Central Bank requires such exposures to be classified under GRE and get the same treatment of claims on corporate with the appropriate risk weights based on the credit rating of the entity.

16. All banks must comply with the latest version of the GRE list for classification and risk weighting of entities. Banks that have information that would lead to the addition (or removal) of an entity to (or from) the GRE list must submit such information to the Central Bank. All banks must comply with the GRE list unless any addition or removal of entities is reflected in the GRE list.

17. Banks Internal audit/compliance department should perform regular reviews to ensure the PSE and GRE classification complies with the Central Bank GRE list.

C. Claims on Multilateral Development Banks (MDBs)

18. Exposures to MDBs shall in general be treated similar to claim on banks, but without using the preferential treatment for short term claims. However, highly rated MDBs, which meet certain criteria specified below, are eligible for a preferential 0% risk weight.

i. Very high quality long-term issuer ratings, i.e. a majority of an MDB's external assessments must be AAA;

ii. Shareholder structure is comprised of a significant proportion of sovereigns with long-term issuer credit assessments of AA- or better, or the majority of the MDB's fund-raising is in the form of paid-in equity/capital and there is little or no leverage;

iii. Strong shareholder support demonstrated by the amount of paid-in capital contributed by the shareholders; the amount of further capital the MDBs have the right to call, if required, to repay their liabilities; and continued capital contributions and new pledges from sovereign shareholders;

iv. Adequate level of capital and liquidity (a case-by-case approach is necessary in order to assess whether each MDB's capital and liquidity are adequate), and

v. Strict statutory lending requirements and conservative financial policies, which would include among other conditions a structured approval process, internal creditworthiness and risk concentration limits (per country, sector, and individual exposure and credit category), large exposures approval by the board or a committee of the board, fixed repayment schedules, effective monitoring of use of proceeds, status review process, and rigorous assessment of risk and provisioning to loan loss reserve. 19. MDBs currently eligible for 0% risk weight are the World Bank Group comprised of the International Bank for Reconstruction and Development, the International Finance Corporation, the Multilateral Investment Guarantee Agency and the International Development Association, the Asian Development Bank, the African Development Bank, the European Bank for Reconstruction and Development, the Inter-American Development Bank, the European Investment Bank, the European Investment Fund, the Nordic Investment Bank, the Caribbean Development Bank, the Islamic Development Bank, the Council of Europe Development Bank, the International Finance Facility for Immunisation and the Asian Infrastructure Investment Bank. The list of MDBs is by the Basel Committee on Banking Supervision (BCBS) and can be found on the website www.bis.org. All banks are required to refer to and comply with the BCBS list. Whilst the BCBS evaluates the eligibility of the entities on a case-by-case basis, the Central Bank has no role in the assessment and decision of entities being eligible for 0% risk weight.

D. Claims on Banks

20. The types of claims that fall under this asset class are claims not limited to those due from banks, nostro accounts, certificates of deposit (CD) issued by banks, and repurchase agreements (repos). A risk weight of 50% (long term) and 20% (short term) is applied to claims on unrated banks. However, this treatment is subject to the provision that no claim on an unrated bank may receive a risk weight lower than that applied to claims on its sovereign of incorporation.

21. Exposure to intra-group of the bank have to be risk weighted according to the external rating of the counterparty entity (e.g. exposures to the head office shall receive the risk weight according to the rating of the head office).

E. Claims on Securities Firms

In addition to providing loans to other banks in the interbank market, banks provide loans to securities firms. The securities firms use these loans to fund the purchase of securities. Exposures to these securities firms shall be treated as claims on banks if these firms are subject to prudential standards and a level of supervision that is equivalent to those applicable to banks. Such supervision must include at least both capital and liquidity requirements. Exposures to all other securities firms that are not treated as claims on banks will be treated as exposures to corporates.

F. Claims on Corporates

22. For the purposes of calculating capital requirements, exposures to corporates include, but are not limited to, exposures (loans, bonds, receivables, etc.) to incorporated entities, associations, partnerships, proprietorships, trusts, funds and other entities with similar characteristics, except those which qualify for one of the other exposure classes. The corporate exposure class does not include exposures to individuals.

23. Claims on corporates may be risk- weighted based on the entity’s external credit rating assessment. The Central Bank may increase the standard risk weight for unrated claims where it judges that a higher risk weight is warranted by the overall default experience. As part of the supervisory review process, the Central Bank may also consider whether the credit quality of corporate claims held by banks warrants a risk weight higher than 100%.

G. Claims Included in the Regulatory Retail Portfolios

To qualify for a 75% risk weight in the regulatory retail portfolio, claims must meet the four criteria stated in the Credit Risk Standard (orientation criterion, product criterion, granularity criterion and value criterion). All other retail claims should be risk weighted at 100%. For granularity criterion and value criterion, the aggregated exposure means gross amount (i.e. not taking any credit risk mitigation into account) of all forms of retail exposures, excluding residential real estate exposures. In case of off-balance sheet items, the gross amount will be calculated after applying credit conversion factors. In addition, “to one counterparty” means one or several entities that may be considered as a single beneficiary (e.g. in the case of a small business that is affiliated to another small business, the limit would apply to the bank’s aggregated exposure on both businesses).

24.Claims secured by residential property and past due retail loans are to be excluded from the overall regulatory retail portfolio for risk weighting purposes. These are addressed separately in the asset classes for residential property or commercial real estate.

H. Claims Secured by Residential Property

25. Claims secured by residential property are defined as loans secured by residential property that is either self-occupied or rented out. The property must be fully mortgaged in favor of the bank.

26. The Loan-to-Value (LTV) ratio is the outstanding loan exposure divided by the value of the property. The value of the property will be maintained at the value at origination unless the Central Bank requires banks to revise the property value downward. The value must be adjusted if an extraordinary, idiosyncratic event occurs resulting in a permanent reduction of the property value. Such adjustment must be notified to the Central Bank. If the value has been adjusted downwards, a subsequent upwards adjustment can be made but not to a higher value than the value at origination.

27. A 35% risk weighting shall apply to eligible residential claims if the LTV ratio is less than 85% and the exposure is less than AED 10 million. When the loan amount exceeds AED 10 million and the LTV is below 85%, the loan amount up to AED 10 million will receive 35% risk weight and the remaining amount above AED 10 million receives 100% risk weight.

28. A risk weight of 75% may be applied by banks that do not hold information regarding LTVs for individual exposures

29. For residential exposures that meet the criteria for regulatory retail claims and have an LTV greater than 85%, the 75% risk weight must be applied to the whole loan, i.e. the loan should not be split.

30. The risk-weights in this asset class may be applied to a limit of four individual properties made to a single individual customer that are owner- occupied or rented out by a retail borrower. Any additional exposure to a customer with loans for four individual properties shall be classified as a claim on a commercial property and risk weighted with 100%.

I. Claims Secured by Commercial Real Estate

31. Commercial real estate is defined as a loan granted by a bank to a customer specifically for the purpose of buying or constructing commercial property including residential towers and mixed use towers.

J. Past Due Loans

32. Risk weights of past due loans depend on the degree of provision coverage on the claim. For any past due loan, 100% Credit Conversion Factor (CCF) should be applied for the off-balance sheet component to calculate the credit risk-weighted assets. Any exposure that is past due for more than 90 days should be reported under this asset class, net of specific provisions (including partial write-offs). This differs from the IFRS 9 classification as the past due asset includes any loans more than 90 days past due.

K. Higher-Risk Categories

33. Higher risk weights may be applied to assets that reflect higher risks. A bank may decide to apply a risk weight of 150% or higher.

L. Other Assets

34.Assets in this class include any other form of exposure that does not fit into the specific exposure classes. The standard risk weight for all other assets will be 100%, with the exception of the following exposures:

a) 0% risk weight applied to

i. cash owned and held at the bank or in transit;

ii. Gold bullion held at the bank or held in another bank on an allocated basis, to the extent the gold bullion assets are backed by gold bullion liabilities;

iii. All the deductions from capital according to the Tier capital supply of Standards of Capital Adequacy in the UAE, for reconciliation between the regulatory return and the audited/reviewed financial statement.

b) 20% risk weight:

i. Cash items in the process of collection.

c) 100% risk weight

i. Investments in the capital of banking, financial and insurance entities to which a credit risk standardised approach applies, unless they are deducted from regulatory capital according to section 3.9 of Tier capital supply of Standards Capital Adequacy in the UAE. (listed entity)

ii. Investments in commercial entities below the materiality thresholds according to section 5 of Tier capital supply of Standards of Capital Adequacy in the UAE (listed);

iii. Premises, plant and equipment and other fixed assets,

iv. Prepaid expenses such as property taxes and utilities,

v. All other assets

d) 150% risk weight

i. The amount of investments in the capital of banking, financial and insurance entities to which a credit risk standardised approach applies unless they are deducted from regulatory capital deduction according to section 3.9 of Tier capital supply of Standards of Capital Adequacy in the UAE (unlisted entity);

ii. Investments in commercial entities below the materiality thresholds according to section 5 of Tier capital supply of Standards of Capital Adequacy in the UAE (unlisted entity).

e) 250% risk weight

i. Investments in the capital of banking, financial and insurance entities to which a credit risk standardised approach, applies unless they are deducted from regulatory capital according to the threshold deduction described in section 3.10 of Tier capital supply of Standards of Capital Adequacy in the UAE.

ii. Deferred tax assets (DTAs) which depend on future profitability and arise from temporary differences unless they are not deducted under threshold deductions described in section 4 of Tier capital supply of Standards of Capital Adequacy in the UAE.

f) 1250% risk weight

i. Investments in commercial entities in excess of the materiality thresholds must be risk-weighted at 1/ (Minimum capital requirement) (i.e. 1250%).

M. Off-Balance Sheet Items: Credit Conversion Factors

35.Under the standardised approach, off-balance sheet items are converted into credit exposure equivalents with Credit Conversion Factors (CCFs). CCFs approximate the potential amount of the off-balance sheet facility that would have been drawn down by the client by the time of its default. The credit equivalent amount is treated in a manner similar to an on-balance sheet instrument and is assigned the risk weight appropriate to the counterparty. The categories of off-balance sheet and its appropriate CCFs are outlined in the standard.

Calculating credit equivalent amounts for off-balance sheet item:

(Principal amount – provision amount) * CCF = Credit equivalent amount.

Bank guarantees

36.There are two types of bank guarantees viz. financial guarantees (direct credit substitutes); and performance guarantees (transaction-related contingent items).

37.Financial guarantees essentially carry the same credit risk as a direct extension of credit i.e. the risk of loss is directly linked to the creditworthiness of the counterparty against whom a potential claim is acquired, and therefore attracts a CCF of 100%.

38.Performance guarantees are essentially transaction-related contingencies that involve an irrevocable undertaking to pay a third party in the event the counterparty fails to fulfil or perform a contractual non-financial obligation. In such transactions, the risk of loss depends on the event which need not necessarily be related to the creditworthiness of the counterparty involved. Performance guarantees attract a CCF of 50%.

Commitments

39.The credit conversion factor applied to a commitment is dependent on its maturity. Banks should use original maturity to report these instruments.

40.Longer maturity commitments are considered to be of higher risk because there is a longer period between credit reviews and less opportunity to withdraw the commitment if the credit quality of the customer deteriorates. Commitments with an original maturity up to one year and commitments with an original maturity over one year will receive a CCF of 20% and 50%, respectively.

41.However, any commitments that are unconditionally cancellable at any time by the bank without prior notice, or that effectively provide for automatic cancellation due to deterioration in a borrower’s creditworthiness, will receive a 0% CCF. This requires that banks conduct formal reviews of the facilities regularly and this provides the opportunity to take note of any perceived deterioration in credit quality and thereby cancellability by the bank.

42.For exposures that give rise to counterparty credit risk, the exposure amount to be used in the determination of RWA is to be calculated according to the standardised approach for Counterparty Credit Risk (SA-CCR).

N. Credit Risk Mitigation (CRM)

43.Only eligible collateral, guarantees, credit derivatives, and netting under legally enforceable bilateral agreements (such as ISDAs) are eligible for CRM purposes. For example, a commitment to provide collateral or a guarantee is not recognised as an eligible CRM technique for capital adequacy purposes until the commitment to do so is actually fulfilled.

44.No additional CRM will be recognised for capital adequacy purposes on exposures where the risk weight is mapped from a rating specific to a debt security where that rating already reflects CRM. For example, if the rating has already taken into account a guarantee pledged by the parent or sovereign entity, then the guarantee shall not be considered again for credit risk mitigation purposes.

45.Banks should ensure that all minimum legal and the operational requirements set out in the Standard are fulfilled.

CRM treatment by substitution of risk weights

46.The method of substitution of risk weight is applicable for the recognition of the guarantees and credit derivatives as CRM techniques under both the simple approach and the comprehensive approach. Under this method, an exposure is divided into two portions: the portion covered by credit protection and the remaining uncovered portion.

47.For guarantees and credit derivatives, the value of credit protection to be recorded is the nominal value. However, where the credit protection is denominated in a currency different from that of the underlying obligation, the covered portion should be reduced by a standard supervisory haircut defined in the Credit Risk Standard for the currency mismatch.

48.For eligible collateral, the value of credit protection to be recorded is its market value, subject to a minimum revaluation frequency of 6 months for performing assets, and 3 months for past due assets (if this is not achieved then no value can be recognised). Where the collateral includes cash deposits, certificates of deposit, cash funded credit-linked notes, or other comparable instruments, which are held at a third-party bank in a non-custodial arrangement and unconditionally and irrevocably pledged or assigned to the bank, the collateral will be allocated the same risk weight as that of the third-party bank.

Simple Approach

49.Under simple approach, the eligible collateral must be pledged for at least the life of the exposure, i.e. maturity mismatch is not allowed.

50.Where a bank has collateral in the form of shares and uses the simple approach, a 100% risk weight is applied for listed shares and 150% risk weight for unlisted shares.

Comprehensive Approach

51.Under the comprehensive approach, the collateral adjusted value is deducted from the risk exposure (before assigning the risk weight). Standard supervisory haircuts as defined in the Credit Risk Standard are applied to the collateral because collateral is subject to risk, which could reduce the realisation value of the collateral when liquidated.

52.If the exposure and collateral are held in different currencies, the bank must adjust downwards the volatility- adjusted collateral amount to take into account possible future fluctuations in exchange rates.

53.There is no distinction for applying supervisory haircuts between main index equities and equities listed at a recognised exchange. A 25% haircut applies to all equities.

Capital Add-on under Pillar 2

54.While the use of CRM techniques reduces or transfers credit risk, it gives rise to other risks that need to be adequately controlled and managed. Banks should take all appropriate steps to ensure the effectiveness of the CRM and to address related risks. Where these risks are not adequately controlled, the Central Bank may impose additional capital charges or take other supervisory actions as outlined in Pillar 2 Standard.

III. Shari’ah Implementation

55. Banks that conduct all or part of their activities in accordance with the provisions of Shari’ah laws and have exposure to risks similar to those mentioned in the Credit Risk Standard, shall, for the purpose of maintaining an appropriate level of capital, calculate the relevant risk weighted asset in line with these guidelines. This must be done in a manner compliant with the Shari’ah laws.

56. This is applicable until relevant standards and/or guidelines in respect of these transactions are issued specifically for banks offering Islamic financial services.

IV. Frequently Asked Questions (FAQ)

During the industry consultation the Central Bank received a number of questions related to the Credit Risk Standard and Guidance. To ensure consistent implementation of the Credit Risk Standard in the UAE, the main questions are addressed hereunder.

Claims on Sovereigns

Question 1: What does the 7-year transition for USD exposure to the Federal Government and Emirates Government mean for banks?

During the 7-year transition period, banks are required to have a forward looking plan on USD exposures to Federal and Emirate governments. Banks shall monitor and manage the impact of the change in risk weights of exposures in USD on the bank’s capital position. Exposures in USD as well as the banks’ capital plans will be monitored by the Central Bank.Question 2: What is the appropriate risk weight for exposures to other GCC sovereigns?

A 0% risk weight is applied to GCC Sovereign exposures denominated and funded in the domestic currency of their country. However, exposures in non-domestic currencies (including USD) shall be risk weighted according to the rating of sovereigns.Question 3: Does the Central Bank allow banks to apply unsolicited ratings in the same way as solicited ratings?

Bank should use ratings determined by an eligible External Credit Assessment Institution (ECAIs). Only solicited ratings are allowed to be used. The Central Bank only allows unsolicited ratings from an eligible ECAI for the UAE federal government. All other exposures shall be risk weighted using solicited ratings.Claims on Non-Commercial Public Sector Enterprises

Question 4: Can the bank include claims on a GCC PSE denominated in their local currency under claims of Non-Commercial PSEs?

No, the preferential risk weights for Non-Commercial PSEs are only granted for UAE entities.Question 5: Do all the seven criteria stated in the credit risk guidance have to be met or any of the criterion can be met to classify an entity as non-commercial PSE? In addition, does the bank just follow the so-called GRE list or shall the bank apply the criteria to classify entities as non-commercial PSE?

To classify entities as Non-commercial PSE, the Central Bank will consider in its approval process all seven criteria and in principle all seven criteria must be satisfied. A bank may approach the Central Bank, if the bank thinks that certain entities satisfy the criteria for a Non-commercial PSE that can be added to the GRE list. If banks have information that would lead to changes to of the GRE List, banks should inform the Central Bank accordingly.Question 6: The guidance requires that the bank’s internal audit/ compliance departments perform regular reviews to ensure the PSE and GRE classification complies with the Central Bank's GRE list. What is the expected frequency of such a review?

The frequency of internal audit/compliance should be commensurate with the bank's size, the nature and risks of bank’s operations and the complexity of the bank.Claims on Multilateral Development Banks (MDBs)

Question 7: Does an MDB need to satisfy all of the stated criteria or any one of the criteria to apply a 0% risk-weight?

Exposures to MDBs may receive a risk weight of 0% if they fulfill all five criteria. However, the Central Bank does not decide whether an MDB satisfies the criteria or not. The Basel Committee on Banking Supervision (BCBS) evaluates each MDB’s eligibility for inclusion in the list of 0% RW on a case-by-case basis.Claims on Banks

Question 8: For claims on an unrated bank, can the bank apply the preferential rating as per risk weight table for short-term exposures?

A risk weight of 50% for long term exposures and 20% for short term exposures are applied to claims on unrated banks. However, no claim on an unrated bank may receive a risk weight lower than the risk weight applied to claims on its sovereign of incorporation, irrespectively of the exposure being short-term or long-term.Claims on Corporates

Question 9: Should loans to High Net Worth Individuals (HNIs) be reported under claims in regulatory retail portfolio or claims on corporate?

No, HNI classification should be aligned with the BRF explanatory note and should be reported under claims on corporate.Question 10: What is the treatment for SMEs and in which asset class are SME exposures reported?

Answer: Banks have to follow BRF explanatory note 6.21 for the definition of SME. Exposures classified as SME according to BRF explanatory note, are for capital adequacy reporting purposes classified as “Retail SME” and “corporate SME”. SME exposures fulfilling all of four retail criteria as stated in Section III G of the Credit Risk Standard are reported under “claims on retail”. SME that do not fulfill the retail criteria are treated under claims on corporates as per Section III F of the Credit Risk Standard.Claims secured by Residential Property

Question 11: Does the bank have to assign 100% RW for customers with more than 4 properties?

Yes, if a customer has more than 4 properties, a bank has to report all properties of that customer as claims on commercial properties and the risk weight of the properties shall be 100%.Question 12: Can the bank apply a preferential RW of 35% for properties under construction?

No, the preferential risk weight of 35% applies only to completed properties, as under construction, residential properties incur higher risks than buying completed properties.Claims Secured by Commercial Real Estate

Question 13: Do loans with a collateral of a completed commercial property, irrespective of their purpose, fall under Claims secured by Commercial Real Estate?

No, this asset class is for exposures specifically for the purpose of buying/ constructing commercial property, i.e. real estate loans.Higher-risk Categories

Question 14: What type of exposure would fall under higher risk categories? What is the appropriate RW for higher risk categories?

Almost all the exposures that receive 150% risk weight are reported under the respective asset class. The Central Bank will apply a 150% or higher risk weight, reflecting the higher risks associated with assets that require separate disclosure. For example, but not limited to, real estate acquired in settlement of debt and not liquidated within the statutory period shall be reported under the higher risk asset class with a 150% RW.Other Assets

Question 15: The Credit Risk Standard states in section 5, that equity investment in commercial entities that are below the thresholds shall be risk weighted at 150% if the entity is unlisted. However, if the banking group has full control over the commercial subsidiary, can a lower risk weight be applied?

A 150% risk weight reflects the additional risk the commercial subsidiary underpins on unlisted equity (absence of regulatory requirement, illiquidity, etc.) exposures than listed equity exposures.Issuer and Issuance Rating

Question 16: What will be the treatment of a rated entity (e.g. corporate) that issues a bond?

The bank must classify the bond based on the entity classification (Claim on Corporate) and assign risk weight based on the rating of the entity.Question 17: What will be the treatment of a rated entity (e.g. corporate) that issues a bond with a guarantee by the sovereign specific to the issuance and the bond gets a higher rating than the entity itself?

Classify the bond based on the entity classification (Claim on Corporate) and assign risk weight based on the rating of the bond.Question 18: What will be the treatment of a rated entity (e.g. corporate) that issues a bond with a lower rating than entity?

Classify the bond based on the entity classification (Claim on Corporate) and assign risk weight based on the rating of the bond.Question 19: What will be the treatment if an unrated entity (e.g. corporate) that issues a bond (unrated), but the bond has the guarantee from sovereign, specific and direct guarantee?

Classify the bond based on the entity classification (Claim on Corporate) and assign the risk weight based on the bond rating (unrated). The guarantee should be used for credit risk mitigation by substituting the risk weight of the bond using the claims on sovereign mapping table (e.g. AAA - 0% risk weight).Question 20: What will be the treatment if an unrated entity (e.g. corporate) that issues a bond with a guarantee given by the sovereign to the entity (and not the bond)?

Classify the bond based on the entity classification (Claim on Corporate) and assign the risk weight related to the unrated entity. The guarantee should be used for credit risk mitigation by substituting the risk weight of the bond using the claims on corporate mapping table (e.g. AAA - 20% risk weight).Off Balance-sheet Items

Question 22: The Credit Risk Standards states that, “Any commitments that are unconditionally cancellable at any time by the bank without prior notice, or that effectively provide for automatic cancellation due to deterioration in a borrower’s creditworthiness must be converted into credit exposure equivalents using CCF of 0%”. For using CCF of 0%, please provide explanation on being cancellable at any time without prior notice.

Majority of the unconditionally cancellable commitments are subject to certain contractual conditions, which in practice may not render them as unconditionally cancelled and thereby do not qualify them for 0% CCF, implying that all the off-balance sheet items bear a risk to the bank. Bank shall conduct a formal review of the commitments at regular intervals to ensure that commitments can be cancelled from a legal and practical perspective.Credit Risk Mitigation

Question 23: Is an approval required from the Central Bank to switch between the simple and comprehensive approach for Credit Risk Mitigation techniques? For a bank that applies the comprehensive approach, is an approval required to go back to the simple approach?

A bank that intends to apply the comprehensive approach requires prior approval from the Central Bank. Once approved and if the bank wishes to go back to simple approach, a bank requires the Central Bank's approval again to go to the simple approach.V. Appendix: Computation of Exposures with Credit Risk Mitigation Effects

Bank A repos out cash of AED 1000 to a corporate with an external rating of AA. The corporate provides collateral in the form of debt securities issued by a bank with an external rating of AA. The debt securities have a remaining maturity of 7 years and a market value of AED 990.

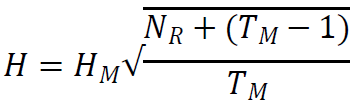

Minimum holding period for various products Transaction type Minimum holding period Condition Repo-style transaction 5 Business days Daily remargining Other capital market transactions 10 Business days Daily remargining Secured lending 20 Business days Daily revaluation The haircut for the transaction with other than 10 business days minimum holding period, as indicated above, will have to be adjusted by scaling up or down the haircut for 10 business days as per the formula given below:

Variables Details of the Variables Supervisory haircuts Scaling factor Adjusted haircuts He Haircut appropriate to the underlying exposure Exposure in the form of cash, supervisory haircut 0% 0 Not applicable Hc Haircut appropriate to the Collateral Debt securities issued by a bank supervisory haircut 8% 0.71 Supervisory haircut (8%)* Scaling factor (0.71 )= 6% Hfx Haircut appropriate for Currency Mismatch No Currency Mismatch 0 Not applicable The exposure amount after risk mitigation is calculated as follows:

Variables E*= max {0, [E x (1 + He) – C x (1 – Hc – Hfx)]} Value E* Net credit exposure (i.e. exposure value after CRM) 69.4 E Principal Amount, which is net of specific provisions, if any For off-balance sheet, it is the credit equivalent amount 1000 He Haircut appropriate to the underlying exposure (cash) 0 C Value of the collateral before CRM 990 Hc Haircut appropriate to the Collateral 6% Hfx Haircut appropriate for Currency Mismatch 0 Risk weighted asset for the exposure = (69.40 * 50% (AA)) = 34.70

(Exposure * Risk weight)