VI. Illustrations of Replacement Cost Calculations with Margining

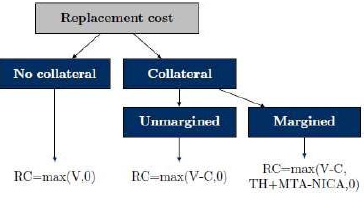

Calculation of Replacement Cost (RC) depends whether or not a trade is collateralized, as illustrated below and in the summary table.

Transaction Characteristics Replacement Cost (RC) No collateral Value of the derivative transactions in the netting set, if that value is positive (else RC=0) Collateralized, no margin Value of the derivative transactions in the netting set minus the value of the collateral after applicable haircuts, if positive (else RC=0) Collateralized and margined Same as the no margin case, unless TH+MTA-NICA (see definitions below) is greater than the resulting RC - •TH = positive threshold before the counterparty must send collateral to the bank

- •MTA = minimum transfer amount applicable to the counterparty

- •NICA = net independent collateral amount other than variation margin (unsegregated or segregated) posted to the bank, minus the unsegregated collateral posted by the bank. The quantity TH + MTA – NICA represents the largest net exposure, including all collateral held or posted under the margin agreement that would not trigger a collateral call.

A. Illustration 1: Margined Transaction

A bank has AED80 million in trades with a counterparty. The bank currently has met all past variation margin (VM) calls, so the value of trades with the counterparty is offset by cumulative VM in the form of cash collateral received. Furthermore, an “Independent Amount” (IA) of AED 10 million was agreed in favour of the bank, and none in favour of its counterparty. This leads to a credit support amount of AED 90 million (80 million plus 10 million), which is assumed to have been fully received as of the reporting date. There is a small “Minimum Transfer Amount” (MTA) of AED1 million, and a “Threshold” (TH) of zero.

In this example, the V-C term in the replacement cost (RC) formula is zero, since the value of the trades is more than offset by collateral received; AED80 million – AED90 million = -10 million. The term (TH + MTA - NICA) is -9 million (0 TH + 1 million MTA - 10 million of NICA held). Using the replacing cost formula:

RC = MAX {(V-C), (TH+MTA-NICA), 0}

= MAX{(80-90),(0+1-10),0}

= MAX{-10,-9,0} = 0

Because both V-C and TH+MTA-NICA are negative, the replacement cost is zero. This occurs because of the large amount of collateral posted by the bank’s counterparty.

B. Illustration 2: Initial Margin

A bank, in its capacity as clearing member of a CCP, has posted VM to the CCP in an amount equal to the value of the trades it has with the CCP. The bank has posted AED10 million in cash as initial margin, and the initial margin is held in such a manner as to be bankruptcy-remote from the CCP. Assume that the value of trades with the CCP are -50 million, and the bank has posted AED50 million in VM to the CCP. Also assume that MTA and TH are both zero under the terms of clearing at the CCP.

In this case, the V-C term is zero, since the already posted VM offsets the negative value of V. The TH+MTA-NICA term is also zero, since MTA and TH both equal zero, and the initial margin held by the CCP is bankruptcy remote and thus does not affect NICA. Thus:

RC = MAX {(V-C), (TH+MTA-NICA), 0}

= MAX{(-50-(-50)), (0+0-0), 0}

= MAX{0,0,0} = 0

Therefore, the replacement cost RC is zero.

C. Illustration 3: Initial Margin Not Bankruptcy Remote

Consider the same case as in Illustration 2, except that the initial margin posted to the CCP is not bankruptcy remote. Since this now counts as part of the collateral C, the value of V-C is AED10 million. The value of the TH+MTA-NICA term is AED10 million due to the negative NICA of -10 million. In this case:

RC = MAX {(V-C), (TH+MTA-NICA), 0}

= MAX{(-50-(-50)-(-10)), (0+0-(-10)), 0}

= MAX{10,10,0} = 10

The RC is now AED10 million, representing the initial margin posted to the CCP that would be lost if the CCP were to default.

D. Illustration 4: Maintenance Margin Agreement

Some margin agreements specify that a counterparty must maintain a level of collateral that is a fixed percentage of the mark-to-market (MtM) of the transactions in the netting set. For this type of margining agreement, the Independent Collateral Amount (ICA) is the percentage of MtM that the counterparty must maintain above the net MtM of the transactions covered by the margin agreement. For example, suppose the agreement states that a counterparty must maintain a collateral balance of at least 140% of the MtM of its transactions. Further suppose for purposes of this illustration that there is no TH and no MTA, and that the MTM of the derivative transactions is 50. The counterparty posts 80 in cash collateral. ICA in this case is the amount that the counterparty is required to post above the MTM (140%x50 – 50 = 20). Since MtM minus the collateral is negative (50-80 = -30), and MTA+TH-NICA also is negative (0+0-20 = -20), the replacement cost RC is zero. In terms of the replacement cost formula:

RC = MAX {(V-C), (TH+MTA-NICA), 0}

= MAX{(50-80), (0+0-20), 0}

= MAX{-30,-20,0} = 0