II. Clarifications

A. Scope

4.The Standards covers banks’ equity investments held in the banking book. Note that equity positions within the trading book are covered by the market risk capital requirements that apply to trading book positions.

5.The Central Bank has chosen not to use the national discretion provided within the BCBS framework to exclude from the standard equity positions in entities whose debt obligations qualify for a zero risk weight. The Central Bank also has chosen not to use the national discretion provided within the BCBS framework to exclude from the scope of the standard equity investments made under identified official programs that support specified sectors of the economy

B. General Design of the Capital Requirement

6.At a high level, the framework is designed such that the risk-weight for a bank’s equity investment in a fund depends on the average risk weight that would be applicable to the assets of the fund, and on the extent of use of leverage by the fund. The approach to the average risk weight for any fund will reflect one or more of the three approaches described briefly above (and described more fully in the Standards).

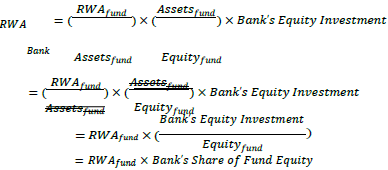

7.The illustration below gives a general overview of how the average risk weight and leverage are combined, subject to a cap of 1250%, and then applied to the bank’s equity investment in the funds.

8.For example, if the average risk weight of the assets held by the fund is 80%, and the fund is financed through half debt and half equity, then the ratio of assets to equity would be 2.0 and the risk weight applied to a bank’s investment in the fund would be:

80% x 2.0 = 160%

If instead the same fund is financed 90% by debt, then the ratio of assets to equity would be 10, and the risk weight applied to the bank’s investment in the fund would be 800% (80% x 10).

9.Another way to view the capital requirement for equity investments in funds is that a bank generally must count a proportional amount of the risk-weighted assets (RWA) of the fund as the bank’s own RWA for capital purposes, in proportion to the bank’s share of the equity of the fund. Ignoring the 1250% limit for simplicity, the RWA calculation can be written as:

The rearrangement of the terms in the equation highlights that the bank’s RWA from the EIF is the bank’s proportional share of the fund’s RWA – if the bank holds a 5% share of the equity in the fund, then the bank’s RWA is 5% of the total RWA of the fund. This is a logical treatment – if a bank effectively owns 5% of a fund, the bank must hold capital as if it owns 5% of the fund’s risk-weighted assets.

C. Look-Through Approach

10.The LTA requires a bank to assign the same risk weights to the underlying exposures of a fund as would be assigned if the bank held the exposures directly. The information used for to determine the risk weights must meet the requirements stated in the Standards, including sufficiency, frequency, and third party review. However, that information is not required to be derived from sources that are subject to an external audit.

11.RWA and assets of investment funds should, to the extent possible, be evaluated using the same accounting standards the bank would apply if the assets were held directly. However, where this is not possible due to constraints on available information, the evaluation can be based on the accounting standards applied by the investment fund, provided the treatment of the numerator (RWA) and the denominator (total unweighted assets) is consistent.

12.If a bank relies on third-party calculations for determining the underlying risk weights of the exposures of the fund, the risk weights should be increased by a factor of 1.2 times to compensate for the fact that the bank cannot be certain about the accuracy of third-party information. For instance, any exposure that is ordinarily subject to a 20% risk weight under the risk-based capital standards would be weighted at 24% (1.2×20%) when the look-through is performed by a third party.

D. Mandate-Based Approach

13.Under the MBA, banks may use the information contained in a fund’s mandate, or in the rules or regulations governing such investment funds in the relevant jurisdiction. Information used for this purpose is not strictly limited to a fund’s mandate or to national regulations or other requirements that govern such funds. For example, a bank could obtain information from the fund’s prospectus or from other disclosures of the fund.

14.To ensure that all underlying risks are taken into account (including CCR) and that the MBA renders capital requirements no less than the LTA, the Standards requires that risk-weighted assets for funds’ exposures be calculated as the sum of three items:

- •On-balance-sheet exposures;

- •Off-balance-sheet exposures including notional value of derivatives exposures; and

- •CCR exposure for derivatives.

15.As with the LTA, for purposes of the MBA the RWA and assets of investment funds should, to the extent possible, be evaluated using the same accounting standards the bank would apply if the assets were held directly. However, where this is not possible due to constraints on available information, the evaluation can be based on the accounting standards applied by the investment fund, provided the treatment of the numerator (RWA) and the denominator (total unweighted assets) is consistent.

16.In general, the MBA aims to take a conservative approach by calculating the highest risk-weighted assets the fund could achieve under the terms of its mandate or governing laws and regulations. Under the MBA, the bank should assume that the fund’s assets are first invested to the maximum extent allowable in assets that would attract the highest risk weight, and then to the maximum extent allowable in the next riskiest type of asset, and so on until all of the fund’s balance sheet assets have been assigned to a risk-weight category. If more than one risk weight could be applied to a given exposure, the bank must use the maximum applicable risk weight. For example, if the mandate does not place restrictions on the rating quality of the fund’s investments in corporate bonds, the bank should apply a risk weight of 150% to the fund’s corporate bond positions.

17.For derivatives, when the replacement cost is unknown, the Standards takes a conservative approach by setting replacement cost equal to the notional amount of the derivatives contracts. When the notional amount of a fund’s derivative exposure is unknown, the approach again is conservative: the bank should use the maximum notional amount of derivatives allowed under the fund’s mandate. When the PFE for derivatives is unknown, the PFE add-on should be set at 15% of the notional value. Thus, if the replacement cost and PFE add-on both are unknown, a total multiplication factor of 1.15 must be applied to the notional amount to reflect the CCR exposure.

18.Instead of determining a CVA charge associated with the fund’s derivative exposures, the Standards allows banks to multiply the CCR exposure by a factor of 1.5 before applying the risk weight associated with the counterparty. However, a bank is not required to apply the 1.5 factor for situations in which the CVA capital charge would not otherwise be applicable. Notably, this includes derivative transactions for which the direct counterparty is a qualifying central counterparty.

E. Leverage Adjustment

19.A leverage adjustment is applied to the average risk weight of the fund under either the LTA or the MBA. A similar leverage adjustment is not necessary for the FBA, because the risk weight of 1250% applied under the FBA to equity investments in funds is fixed at that maximum value.

20.When determining the leverage adjustment under the MBA, banks are required to make conservative assumptions using information from the fund’s mandate. Specifically, the Standards requires that banks assume the fund will use financial leverage up to the maximum amount permitted under the fund’s mandate, or up to the maximum permitted under the regulations governing that fund. This maximum may be significantly greater than the actual leverage for the fund at any point in time.