IX. Operational Risk

I. Introduction and Scope

1.This section of the guidance supports the Operational Risk Standard in clarifying the calculation of the Operational risk capital requirement.

2.Operational risk has existed since banks have been in business. However, it is only in recent decades that the management of operational risk (including measurement techniques) has evolved into a distinct discipline, long after this was the case for both credit risk and market risk.

3.In this same period, the significance of operational risk in banks became widely recognised. This development was influenced by numerous high-profile operational risk events and related losses, along with such factors as banks' greater reliance on technology and increased use of outsourcing, the growing sophistication of cyber threats, and the pace of change in the financial services sector.

II. Clarification

4.Operational risk includes legal and compliance risk but excludes strategic and reputational risk. The exclusion of strategic and reputational risk is because they relate more to indirect losses, the definition, measurement and quantification of which would give rise to significant complexities.

5.The operational risk capital charge represents the amount of capital that a bank should maintain as a cushion against losses arising from operational risk.

6.The operational risk capital charge is first calculated using the appropriate approach under Basel III. It is then converted into a risk-weighted asset equivalent by multiplying the charge by 12.5 and adding the result to the total risk-weighted assets for credit risk.

III. Approaches

7. The calculation of the operational risk capital charge is covered under the Standards for Capital Adequacy of banks in the UAE.

8. The approaches represent a continuum of increasing sophistication and risk sensitivity. The charge is to be calculated using one of the following two approaches:

a. Basic Indicator Approach (BIA)

9. The Basic Indicator Approach (BIA) is a simple approach for calculating the capital charge for operational risk. It can be used by banks that are not internationally active, as well as by banks that are internationally active but may not yet have risk management systems in place for using the more advanced approaches for measuring operational risk.

10. While the approach is available for all banks as a 'point of entry', irrespective of their level of sophistication, Central Bank expects internationally active banks and banks with significant operational risk to discontinue indefinitely with the Basic Indicator Approach.

The Basic Indicator Approach Components

11. The operational risk capital charge under the BIA is based on two components:

- 1.The exposure indicator, represented by the Gross Income (GI) of a bank as a whole.

- 2.The fixed factor, alpha (α), set by the Basel Committee.

The formula for calculating the capital charge for operational risk under the BIA is as follows:

Where:

KBIA = The capital charge under the BIA;

GI = Annual gross income, where positive, over the previous three years;

n = Number of the previous three years for which gross income is positive; and

α =15%, relating the industry wide level of required capital to the industry wide level of the indicator.

1.Gross Income of the Bank

12. Gross income is a broad indicator that serves as a proxy for the likely exposure of a bank to operational risk. It is the total of net interest income plus net non-interest income of a bank as a whole. Net interest income is defined as interest income of a bank (for example, from loans and advances) minus the interest expenses (for example, interest paid on deposits). Net non-interest income is defined as fees and commissions earned minus the non-interest expenses (that is, fees and commissions paid) and other income.

13. Gross income used in the calculation of the capital charge for operational risk should be:

- -Gross of any provisions, for example, for unpaid interest. This is because such amounts should have normally formed part of a bank's income but have been set aside for likely credit losses.

- -Gross of operating expenses, including fees paid to outsourcing service providers. This is because outsourcing of activities does not fully transfer operational risk to the service provider. Outsourcing is the strategic use of outside resources to perform business functions that are traditionally managed by internal staff. Outsourcing offers the advantage of access to specialised and experienced personnel that may not be available internally, and enables banks to concentrate on their core business and reduce costs.

14. Only sustainable, renewable and recurrent sources of income are to be used as the basis for calculating the operational risk capital charge. Banks should perform a reconciliation between the gross income reported on the capital adequacy return and the audited financial statements. This information should be available to the Central Bank upon request. As such, gross income should exclude:

- -realised profits/losses from the sale of securities classified as 'held to maturity' and 'available for sale', which typically constitute items of the banking book under certain accounting standards. The intention is to hold such securities for some time or up to their full term and not for trading purposes. Their sale does not represent sustainable income from normal business.

- -Held to maturity securities are those that the bank intends to hold indefinitely or until the security reaches its maturity. Available for sale securities includes securities that are neither held for trading purposes nor intended to be held till maturity. These are securities that the bank intends to hold in the short or medium term, but may ultimately sell. Banking book relates to positions that are held to maturity with no trading intent associated with them. Most loans and advances are included in the banking book as they are intended to be held until maturity. At times, there may also be liquid positions assigned to the banking book if they are intended to be held over a longer term or to maturity.

- -Extraordinary or irregular items as well as income derived from insurance claims. Again, these items are to be excluded, as they are not sustainable sources of income for a bank.

15. Banks sometimes outsource certain activities, such as processing and maintaining data on loan collection services to external service providers. Alternatively, banks may act as service providers to other banks. This results in the payment or receipt of a fee for the outsourced service.

16. Basel provides the following guidance for the treatment of outsourcing fees paid or received, while calculating the gross income for the purpose of calculating the operational risk capital charge:

- -Outsourcing fees paid by a bank to a service provider do not reduce the gross income of the bank.

- -Outsourcing fees received by a bank for providing outsourcing services are included in the definition of gross income.

2.Alpha

17. Alpha is a fixed factor, set by the Basel Committee. It serves as a proxy for the industry-wide relationship between operational risk loss experience of a bank and the aggregate level of the operational risk exposure as reflected in its gross income.

Treatment of Negative Gross Income

18. The operational risk capital charge under the BIA is assumed that a bank has positive gross income for all of the previous three years. However, some banks may have negative gross income for some year(s), for example, resulting from poor financial performance. Figures for any year in which annual gross income is negative or zero shall be excluded from both the numerator and denominator when calculating the gross income average.

19. On this basis, the figures presented in the 3 years' calculations should reconcile (or be reconcilable) with the bank’s audited financial statements.

b. Standardised Approach (SA)

20.The Standardised Approach (SA) represents a refinement along the continuum of approaches for calculating the operational risk capital charge. While this approach also relies on fixed factors as a percentage of gross income, it allows banks to use up to eight such factors, called betas, depending upon their business lines.

21.The calculation of the operational risk charge under this approach is more risk sensitive than the BIA.

The Standardised Approach Capital Charge

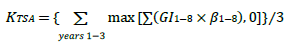

22.Under the Standardised Approach (SA), the operational risk capital charge is based on the operational risk capital charges for individual business lines in a bank. The formula for calculating the operational risk capital charge under the SA is as follows:

Where:

KTSA = the capital charge under the Standardised Approach

GI1-8 = the annual gross income in a given year, as defined in the Basic Indicator Approach (BIA), for each of the eight business lines

β 1-8 = a fixed percentage, set by the committee, relating the level of required capital to the level of the gross income for each of the eight business lines

The Standardised Approach Components

23.The Standardised Approach identifies two main components to be used in calculating the operational risk capital charge:

1.Gross Income of Eight Business Lines

24.Eight business lines are recommended for use by the Basel Committee in calculating the operational risk charge under the SA. These business lines are considered as being representative of the various kinds of businesses undertaken by banks. The identified business lines briefed below are:

- 1.Corporate finance: banking arrangements and facilities provided to large commercial enterprises, multinational companies, non-bank financial institutions, government departments etc.

- 2.Trading and sales: treasury operations, buying and selling of securities, currencies and commodities for proprietary and client accounts.

- 3.Retail banking: financing arrangements for private individuals, retail clients and small businesses such as personal loans, credit cards, auto loans, etc. as well as other facilities such as trust and estates and investment advice.

- 4.Commercial banking: financing arrangements for commercial enterprises, including project finance, real estate, trade finance, factoring, leasing, guarantees, bills of exchange etc.

- 5.Payment and settlement: activities relating to payments and collections, interbank funds transfer, clearing and settlement.

- 6.Agency services: acting as issuing and paying agents for corporate clients, providing custodial services etc.

- 7.Asset management: managing funds of clients on a pooled, segregated, retail, institutional, open or closed basis under a mandate.

- 8.Retail brokerage: broking services provided to customers that are retail investors rather than institutional investors.

25.Under the SA, the gross income is calculated for each of the eight business lines. It serves as a proxy for the likely scale of exposure of that business line of the bank to operational risk. Since all income has to be allocated to a business line, the sum of the gross income of the eight business lines should equal the gross income for the bank as a whole

26. Just like in the Basic Indicator Approach, gross income for SA comprises net interest income plus net non-interest income as defined in the Operational Risk section of the Standards re Capital Adequacy.

2.Beta

27.Beta serves as a proxy for the industry-wide relationship between the operational risk loss experience and the level of operational risk exposure as reflected in the gross income for a business line. It is representative of the amount of loss that can be incurred by a bank given that level of exposure (represented by gross income) in a business line.

28.The beta factors for the eight business lines as set by the Basel Committee are as follows:

Beta Business line Beta factor β 1 Corporate finance 18% β 2 Trading and sales 18% β 3 Retail banking 12% β 4 Commercial banking 15% β 5 Payment and settlement 18% β 6 Agency services 15% β 7 Asset management 12% β 8 Retail brokerage 12% 29.The beta factors have been set within a range of 12-18% depending upon the degree of operational risk perceived in a business line. Thus, a 12% beta factor for retail banking indicates that, in general, the operational risk in retail banking is lower than the operational risk in commercial banking. The latter, which has a beta of 15%, carries a lower operational risk than, for example, payment and settlement, which carries a beta factor of 18%.

Treatment of Negative Gross Income from Business lines

30.Some banks may have negative gross income for some years in some business lines. This will result in a negative capital charge for the business line for that year. If the gross income and the resulting capital charge of a specific business line is negative, the aggregate of the capital charges across business lines for that year could still be positive, so long as the gross income from other business lines is positive.

31.The following guidance applies for treatment of negative capital charges under the Standardised Approach:

- -In any given year, negative charges in business lines may offset positive capital charges in other business lines without any limit.

- -If the total capital charge, after offsetting negative and positive capital charges of business lines, is negative for a given year, then the numerator for that year will be set to zero.

- -If negative gross income distorts the operational risk capital charge calculated under the SA, the Central Bank will consider appropriate supervisory action under Pillar 2.

Calculating the Operational risk capital charge under the Standardised Approach (SA)

The calculation of the capital charge for operational risk under the SA follows the following steps:

Step 1: Calculate the capital charge for each business line using its gross income and applicable beta factor in year 1.

If the gross income from a business line is negative, the capital charge for that business line in year 1 will be negative.

Step 2: Sum the eight capital charges of business lines for Year 1.

In a year, negative capital charges in some business lines may offset positive capital charges for other business lines without any limit.

Steps 3 and 4: Follow steps 1 and 2 for the other two years.

Step 5: Calculate the 3-year average of the aggregated capital charges. Where the aggregate capital charge across all business lines in a given year is negative, then the input to the numerator for that year will be zero. The denominator will remain 3, representing the three years included in the calculation.

Central Bank supports the use of the Beta given in the Standards re Capital Adequacy as well as here in this guidance above as the basis for the capital calculations under SA.

c. Alternative Standardised Approach (ASA) Capital Charge

32.The Alternative Standardised Approach provides a different exposure indicator for two of the eight business lines, retail banking and commercial banking. These activities essentially comprise traditional banking business and still represent the main business of banks in several jurisdictions.

Calculation of Operational Risk Capital Charge under Alternative Standardised Approach (ASA)

33.Using the ASA, the operational risk capital charge for retail banking and commercial banking will be based on the following formulas:

Where:

Krb = is the capital charge for retail banking

m = 0.035

β rb = is the beta factor for retail banking (12%)

LArb = is the total outstanding retail loans and advances (non-risk weighted and gross of provisions), averaged over the past three years

Where:

KCB = is the capital charge for commercial banking

m = 0.035

βCB= is the beta factor for commercial banking (15%)

LACB = is the total outstanding commercial loans and advances (non-risk weighted and gross of provisions), averaged over the past three years

For the other six business lines, the calculation of the operational risk capital charge will be based on the gross income and beta factor of that business line, as prescribed under the SA.

Further Options under the Alternative Standardised Approach (ASA)

34.Further options are available at under the ASA for calculating the operational risk capital charge to address problems in disaggregation of the exposure indicator among business lines by banks. However, the greater the disaggregation, the better will be the alignment of the capital charge with a bank's operational risk profile.

35.Available options relate to using loans and advances in commercial and retail banking business lines and gross income in the other six business lines as the exposure indicators with different beta factor combinations:

- -Option 1 – using a common beta factor of 15% for commercial loans and retail loans, and the SA beta factors for the other six business lines

- -Option 2 – using the SA beta factors of 15% and 12%, respectively, for commercial loans and retail loans and a common beta factor of 18% for the other six business lines

- -Option 3 – using a common beta of 15% for commercial loans and retail loans and a common beta factor of 18% for the other six business lines

For further details, kindly refer to the Appendix below.

IV. Shari’ah Implementation

36.Banks that conduct all or part of their activities in accordance with the provisions of Shari’ah law and have exposure to risks similar to those mentioned in the Operational Risk Standard, shall, for the purpose of maintaining an appropriate level of capital, calculate the relevant risk weighted asset in line with these guidelines. This must be done in a manner compliant to the Shari’ah law.

37.This is applicable until relevant standards and/or guidelines in respect of these transactions are issued specifically for banks offering Islamic financial services.

V. Frequently Asked Questions

A. Basic Indicator Approach

Question 1: If a bank incurs a negative gross income in any of the previous three years, will it be taken into account under the Basic Indicator Approach (BIA)?

The basis for working out the capital charge for operational risk under the BIA is three-year average of positive gross income. If the gross income for any of the previous three years is negative or zero, the figures for that year will be excluded from both the numerator and the denominator when calculating the capital charge. The negative gross income will not be added to the numerator and the denominator will exclude the year in which the income is negative.

As mentioned under the Basic Indicator Approach, if negative gross income distorts a bank’s Pillar 1 capital charge under the Standardised Approach, supervisors will consider appropriate supervisory action under Pillar 2.Question 2: Can the Central Bank detail or provide examples of the extraordinary or irregular items under the definition of Gross income. Does this cover the bank selling off certain part of its business?

An extraordinary or irregular item consists of gains or losses included on a bank's P&L statement (usually reported separately as these items are not predictors of future performance) from events that are unusual and infrequent in nature. Such items are the result of unforeseen and atypical events that are outside the normal course of the core banking business (i.e. outside the types of income described in paragraph 13 of the Operational Risk section of Standards re Capital Adequacy in the UAE). For example, income derived from non-core banking business; income from discontinued operations; extraordinary income (e.g. from the sale of certain part a banking business).B. Standardised Approach

Question 3: Define business Segments under 'Retail Brokerage' and 'Asset Management'?

- •Retail Brokerage - Examples of activities:

Execution and full service, such as:- i.Reception and transmission of orders in relation to one or more financial instruments

- ii.Execution of orders on behalf of clients

- •Asset Management- Examples of activities:

- i.Portfolio management

- ii.Managing of Investments funds, including: pooled funds, segregated funds, retail funds, institutional funds, closed funds, open funds, private equity funds

Question 4: What is the objective mapping criteria for mapping ancillary business function that supports more than one business line?

Such objective mapping criteria depends on the business and ancillary business mix of a bank. These criteria are not preset by the Central Bank. A bank should establish internally such criteria, reflecting its internal organisation, and these should be subject to independent review as per point (ix) of paragraph 12 of the Operational Risk section of Standards re Capital Adequacy in the UAE. The allocation can be done pro-rata based on the chosen criteria.

Examples of objective criteria include:- 1.number of full-time equivalent members of staff,

- 2.time sheet man-hours,

- 3.number of clients or transactions originated from each business line,

- 4.volume of business originated from each business line.

Question 5: Business Segments/ functions that are to be mapped to 'Payment and Settlement' can be clearly articulated, as currently Level 2 defines the business segment as 'External Clients'

There is no fixed definition of external clients but all clients that the bank deals with externally with regards to Payment and Settlements need to be incorporated in this business line.- •Retail Brokerage - Examples of activities:

C. Alternative Standardised Approach

Question 6: What exposure indicator is used in the ASA approach?

In the ASA, gross income is replaced by the credit volume in terms of outstanding loans and advances (L&A) multiplied by a factor m (fixed at 0.035), as the exposure indicator for retail and commercial banking business lines. The loans and advances are non-risk weighted and gross of provisions.Question 7: Why is the volume-based indicator alternative provided?

This volume-based indicator is provided to avoid large differences in the operational risk requirement caused by differences in income margins across banks and jurisdictions in these business lines. Gross income is not an appropriate exposure indicator of the extent of operational risk in retail and commercial lending.Question 8: Can a bank choose to adopt ASA on its own?

No, the Central Bank must be satisfied that the alternative approach provides an improved basis for calculating the capital charge for operational risk in the bank. Reverting to the SA after adopting ASA is only possible with the approval of the Central Bank.Question 9: What comprises Commercial Loans and Advances?

Under the ASA, commercial loans and advances will include outstanding amounts (non-risk weighted and gross of provisions) averaged over the past three years, from the following credit portfolios:Commercial loans included for ASA Definitions Corporates Loans to a corporation, partnership or proprietorship firm Sovereigns Loans to sovereigns and their central banks, certain public sector enterprises and multilateral development banks Banks Loans to other banks and regulated securities firms Specialised lending Loans for project finance, object finance, commodities finance, income producing real estate and commercial real estate Small and medium enterprises treated as corporates Loans to small and medium enterprises belonging to a group with annual gross turnover that exceeds AED 250 million Purchased corporate receivables Bank finance against amounts due to corporates from third parties for goods and/or services provided by them. Book value of securities held in the banking book The value at which securities have been purchased rather than their market value. Securities that are held in the banking book are intended to be held until maturity. There is no intent of trading in these securities. Question 10: What comprises Retail Loans?

For the purpose of the ASA, retail loans will include total outstanding amounts (non-risk weighted and gross of provisions) averaged over the past three years in the following credit portfolios:Retail loans included for ASA Definitions Retail Exposures to individuals, residential mortgage loans etc. SMEs treated as retail Loans extended to small and medium businesses and managed as retail exposures by the bank. Purchased retail receivables Bank finance against amounts due to bank’s retail clients from third parties for goods and/or services provided by them Question 11: What is the threshold to decide a large diversified bank in terms of assets book size/composition or any other indicators?

Currently, there is no such threshold. The Central Bank will perform an assessment for each bank applying to qualify for ASA. The qualifying criteria provided in paragraph 28 of the Operational Risk section of Standards re Capital Adequacy in the UAE, especially the first one (90% income from retail/commercial banking) are stringent. The Central Bank will review whether the bank meets the 90% standard to determine whether an additional size cut-off is appropriate.Question 12: Retail or commercial banking activities shall account for at least 90% of its income. Please clarify whether this needs to be seen in the current year or an average of all the 3 years based on which the Operational Risk capital is being computed

Testing the 90% rule across a period of three consecutive years will be more appropriate.Question 13: "The bank's operational risk management processes and assessment system shall be subject to validation and regular independent review". Can we get clarification on the difference between the validation and the review, and what are the scope and responsible party for each?

Validation of models and tables must be performed by the internal auditor or by the external auditor.Question 14: In terms of the "regular reporting", is an official ORM meeting required? For example, Operational Risk Business/ Country / Group Committee meetings?

It is up to the bank how it conveys the regular reports to the senior management and the board of directors, but the evidence of these reports were submitted needs to be documented for example senior management signatures on the reports.

Question 15: Is operational risk capital charge revision a quarterly activity going forward or it remains as a yearly activity at the end of the year?

Will it be more adequate if we use current years’ gross income to compute operational risk rather last year's audited numbers only.

If the quarterly income is audited, the bank should use the quarterly data, which means the same quarter in the previous two years needs to be taken into consideration or else, the yearly audited data needs to be incorporated

The standards state only audited numbers need to be used and as such, if the current year’s income is audited, it can be used as part of the computationQuestion 16: Elaboration of definition and scope of Operational Risk should be helpful. For example, whether Operational Risk includes other risk types such as Fraud Risk, Business Continuity Risk etc.

The definition and scope of Operational risk is sufficiently elaborated in the Operational Risk Standard of the Capital Adequacy Standards of Banks in the UAE and the Operational Risk Guidance. If operational risks were not sufficiently covered under Pillar I, then the uncovered risk should be part of the Pillar 2 ICAAP calculation.Question 17: As per the definition of gross income, "income derived from insurance" is to be excluded from the income while computing Operational RWA.

We would request clarification if this also refers to bancassurance i.e. Bank's commission income earned on insurance products that are sold on behalf of insurance companies."

Any income which the bank earns out of the bancassurance should be treated as income derived from insurance.VI. Examples

A. Basic Indicator Approach

The Basic Indicator Approach (BIA) is a simple approach for calculating the capital charge for operational risk. It can be used by banks that are not internationally active, as well as by banks that are internationally active but may not as yet have risk management systems in place for using the more advanced approaches for measuring operational risk. Below is an example of ABC bank and how the Operational risk capital charge is calculated on Basic Indicator Approach

1- Calculating gross income through the table shows part of the income statement of ABC bank for 2003.

Income statement of ABC bank for 2003 Operating income Interest income 150 Interest expenses 110 Provisions made 20 Net interest income after provisions 20 Fees and commissions received 80 Fees and commissions paid 50 including fees paid for outsourcing 12 Other income

From disposal of subsidiaries

From disposal of available for sale

Investments

10

8

0Net non-interest income 48 Total operating income 68 The net interest income to be used in gross income for calculating the operational risk capital charge after provisions. Normally banks reduce this amount to arrive at the operating income, however, in the calculation of capital charge for operational risk, net interest income is gross of provisions.

In this example, net interest income is interest income minus interest expenses.

150 – 110 = 40

While for calculating net non-interest income for calculating operational risk capital charge, in this example:

Net non-interest income is fees and commissions received (80) minus fees and commissions paid, adjusted for outsourcing fees paid (50 – 12 = 38). Therefore, the amount will be 42.

2- Calculating operational risk capital charge under BIA

The following table shows how to calculate the operational risk capital charge under the BIA.

Year Gross income of the bank 2002 120 2003 20 2004 250 Total positive GI for 3 years 390 (120+20+250) Three year average of positive Gross Income 130 (390/3) Alpha 15% Operational risk capital requirement under BIA 19.5 ((390*15%)/3 or 130*15% 3- Treatment of Negative Gross Income

Below is the calculation of the operational risk capital charge when the bank has negative gross income for a year.

Amount Gross income year 1 -120 Gross income year 2 20 Gross income year 3 250 Total of positive gross income 270 Number of years with positive gross income 2 Average of positive annual gross income for the last three years 135 (270/2) Alpha 15% Operational risk capital requirement 20.25 (135*15%) Since negative gross income leads to exclusion of data points for that year from both the numerator and the denominator of the BIA operational risk formula, it could at times result in some distortions. For example, a bank that has negative gross income for one of three years might end up with a higher operational risk capital charge than if it were to have positive gross income for that year, even if it was a small amount. To ensure that such distortions do not occur, the supervisor should review and consider appropriate actions under Pillar 2.

B. Standardised Approach

1- Below is small example indicated which to include and exclude in the gross income:

Included Excluded Provisions Profits/losses from sale of securities Operating expenses Extraordinary/ irregular items Gross income for each business line should:

- -Be gross of any provisions (for example, for unpaid interest).

- -Be gross of operating expenses, including fees paid to outsourcing service providers.

- -Exclude realised profits/losses from the sale of securities in the banking book.

- -Exclude extraordinary or irregular items as well as income derived from insurance claims.

2- The following table shows how to calculate the capital charge for operational risk using the Standardised Approach:

Business line Beta factor Gross income Capital requirement Year 1 Year 2 Year 3 Year 1 Year 2* Year 3 Average Corporate finance 18% 250 300 200 45 54 36 Trading and sales 18% 100 -70 -80 18 -12.6 -14.4 Retail banking 12% 500 200 -300 60 24 -36 Commercial banking 15% 400 300 400 60 45 60 Payment and settlement 18% 300 350 300 54 63 54 Agency services 15% 75 50 45 11.25 7.5 6.75 Asset management 12% 50 -100 -20 6 -12 -2.4 Retail brokerage 12% 150 100 80 18 12 9.6 Total Gross Income 1,825 1,130 625 Aggregate Capital Requirement** 272.25 180.9 113.55 189*** *Gross Income x Beta factor

**Sum of eight capital charges for the year – remember within a year negative capital charges can offset positive charges among business lines

***Three-year average capital charge

3- Another example to illustrate the negative Gross income:

*Total capital charge against all business lines for year 2 is negative (-17.1), so the numerator for year 2 is set to zero

**Capital charge averaged for three years, with the numerator for year 2 set to zero

C. Alternative Standardised Approach

The following table shows how to calculate the capital charge for operational risk using the Alternative Standardised Approach.

Business line Beta factor Exposure Indicator* Capital requirement** Year 1 Year 2 Year 3 Year 1 Year 2 Year 3 Average Corporate finance 18% 250 300 200 45 54 36 Trading and sales 18% 100 -70 -80 18 -12.6 -14.4 Retail banking 12% 700*** 875*** 945*** 84 105 113.4 Commercial banking 15% 875*** 910*** 980*** 131.25 136.5 147 Payment and settlement 18% 300 350 300 54 63 54 Agency services 15% 75 50 45 11.25 7.5 6.75 Asset management 12% 50 -100 -20 6 -12 -2.4 Retail brokerage 12% 150 100 80 18 12 9.6 Total Gross Income 2,500 2,415 2,450 Aggregate Capital Requirement 367.5 353.4# 349.95 356.95## *Gross income/loans & advances x m

**Exposure indicator (GI or LA x m) x β

***Outstanding loans and advances x m (0.035)

# Sum of eight capital charges for the year

## Three year average capital chargeVII. Appendix

Further Options under the ASA – Option 1

Under the ASA Option 1, banks may aggregate retail and commercial banking using a common beta of 15%, instead of 12% and 15%, respectively, as prescribed under the Standardised Approach (SA). For the other six business lines, the relevant beta factors as prescribed under the SA are used. The exposure indicator remains the volume of loans and advances for commercial and retail banking and gross income for the other six business lines.

Further Options under the ASA – Option 2

Under Option 2, banks may maintain the SA beta factors of 12% and 15% for retail and commercial banking and aggregate the other six business lines with a beta factor of 18%. The volume of loans and advances is used as the exposure indicator for commercial and retail banking. Gross income is used for the other six business lines. Banks undertaking predominantly traditional banking activities, such as retail and commercial banking, and unable to segregate their gross income according to business lines may find it useful to adopt this option.

Further Options under the ASA – Option 3

Under Option 3, banks may aggregate retail and commercial banking with a beta factor of 15% and the other six business lines with a beta factor of 18%. The volume of loans and advances is used as the exposure indicator for retail banking and commercial banking. Gross income is used for the other six business lines.