Leverage Ratio

Leverage Ratio

I. Introduction

1. Risk-based capital adequacy ratios measure the extent to which a bank has sufficient capital relative to the risk of its business activities. They are based on a foundational principle: that a bank that takes higher risks should have higher capital to compensate.

2. Leverage, on the other hand, measures the extent to which a bank has financed its assets with equity. It does not matter what those assets are, or their risk characteristics. The leverage ratio, by placing an absolute cap on exposures relative to a bank’s capital, is an important component of the Central Bank capital framework, and complements the risk-based capital adequacy regime. However, neither of these parts of the framework stands alone: it is important to look at Central Bank capital requirements as a package of constraints that mutually reinforce prudent behaviour. Even though the leverage ratio has been designed as a backstop, it must be a meaningful backstop if it is to serve its intended purpose.

3. One of the underlying causes of the global financial crisis is believed to have been the build-up of excessive on- and off-balance-sheet leverage in the banking system. At the height of the crisis, developments in financial markets forced banks to reduce leverage in a manner that likely amplified downward pressures on asset prices. This deleveraging process exacerbated the feedback loop between losses, falling bank capital, and shrinking credit availability.

4. The Central Bank’s leverage ratio framework introduces a simple, transparent, non-risk-based leverage ratio to act as a credible supplementary measure to the risk-based capital requirements. The leverage ratio is intended to:

- restrict the build-up of leverage in the banking sector to avoid destabilizing deleveraging processes that can damage the broader financial system and the economy; and

- reinforce the risk-based requirements with a simple, non-risk-based “backstop” measure.

5. The Basel Committee on Banking Supervision (BCBS) adopted the leverage ratio with the launch of Basel III in December 2010. A revised leverage ratio framework, titled Basel III Leverage Ratio Framework and Disclosure Requirements, was published in January 2014. In December 2017, the leverage ratio was finalized along with the rest of the Basel III capital framework. Prior to each release of the leverage ratio, the BCBS published consultative documentation and sought comments from the industry. Additionally, in 2015 and 2017, the BCBS published revised Pillar 3 disclosure requirements, including updated disclosure requirements for the leverage ratio.

6. In designing the UAE leverage ratio framework, the Central Bank considered the full evolution of the BCBS leverage ratio, including consultative frameworks, reporting requirements, and comments raised by banks and industry bodies across the globe. The Central Bank’s Standards for Leverage Ratio is based closely on the requirements articulated by the BCBS in the document Basel III: Finalising post-crisis reforms, December 2017.

7. This Guidance should be read in conjunction with the Central Bank’s Standards on Leverage Ratio, as it is intended to provide clarification of the requirements of that Standards, and together with that Standards supports the Central Bank’s Regulations Re Capital Adequacy.

II. Clarifications of the Standards

8. The leverage ratio framework is designed to capture leverage associated with both on- and off-balance-sheet exposures. It also aims to make use of accounting measures to the greatest extent possible, while at the same time addressing concerns that (i) different accounting frameworks across jurisdictions raise level playing field issues and (ii) a framework based exclusively on accounting measures may not capture all risks.

a. Leverage Ratio and Capital

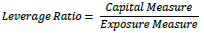

9. The leverage ratio is defined as the capital measure divided by the exposure measure, expressed as a percentage:

10. The capital measure is Tier 1 capital as defined for the purposes of the Central Bank risk-based capital framework, subject to transitional arrangements. In other words, the capital measure for the leverage ratio at a particular point in time is the applicable Tier 1 capital measure at that time under the risk-based framework.

11.The minimum requirement for the leverage ratio is established in the Central Bank’s Regulations Re Capital Adequacy.

12. The Standards includes the possibility that the Central Bank may consider temporarily exempting certain central bank “reserves” from the leverage ratio exposure measure to facilitate the implementation of monetary policies in exceptional macroeconomic circumstances. In this context, the term “reserves” refers to certain bank balances or placements at the Central Bank. Certain other jurisdictions have pursued monetary policies that resulted in a significant expansion of such bank balances at the Central Bank, for example through policies commonly described as “quantitative easing.” While the Central Bank has no plan to implement such policies, the inclusion of this flexibility in the Standards ensures that, in the event that such policies were to be implemented, the minimum leverage requirement could be adjusted in a manner that allows it to continue to serve its appropriate prudential role. Per the requirements of the BCBS framework, the Central Bank would also increase the calibration of the minimum leverage ratio requirement commensurately to offset the impact of exempting central bank reserves, since actual bank leverage ratios would be expected to increase due to the exclusion of these exposures.

b. Scope of Consolidation

13. The framework applies on a consolidated basis, following the same scope of regulatory consolidation used in the risk-based capital requirements (see Regulations re Capital Adequacy). For example, if proportional consolidation is applied for regulatory consolidation under the risk-based framework, the same criteria shall be applied for leverage ratio purposes.

14. Where a banking, financial, insurance or commercial entity is outside the scope of regulatory consolidation, only the investment in the capital of such entities (that is, only the carrying value of the investment, as opposed to the underlying assets and other exposures of the investee) is included in the exposure measure. However, any such investments that are deducted from Tier 1 capital may be excluded from the exposure measure.

c. Exposure Measure

15. The exposure measure includes both on-balance-sheet exposures and off-balance-sheet (OBS) items. On-balance-sheet exposures are generally included at their accounting value, although exposures arising from derivatives transactions and securities financing transactions (SFTs) are subject to separate treatment.

16. Except where a different treatment is specified, no offset is allowed for physical or financial collateral held, guarantees in favour of the bank or other credit risk mitigation techniques.

17. Balance sheet assets that are deducted from Tier 1 capital may also be deducted from the exposure measure. For example:

- Where a banking, financial or insurance entity is not included in the regulatory scope of consolidation, the amount of any investment in the capital of that entity that is totally or partially deducted from Common Equity Tier 1 (CET1) or Additional Tier 1 capital may also be deducted from the leverage ratio exposure measure.

- Prudent valuation adjustments for exposures to less liquid positions that are deducted from Tier 1 capital as per the Central Bank’s Market Risk Standards may be deducted from the leverage ratio exposure measure.

18. Liability items must not be deducted from the leverage ratio exposure measure. For example, gains/losses on fair valued liabilities or accounting value adjustments on derivative liabilities due to changes in the bank’s own credit risk must not be deducted from the leverage ratio exposure measure.

19. The Central Bank will be vigilant to transactions and structures that have the result of inadequately capturing banks’ sources of leverage. Examples of concerns that might arise in such leverage ratio exposure measure minimizing transactions and structures may include: securities financing transactions where exposure to the counterparty increases as the counterparty’s credit quality decreases or securities financing transactions in which the credit quality of the counterparty is positively correlated with the value of the securities received in the transaction (i.e. the credit quality of the counterparty falls when the value of the securities falls); banks that normally act as principal but adopt an agency model to transact in derivatives and SFTs in order to benefit from the more favorable treatment permitted for agency transactions under the leverage ratio framework; collateral swap trades structured to mitigate inclusion in the leverage ratio exposure measure; or use of structures to move assets off the balance sheet. This list of examples is by no means exhaustive.

- Where a banking, financial or insurance entity is not included in the regulatory scope of consolidation, the amount of any investment in the capital of that entity that is totally or partially deducted from Common Equity Tier 1 (CET1) or Additional Tier 1 capital may also be deducted from the leverage ratio exposure measure.

d. On-Balance Sheet Exposures

20. Where a bank recognizes fiduciary assets on the balance sheet, these assets can be excluded from the leverage ratio exposure measure provided that the assets meet the IFRS 9 criteria for de-recognition and, where applicable, IFRS 10 for deconsolidation.

e. Derivative Exposures

21. The basis for the framework’s treatment of derivative transactions is a modified version of Standardised Approach to Counterparty Credit Risk (SA-CCR) in Basel III. It captures both the exposure arising from the underlying of the derivative contract and the related counterparty credit risk. The exposure measure amount is generally equal to the sum of the replacement cost (the mark-to-market value of contracts with positive value) and an add-on representing the transaction’s potential future exposure, with that sum multiplied by a scaling factor of 1.4. Valid bilateral netting contracts can reduce the exposure amount, but collateral received generally cannot. There are specific rules governing the treatment of cash variation margin, clearing services and written credit derivatives.

22. If, under a bank’s operative accounting standards, there is no accounting measure of exposure for certain derivative instruments because they are held (completely) off balance sheet, the bank must use the sum of positive fair values of these derivatives as the replacement cost.

23. Netting across product categories such as derivatives and SFTs is not permitted in determining the leverage ratio exposure measure. However, where a bank has a cross-product netting agreement in place that meets the eligibility criteria; it may choose to perform netting separately in each product category provided that all other conditions for netting in this product category that are applicable to the leverage ratio framework are met.”

24. Variation margin may be netted against derivative exposures, but only where the margin is paid in cash. This is the appropriate treatment for the leverage calculation, since the cash margin payment is, for all intents and purposes, a settlement of a liability. It also has the advantage, as would not have otherwise been the case, of encouraging the good risk management practice of taking cash collateral against derivative exposures, and is consistent with broader regulatory objectives that promote the margining of OTC derivatives.

25. One of the criteria necessary in order to recognize cash variation margin received as a form of pre-settlement payment is that variation margin exchanged must be the full amount necessary to extinguish the mark-to-market exposure of the derivative. In situations where a margin dispute arises, the amount of non-disputed variation margin that has been exchanged can be recognized.

26. Where a bank provides clearing services as a “higher level client” within a multi-level client structure, the bank need not recognize in its leverage ratio exposure measure the resulting trade exposures to the ultimate clearing member (CM) or to an entity that provides higher-level services to the bank if it meets specific conditions.

27. Among these conditions is a requirement that offsetting transactions are identified by the QCCP as higher level client transactions and collateral to support them is held by the QCCP and/or the CM, as applicable, under arrangements that prevent any losses to the higher level client due to the joint default or insolvency of the CM and any of its other clients. To clarify, upon the insolvency of the clearing member, there must be no legal impediment (other than the need to obtain a court order to which the client is entitled) to the transfer of the collateral belonging to clients of a defaulting clearing member to the QCCP, to one or more other surviving clearing members or to the client or the client’s nominee.

28. Another required condition is that relevant laws, regulation, rules, contractual or administrative arrangements provide that the offsetting transactions with the defaulted or insolvent CM are highly likely to continue to be indirectly transacted through the QCCP, or by the QCCP, if the CM defaults or becomes insolvent. Assessing whether trades are highly likely to be ported should consider factors such as a clear precedent for transactions being ported at a QCCP, and industry intent for this practice to continue. The fact that QCCP documentation does not prohibit client trades from being ported is not sufficient to conclude that they are highly likely to be ported.

29. The effective notional amount referenced by a written credit derivative is to be included in the leverage ratio exposure measure. Note that this is added to the general exposure measure for derivatives because a written credit derivative exposes a bank both to counterparty credit risk and to credit risk from the underlying reference entity for the derivative.

30. The effective notional amount of a written credit derivative may be reduced by any negative change in fair value amount that has been incorporated into the calculation of Tier 1 capital with respect to the written credit derivative. For example, if a written credit derivative had a positive fair value of 20 on one date, but then declines by 30 to have a negative fair value of 10 on a subsequent reporting date, the effective notional amount of the credit derivative may be reduced by 10 – the effective notional amount may not be reduced by 30. However, if on the subsequent reporting date, the credit derivative has a positive fair value of five, the effective notional amount cannot be reduced at all. This treatment is consistent with the rationale that the effective notional amounts included in the exposure measure may be capped at the level of the maximum potential loss, which means that the maximum potential loss at the reporting date is the notional amount of the credit derivative minus any negative fair value that has already reduced Tier 1 capital.

31. The resulting exposure amount for a written credit derivative may be further reduced by the effective notional amount of a purchased credit derivative on the same reference name, provided that certain conditions are met. Among these conditions is a requirement that credit protection purchased through credit derivatives is otherwise subject to the same or more conservative terms as those in the corresponding written credit derivative. For example, the application of the same material terms would result in the following treatments:

- In the case of single name credit derivatives, the credit protection purchased through credit derivatives is on a reference obligation that ranks pari passu with, or is junior to, the underlying reference obligation of the written credit derivative. Credit protection purchased through credit derivatives that references a subordinated position may offset written credit derivatives on a more senior position of the same reference entity as long as a credit event on the senior reference asset would result in a credit event on the subordinated reference asset.

- For tranched products, the credit protection purchased through credit derivatives must be on a reference obligation with the same level of seniority.

32. Another required condition is that the credit protection purchased through credit derivatives is not purchased from a counterparty whose credit quality is highly correlated with the value of the reference obligation, which would generate wrong-way risk. Specifically, the credit quality of the counterparty must not be positively correlated with the value of the reference obligation (i.e. the credit quality of the counterparty falls when the value of the reference obligation falls and the value of the purchased credit derivative increases). This determination should reflect careful analysis of the actual risk; a legal connection does not need to exist between the counterparty and the underlying reference entity.

33. For the purposes of the leverage ratio, the term “written credit derivative” refers to a broad range of credit derivatives through which a bank effectively provides credit protection and is not limited solely to credit default swaps and total return swaps. For example, all options where the bank has the obligation to provide credit protection under certain conditions qualify as “written credit derivatives.” The effective notional amount of such options sold by the bank may be offset by the effective notional amount of options by which the bank has the right to purchase credit protection that fulfils the conditions stated in the Standards. For example, to have the same or more conservative material terms, the strike price of the underlying purchased credit protection would need to be equal to or lower than the strike price of the underlying sold credit protection.

- In the case of single name credit derivatives, the credit protection purchased through credit derivatives is on a reference obligation that ranks pari passu with, or is junior to, the underlying reference obligation of the written credit derivative. Credit protection purchased through credit derivatives that references a subordinated position may offset written credit derivatives on a more senior position of the same reference entity as long as a credit event on the senior reference asset would result in a credit event on the subordinated reference asset.

f. Securities Financing Transaction (SFT) Exposures

34. Secured lending and borrowing in the form of SFTs is an important source of leverage. How the framework measures exposure from SFTs depends on whether the bank is acting as a principal or agent. For principal banks, the exposure measure is equal to the sum of gross SFT assets (gross receivables related to SFTs, with some adjustments) and an amount representing counterparty credit risk. When acting as an agent, depending on the structure of the SFT, a bank may be able to ignore the collateral involved and reflect only the counterparty credit risk component, or it may have to include both. The framework also includes specific rules for SFTs that qualify for sale treatment under the operative accounting regime.

35. A degree of netting is allowed for SFTs, but only where strict criteria are met (for example, same counterparty, same maturity date). In these cases, the net position provides the better measure of the degree of leverage in a set of transactions between counterparties.

36. When a bank acts as a principal, its SFT exposure is the sum of gross SFT assets (subject to adjustments) and a measure of counterparty credit risk calculated as the current exposure without an add-on for potential future exposure.

37. For SFT assets subject to novation and cleared through QCCPs, “gross SFT assets recognized for accounting purposes” are replaced by the final contractual exposure, that is, the exposure to the QCCP after the process of novation has been applied, given that pre-existing contracts have been replaced by new legal obligations through the novation process. However, banks can only net cash receivables and cash payables with a QCCP if the requisite criteria are met. Any other netting permitted by the QCCP is not permitted for the purposes of the Basel III leverage ratio. Gross SFT assets recognized for accounting purposes must not recognize any accounting netting of cash payables against cash receivables (e.g. as currently permitted under the IFRS accounting framework). This regulatory treatment has the benefit of avoiding inconsistencies from netting which may arise across different accounting regimes.

38. Where a bank acting as an agent in an SFT does not provide an indemnity or guarantee to any of the involved parties, the bank is not exposed to the SFT and therefore need not recognize those SFTs in its leverage ratio exposure measure.

39. In situations where a bank is economically exposed beyond providing an indemnity or guarantee for the difference between the value of the security or cash its customer has lent and the value of the collateral the borrower has provided, a further exposure equal to the full amount of the security or cash must be included in the leverage ratio exposure measure. An example of this scenario could arise due to the bank managing collateral received in the bank’s name or on its own account rather than on the customer’s or borrower’s account (e.g. by on-lending or managing unsegregated collateral, cash or securities). However, this does not apply to client omnibus accounts that are used by agent lenders to hold and manage client collateral provided that client collateral is segregated from the bank’s proprietary assets and the bank calculates the exposure on a client-by-client basis.

g. Off-Balance Sheet Items

40. OBS items arise from such transactions as credit and liquidity commitments, guarantees and standby letters of credit. The amount that is included in the exposure measure is determined by multiplying the notional amount of an OBS item by the relevant credit conversion factor (CCF) from the Central Bank’s Standards for Leverage Ratio.

41. The off-balance-sheet exposure measure will be calculated using credit equivalent values. This reflects the fact that the degree of leverage in these transactions is not the same as if banks had made fully funded loans. That is, a 100% credit conversion factor (CCF) overestimates leverage. The use of standardised CCFs retains a consistent and conservative treatment that is not dependent on the risk of the bank’s counterparty.

42. Where there is an undertaking to provide a commitment on an off-balance-sheet item, banks are to apply the lower of the two applicable CCFs. For example:

- If a bank has a commitment to open short-term self-liquidating trade letters of credit arising from the movement of goods, a 20% CCF will apply, instead of a 40% CCF; and

- If a bank has an unconditionally cancellable commitment to issue direct credit substitutes, a 10% CCF will apply, instead of a 100% CCF.

- If a bank has a commitment to open short-term self-liquidating trade letters of credit arising from the movement of goods, a 20% CCF will apply, instead of a 40% CCF; and

III. Frequently Asked Questions

Question 1: Is the starting point for the leverage ratio exposure calculation total on-balance-sheet assets as reported in the financial statements?

Yes, total assets are the correct starting point, with adjustments as specified in the Standards, and with additions for off-balance-sheet exposure as required under the Standards.Question 2: Should aspects of derivatives exposures or SFT exposures that are on the balance sheet be included as part of on-balance-sheet exposure, or as part of derivatives or SFT exposure?

Certain exposures related to derivatives may appear on the balance sheet; the same is true for SFTs. Those exposures related to derivatives or SFTs should be excluded from the on-balance-sheet component of the leverage ratio exposure calculation, and instead included with either derivatives exposure or SFT exposure, as appropriate.Question 3: Why is collateral on the bank’s balance sheet part of the exposure measure for the leverage ratio calculation?

The leverage ratio framework as developed by the Basel Committee treats all assets on a bank’s balance sheet as creating equal risk. If the bank holds collateral on its balance sheet, the collateral is an asset of the bank, and changes in the value of that collateral affect the bank’s total assets and capital. In this sense, the leverage ratio calculation treats collateral as an additional source of risk exposure to the bank, even though the purpose of taking the collateral may be credit risk mitigation. The leverage ratio treats most types of secured exposures the same way, on a gross basis without taking into account the effects of collateral.Question 4: Is the calculation of counterparty credit risk exposure the same as the calculation used in the SA-CCR standards of the Central Bank?

Not quite – the CCR exposure calculation for the leverage ratio is similar, but with some differences. Potential Future Exposure is different because the PFE multiplier is set equal to 1, rather than possibly being less than 1 as under the CCR Standards. Replacement Cost also differs, due to some differences in the treatment of eligible collateral. The requirements are covered in para 44 to 46 of the Leverage Ratio Standards.Question 5: Why is the PFE multiplier set to 1 for derivatives in the calculation of the leverage ratio exposure measure?

The PFE multiplier is set to 1 because unlike the SA-CCR calculation, there is no “credit” given to the bank for overcollateralization for the leverage ratio. This is in the spirit of other aspects of the leverage ratio exposure calculation, which strictly limits the recognition of various forms of credit risk mitigation.Question 6: What types of commitments can qualify for a CCF less than 40%?

Commitments that are unconditionally cancellable at any time by the bank without prior notice, or that effectively provide for automatic cancellation due to deterioration in a borrower’s creditworthiness, without observed constraints on the bank’s ability to cancel such commitments. As noted in the Standards, such commitments are subject to a 10% CCF.Question 7: The Standards states “general provisions or general loan loss reserves which have reduced Tier 1 capital may be deducted from the leverage ratio exposure measure.” Does this imply that for banks under the standardised approach all general provisions held on the balance sheet are permitted to be deducted from the exposure measure?

Yes, that interpretation is correct.Question 8: The Standards does not mention interest in suspense; are bank’s allowed to deduct this from the leverage ratio exposure measure?

No, interest in suspense should be included as an exposure. However, specific provisions for interest in suspense can be deducted.IV. Examples: Calculation of Gross SFT Assets

This section provides simple examples to help clarify the calculation of adjusted gross SFT assets for the leverage ratio exposure measure. These examples are for guidance only; banks should consult the actual Leverage Ratio Standards for the specific requirements. Note that the SFT examples do not include the calculation of CCR exposure for the SFTs, which is required under the leverage ratio standards.

For purposes of these examples, consider a bank with a simple initial balance sheet consisting of assets of 200 cash and 400 in investment securities, funded by 600 in equity, with no other initial liabilities. In simple T-account format, the bank’s initial position is the following:Assets Liabilities and Equity Cash 200 Investment Securities 400 Equity 600 600 600 Example 1: Single Repurchase Agreement

A customer obtains financing from the bank through a repurchase agreement. The customer provides securities to the bank of 110, receives cash of 100, and commits to repurchase the securities at a specified future date. This is the bank’s only SFT.

After the transaction, the bank’s balance sheet appears as follows:Assets Liabilities and Equity Cash 100 Investment Securities 510 Repo Encumbered Securities -110 Cash Receivable 100 Equity 600 600 600 For purposes of the leverage ratio, gross SFT assets would be the sum of the cash receivable created and the investment securities received, 100+110, for a total of 210. However, this total is reduced by the value of the securities received under the SFT because the bank has recognized the securities as an asset on its balance sheet, leading to an adjusted gross SFT asset value of 100 for inclusion in the leverage ratio exposure measure.

Note that in this example, the net effect on leverage ratio exposure would be zero, since on-balance-sheet assets exclusive of SFT assets decline by 100.Example 2: Single Reverse Repurchase Agreement

A bank obtains funding by reversing out securities in exchange for cash. The bank receives 100 cash, repos out 110 in securities, and will repurchase the securities at a specified future date. This is the bank’s only SFT.

After the transaction, the bank’s balance sheet appears as follows:Assets Liabilities and Equity Cash 300 Investment Securities 290 Cash Payable 100 Repo Encumbered Securities 110 Equity 600 700 700 For purposes of the leverage ratio, gross SFT assets would be simply the 100 cash received. Note that in this example, the net effect would be to increase the measured leverage ratio exposure by 100.

Example 3: Simple Repo Portfolio

The bank has two SFTs, the repo from Example 1 above, and the reverse repo from Example 2 above. Both SFTs are with the same counterparty, and are subject to a qualifying master netting agreement under which cash payables and receivables qualify for netting. These are the bank’s only SFTs.

After the transaction, the bank’s balance sheet appears as follows:Assets Liabilities and Equity Cash 200 Investment Securities 400 Cash Payable 100 Cash Receivable 100 Equity 600 700 700 Because the SFT transactions have matching terms, there are offsetting accounting entries for Repo Encumbered Securities, Investment Securities, and Cash. In this case, gross SFT assets would be 310, consisting of 100 cash receivable, 110 investment securities received, and 100 cash received. However, this total is adjusted down by the amount of the securities received and held on the balance sheet (110), and by another 100 due to the netting of the cash payable and the cash receivable, leaving an adjusted total gross SFT assets of 100 to be included in the leverage ratio exposure measure.