Book traversal links for Anti-Money Laundering and Combating the Financing of Terrorism and Illegal Organisations Guidelines for Financial Institutions

Anti-Money Laundering and Combating the Financing of Terrorism and Illegal Organisations Guidelines for Financial Institutions

Effective from 13/7/2023Part I—Overview

1. Introduction

1.1 Purpose and Scope

The purpose of these Anti-Money Laundering and Combating the Financing of Terrorism and the Financing of Illegal Organisations Guidelines for Financial Institutions (FIs) (Guidelines) is to provide guidance and assistance to supervised institutions that are FIs, in order to assist their better understanding and effective performance of their statutory obligations under the legal and regulatory framework in force in the United Arab Emirates (UAE or State).

These Guidelines have been prepared as a joint effort between the Supervisory Authorities of the UAE, and set out the minimum expectations of the Supervisory Authorities regarding the factors that should be taken into consideration by each of the supervised financial institutions which fall under their respective jurisdictions, when identifying, assessing and mitigating the risks of money laundering (ML), the financing of terrorism (FT), and the financing of illegal organisations.

Nothing in these Guidelines is intended to limit or otherwise circumscribe additional or supplementary guidance, circulars, notifications, memoranda, communications, or other forms of guidance or feedback, whether direct or indirect, which may be published on occasion by any of the Supervisory Authorities in respect of the supervised institutions which fall under their respective jurisdictions, or in respect of any specific supervised institution.

Finally, it should be noted that, guidance on the subject of the United Nations Targeted Financial Sanctions (TFS) regime, and the related Cabinet Decision No. (74) of 2020 Regarding Terrorism Lists Regulation and Implementation of UN Security Council Resolutions On the Suppression and Combating of Terrorism, Terrorists Financing & Proliferation of Weapons of Mass Destruction, and Related Resolutions is outside of the scope of these Guidelines.

1.2 Applicability

Unless otherwise noted, these Guidelines apply to all Financial Institutions, and the members of their boards of directors, management and employees, established and/or operating in the territory of the UAE and their respective Financial and Commercial Free Zones, whether they establish or maintain a Business Relationship with a Customer, or engage in any of the financial activities and/or transactions or the trade and/or business activities outlined in Articles (2) and (3) of Cabinet Decision No. (10) of 2019 Concerning the Implementing Regulation of Decree Law No. (20) of 2018 On Anti-Money Laundering and Combating the Financing of Terrorism and Illegal Organisations.

Specifically, they are applicable to all such natural and legal persons in the following categories:

• Banks, finance companies, exchange houses, money service businesses (including hawaladar or other monetary value transfer services);

• Insurance companies, agencies, and brokers;

• Securities and commodities brokers, dealers, advisors, investment managers;

• Virtual asset service providers (VASPs);

• Other financial institutions not mentioned above.

1.3 Legal Status

Article 44.11 of Cabinet Decision No. (10) of 2019 Concerning the Implementing Regulation of Decree Law No. (20) of 2018 On Anti-Money Laundering and Combating the Financing of Terrorism and Illegal Organisations charges Supervisory Authorities with “providing Financial Institutions…with guidelines and feedback to enhance the effectiveness of implementation of the Crime-combatting measures.”

As such, these Guidelines do not constitute additional legislation or regulation, and are not intended to set legal, regulatory, or judicial precedent. They are intended rather to be read in conjunction with the relevant laws, cabinet decisions, regulations and regulatory rulings which are currently in force in the UAE and their respective Free Zones, and supervised institutions are reminded that the Guidelines do not replace or supersede any legal or regulatory requirements or statutory obligations. In the event of a discrepancy between these Guidelines and the legal or regulatory frameworks currently in force, the latter will prevail. Specifically, nothing in these Guidelines should be interpreted as providing any explicit or implicit guarantee or assurance that the Supervisory or other Competent Authorities would defer, waive, or refrain from exercising their enforcement, judicial, or punitive powers in the event of a breach of the prevailing laws, regulations, or regulatory rulings.

These Guidelines, and any lists and/or examples provided in them, are not exhaustive and do not set limitations on the measures to be taken by supervised institutions in order to meet their statutory obligations under the legal and regulatory framework currently in force. As such, these Guidelines should not be construed as legal advice or legal interpretation. Supervised institutions should perform their own assessments of the manner in which they should meet their statutory obligations, and they should seek legal or other professional advice if they are unsure of the application of the legal or regulatory frameworks to their particular circumstances.

1.4 Organisation of the Guidelines

These Guidelines are organized into five (5) parts, roughly corresponding to the following major themes:

Part I—Overview (including background information on the UAE’s AML/CFT legislative and strategy framework, and highlights of key provisions of the law and regulations affecting Financial Institutions);

Part II—Identification and Assessment of ML/FT Risks;

Part III—Mitigation of ML/FT Risks;

Part IV—AML/CFT Compliance Administration and Reporting (including guidance on governance, suspicious transaction reporting, and record-keeping);

The various sections and sub-sections of each part are organized according to subject matter. In general, each section or subsection includes references to the articles of the AML-CFT Law and/or the AML-CFT Decision to which it pertains. While it has been kept to a minimum, users may find that there are instances of repetition of some content throughout various sections of the Guidelines. This has been done in order to ensure that each section or sub-section pertaining to a specific subject matter is comprehensive, and to minimize the need for cross-referencing between sections.

In some cases, the requirements or provisions of specific sections of the relevant legal and regulatory frameworks are deemed sufficiently clear with regard to the statutory obligations of supervised institutions such that no additional guidance on those sections is provided for in these Guidelines. In other cases, guidance is provided with regard to subjects which are not covered explicitly in the AML-CFT Law or the AML-CFT Decision, but which are nevertheless addressed either implicitly or by reference to international best practices.

In certain instances in which there are meaningful differences between the relevant legal and regulatory framework currently in force and previous laws or regulations, or in which there are differences in specific regulatory requirements between various Supervisory Authorities, the Guidelines may or may not highlight these differences. In the event of such differences or discrepancies, supervised institutions seeking further clarification on matters related to those sections are invited to contact their relevant Supervisory Authority through the established channels.

It is the Supervisory Authorities’ intention to update or amend these Guidelines from time to time, as and when it is deemed appropriate. Supervised institutions are reminded that these Guidelines are not the only source of guidance on the assessment and management of ML/FT risk, and that other bodies, including international organisations such as FATF,

MENAFATF and other FATF-style regional bodies (FSRBs), the Egmont Group, and others also publish information that may be helpful to them in carrying out their statutory obligations. It is the sole responsibility of supervised institutions to keep apprised and updated at all times regarding the ML/FT risks to which they are exposed, and to maintain appropriate risk identification, assessment, and mitigation programmes, and to ensure their responsible officers, managers and employees are adequately informed and trained on the relevant policies, processes, and procedures.

Text from the AML-CFT and the AML-CFT Decision are quoted, or otherwise summarized or paraphrased, from time to time throughout these Guidelines. For the sake of convenience, unless specifically noted to the contrary, all references in the text to the term “financing of terrorism” also encompass the financing of illegal organisations. In general, capitalized terms in the text of these Guidelines have the meanings provided in the Glossary of Terms (see Appendix 11.1). However, in the event of any inconsistency or discrepancy between the text or definitions provided for in the Law and/or the Cabinet Decision and such quotations, summaries or paraphrases, or such defined terms, the former shall prevail.

2. Overview of the AML/CFT Legal, Regulatory, and National Strategy Frameworks of the United Arab Emirates

2.1 National Legislative and Regulatory Framework

The legal and regulatory structure of the UAE is comprised of a matrix of federal civil, commercial and criminal laws and regulations, together with the various regulatory and Supervisory Authorities responsible for their implementation and enforcement, and various local civil and commercial legislative and regulatory frameworks in the Financial and Commercial Free Zones. As criminal legislation is under federal jurisdiction throughout the State, including the Financial and Commercial Free Zones, the crimes of money laundering, the financing of terrorism, and the financing of illegal organisations are covered under federal criminal statutes and the federal penal code. Likewise, federal legislation and implementing regulations on the combating of these crimes are in force throughout the UAE, including the Financial and Commercial Free Zones. Their implementation and enforcement are the responsibility of the relevant regulatory and Supervisory Authorities in either the federal or local jurisdictions.

The principal AML/CFT legislation within the State is Federal Decree-Law No. (20) of 2018 On Anti-Money Laundering and Combating the Financing of Terrorism and Financing of Illegal Organisations (the “AML-CFT Law” or “the Law”) and implementing regulation, Cabinet Decision No. (10) of 2019 Concerning the Implementing Regulation of Decree Law No. (20) of 2018 On Anti-Money Laundering and Combating the Financing of Terrorism and Illegal Organisations (the “AML-CFT Decision” or “the Cabinet Decision”).

The UAE issued Cabinet UBO Resolution No. 58 of 2020 on the Regulation of the Procedures of the Real Beneficiary (UBO Resolution) which came into effect on 28 August 2020 and replaced Cabinet Resolution No. 34 of 2020 issued earlier this year.

The UBO Resolution introduces the requirement for a beneficial ownership register in the UAE mainland and unifies the minimum disclosure requirements for corporate entities incorporated in the UAE mainland and in the non-financial free zones. Financial free zones (Abu Dhabi Global Market (ADGM) and Dubai International Financial Centre (DIFC) and companies owned by the Federal Government and their subsidiaries are not covered by the UBO Resolution.

2.2 International Legislative and Regulatory Framework

The AML/CFT legislative and regulatory framework of the UAE is part of a larger international AML/CFT legislative and regulatory framework made up of a system of intergovernmental legislative bodies and international and regional regulatory organisations. On the basis of international treaties and conventions in relation to combating money laundering, the financing of terrorism and the prevention and suppression of the proliferation of weapons of mass destruction, intergovernmental legislative bodies create laws at the international level, which participating member countries then transpose into their national counterparts. In parallel, international and regional regulatory organisations develop policies and recommend, assess and monitor the implementation by participating member countries of international regulatory standards in respect of AML/CFT.

Among the major intergovernmental legislative bodies, and international and regional regulatory organisations, with which the government and the Competent Authorities of the State actively collaborate within the sphere of the international AML/CFT framework are:

• The United Nations (UN): The UN is the international organization with the broadest range of membership. Founded in October of 1945, there are currently 191 member states of the UN from throughout the world. The UN actively operates a program to fight money laundering, the Global Programme against Money Laundering (GPML), which is headquartered in Vienna, Austria, is part of the UN Office of Drugs and Crime (UNODC).

• The Financial Action Task Force (FATF): The Financial Action Task Force (FATF) is an intergovernmental body established in 1989, which sets international standards and promotes effective implementation of legal, regulatory and operational measures for combating money laundering, terrorist financing and other related threats to the integrity of the international financial system. FATF also monitors the implementation of its standards, the 40 FATF Recommendations and 11 Immediate Outcomes, by its members and members of FSRBs, ensures that the ‘FATF Methodology’ for assessing technical compliance with the FATF Recommendations and the effectiveness of AML/CFT systems is properly applied.

• The Middle East and North Africa Financial Action Task Force (MENAFATF): Recognizing the FATF 40 Recommendations on Combating Money Laundering and the Financing of Terrorism and Proliferation, and the related UN Conventions and UN Security Council Resolutions, as the worldwide-accepted international standards in the fight against money laundering and the financing of terrorism and proliferation, MENAFATF was established in 2004 as a FATF Style Regional Body (FSRB), for the purpose of fostering co-operation and co-ordination between the countries of the MENA region in establishing an effective system of compliance with those standards. The UAE is one of the founding members of MENAFATF.

• The Egmont Group of Financial Intelligence Units: In 1995, a number of FIUs began working together and formed the Egmont Group of Financial Intelligence Units (Egmont Group) (named for the location of its first meeting at the Egmont-Arenberg Palace in Brussels). The purpose of the group is to provide a forum for FIUs to improve support for each of their national AML/CFT programs and to coordinate AML/CFT initiatives. This support includes expanding and systematizing the exchange of financial intelligence information, improving expertise and capabilities of personnel, and fostering better communication among FIUs through technology, and helping to develop FIUs worldwide.

2.3 AML/CFT National Strategy Framework

Money laundering and the financing of terrorism are crimes that threaten the security, stability and integrity of the global economic and financial system, and of society as a whole. The estimated volume of the proceeds of crime, including the financing of terrorism, that are laundered each year is between 2-5% of global GDP. Yet, by some estimates, the volume of criminal proceeds that are actually seized is in the range of only 2% of the total, while roughly only half of that amount eventually ends up being confiscated by competent judicial authorities. Combating money laundering and the financing of terrorist activities is therefore an urgent priority in the global fight against organised crime.

The UAE is deeply committed to combating money laundering and the financing of terrorism and illegal organisations. To this end, the Competent Authorities have established the appropriate legislative, regulatory and institutional frameworks for the prevention, detection and deterrence of financial crimes, including ML/FT. They also continue to work towards reinforcing the capabilities of the resources committed to these efforts, and towards improving their effectiveness by implementing the internationally accepted AML/CFT standards recommended and promoted by FATF, MENAFATF and the other FSRBs, as well as by the United Nations, the World Bank and the International Monetary Fund (IMF).

As part of these efforts, the Competent Authorities of the UAE have taken a number of substantive actions, including among others:

• Enhancing the federal legislative and regulatory framework, embodied by the introduction of the new AML/CFT Law and Cabinet Decision, which incorporate the FATF standards;

• Conducting the National Risk Assessment (NRA) to identify and assess the ML/FT threats and inherent vulnerabilities to which the country is exposed, as well as to assess its capacity in regard to combating ML/FT at the national level;

• Formulating a National AML/CFT Strategy and Action Plan that incorporate the results of the NRA and which are designed to ensure the effective implementation, supervision, and continuous improvement of a national framework for the combating of ML/FT, as well as to provide the necessary strategic and tactical direction to the country’s public and private sector institutions in this regard.

The National Strategy on Anti-Money Laundering and Countering the Financing of Terrorism of the United Arab Emirates is based on four pillars, each of which is associated with its own strategic priorities. These strategic priorities in turn inform and shape the key initiatives of the country’s National Action Plan on AML/CFT.

The pillars of the National Strategy, together with their strategic priorities are summarised in the table below:

National AML/CFT Strategic Pillars Strategic Priorities Legislative & Regulatory Measures Increase effectiveness and efficiency of legislative and regulatory policies and ensure compliance Transparent Analysis of Intelligence Leverage the use of financial databases and the development of information analysis systems to enhance the transparent analysis and dissemination of financial intelligence information Domestic and International Cooperation & Coordination Promote the efficiency and effectiveness of domestic and international coordination and cooperation with regard to the availability and exchange of information Compliance and Law Enforcement Ensure the effective investigation and prosecution of ML/FT crimes and the timely implementation of TFS The National Committee for Combating Money Laundering and the Financing of Terrorism and Illegal Organisations has identified a number of key drivers of success in achieving the goals of the National AML/CFT Strategy. These include, among other things, ensuring:

• Effective coordination between the Financial Intelligence Unit, Law Enforcement Authorities, Public Prosecutors, Supervisory Authorities, and other Competent Authorities within the country;

• Effective compliance with the laws and regulations governing banking activities and other financial services;

• Awareness by FIs of the relevant ML/FT risks facing the UAE in general, and their sectors in particular, as informed by the results of the NRA, as well as their awareness of their statutory obligations in regard to the management and mitigation of those risks.

The present Anti-Money Laundering and Combating the Financing of Terrorism and Illegal Organisations Guidelines for Financial Institutions are thus intended to advance the efforts of the Committee, the Supervisory Authorities, and the other Competent Authorities of the State in this direction.

3. Highlights of Key Provisions Affecting Financial Institutions

The AML-CFT Law and the AML-CFT Decision contain numerous provisions setting out the rights and obligations of supervised institutions, including Financial Institutions, as well as their senior managers and employees. This section highlights some of the key provisions affecting FIs that are of immediate concern. FIs are reminded that it is their sole responsibility to adhere to all provisions of the AML-CFT Law, the AML-CFT Decision, and all regulatory notices, rulings and circulars affecting them.

3.1 Summary of Minimum Statutory Obligations of Supervised Institutions

The AML-CFT Law and the AML-CFT Decision set out the minimum statutory obligations of supervised institutions as follows:

• To identify, assess, understand risks (AML-CFT Law Article 16.1(a), AML-CFT Decision Article 4.1);

• To define the scope of and take necessary due diligence measures (AML-CFT Law Article 16.1(b), AML-CFT Decision Article 4.1(a) and 2);

• To appoint a compliance officer, with relevant qualification and expertise and in line with the requirements of the relevant Supervisory Authority (AML-CFT Decision Article 21, 44.12);

• To put in place adequate management and information systems, internal controls, policies, procedures to mitigate risks and monitor implementation (AML-CFT Law Article 16.1(d), AML-CFT Decision Article 4.2(a));

• To put in place indicators to identify suspicious transactions (AML-CFT Law Article 15, AML-CFT Decision Article 16);

• To report suspicious activity and cooperate with Competent Authorities (AML-CFT Law Article 9.1, 15, 30, AML-CFT Decision Article 13.2, 17.1, 20.2);

• To promptly apply directives of Competent Authorities for implementing UN Security Council decisions under Chapter 7 of the UN Convention for the Prohibition and Suppression of the FT and Proliferation (AML-CFT Law Article 16.1(e), AML-CFT Decision Article 60);

• To maintain adequate records (AML-CFT Law Article 16.1(f), AML-CFT Decision Article 7.2, 24).

Specific guidance on these and other provisions of the AML-CFT Law and the AML-CFT Decision is provided in the following sections.

3.2 Confidentiality and Data Protection

(AML-CFT Law Article 15; AML-CFT Decision Articles 17.2, 21.2, 31.3, 39)

Financial Institutions are obliged to report to the UAE’s Financial Intelligence Unit (FIU) when they have reasonable grounds to suspect a transaction or funds representing all or some proceeds, or suspicion of their relationship to a Crime (see Section 7, Suspicious Transaction Reporting). In reporting their suspicions, they must maintain confidentiality with regard to both the information being reported and to the act of reporting itself, and make reasonable efforts to ensure the information and data reported are protected from access by any unauthorised person.

It should be noted that the confidentiality requirement does not pertain to communication within the FI or its affiliated group members (foreign branches, subsidiaries, or parent company) for the purpose of sharing information relevant to the identification, prevention or reporting of a Crime. However, under no circumstances are FIs, or their managers or employees, permitted to inform a Customer or the representative of a Business Relationship, either directly or indirectly, that a report has been made, under penalty of sanctions (see Section 3.9, Sanctions against Persons Violating Obligations). This is the so-called “tipping off” requirement. This also extends to any related information that might be provided to the FIU or information that is being requested by the FIU.

FIs are not permitted to object to the statutory reporting of suspicions on the grounds of Customer confidentiality or data privacy, under penalty of sanctions. Moreover, data protection laws include provisions that allow the FI to report to the authorities. (see Section 3.9, Sanctions against Persons Violating Obligations).

3.3 Protection against Liability for Reporting Persons

(AML-CFT Law Article 27; AML-CFT Decision Article 17.3)

The AML-CFT Law and the AML-CFT Decision provide Financial Institutions, as well as their board members, employees and authorised representatives, with protection from any administrative, civil or criminal liability resulting from their good-faith performance of their statutory obligation to report suspicious activity to the FIU. This protection is also applicable if they did not know precisely what the underlying criminal activity was, and regardless of whether illegal activity actually occurred.

3.4 Statutory Prohibitions

(AML-CFT Law Article 16.1(c); AML-CFT Decision Articles 13.1, 14, 35.4, 38)

Financial Institutions are prohibited from the following activities:

• Establishing or maintaining any Customer or Business Relationship, conducting any financial or commercial transactions, keeping any accounts under an anonymous or fictitious name or by pseudonym or number;

• Establishing or maintaining a Business Relationship or executing any transaction in the event they are unable to complete adequate risk-based CDD measures in respect of the Customer for any reason;

• Dealing in any way with Shell Banks, whether to open (correspondent) bank accounts in their names, or to accept funds or deposits from them;

• Invoking banking, professional or contractual secrecy as a pretext for refusing to perform their statutory reporting obligation in regard to suspicious activity;

• Issuing or dealing in bearer shares or bearer share warrants.

3.5 Money Laundering

(AML-CFT Law Articles 2.1-3, 4, 29.3, AML-CFT Decision Article 1)

The AML-CFT Law defines money laundering as engaging in any of the following acts willfully, having knowledge that the funds are the proceeds of a felony or a misdemeanour (i.e., a predicate offence):

• Transferring or moving proceeds or conducting any transaction with the aim of concealing or disguising their Illegal source;

• Concealing or disguising the true nature, source or location of the proceeds as well as the method involving their disposition, movement, ownership of or rights with respect to said proceeds;

• Acquiring, possessing or using proceeds upon receipt;

• Assisting the perpetrator of the predicate offense to escape punishment.

Both the AML-CFT Law and the AML-CFT Decision define “funds” in a very broad sense as “assets in whatever form, whether tangible, intangible, movable or immovable including national currency, foreign currencies, documents or notes evidencing the ownership of those assets or associated rights in any forms including electronic or digital forms or any interests, profits or income originating or earned from these assets.” They likewise define “proceeds” as “funds generated directly or indirectly from the commitment of any crime or felony including profits, privileges, and economic interests, or any similar funds converted wholly or partly into other funds.”

Therefore, in order to be considered money laundering, it is not necessary for any of the above-stipulated acts to involve only money or monetary instruments per se, but any number of tangible or intangible assets such as, but not limited to:

• Funds bank or other financial accounts, including so-called virtual or crypto currencies;

• Financial instruments or securities, such as shares, bonds, notes, commercial paper, promissory notes, IOUs, share warrants, options, rights (including land rights), or other transferrable securities or bearer negotiable instruments;

• Contracts, loan instruments, titles, claims, insurance policies, or their assignment;

• Intellectual property (including but not limited to patents or registered trademarks), royalties, licenses, or the rights thereto;

• Physical property, including but not limited to commodities, land, precious metals and stones, motor vehicles or vessels, works of art, or any other goods exchanged as payment-in-kind.

The size or monetary value of the financial or commercial transaction, the timeframe during which it took place, and the nature of the funds or proceeds (whether in liquid funds or some other tangible or intangible asset) are irrelevant to the suspicion and reporting of a suspicious transaction.

The AML-CFT Law designates money laundering as a criminal offence. Its prosecution is independent of that of any predicate offence to which it is related or from which the proceeds are derived. The suspicion of money laundering is not dependent on proving that a predicate offence has actually occurred or on proving the illicit source of the proceeds involved, but can be inferred from certain information, including indicators or behavioural patterns.

According to the 2018 National Risk Assessment, professional third-party money laundering has been identified as one of the top ML/FT threats in the UAE.

3.6 Predicate Offences

The AML-CFT Law defines a predicate offence as “any act constituting an offence or misdemeanour under the applicable laws of the State whether this act is committed inside or outside the State when such act is punishable in both countries.” A predicate offence is therefore any crime, whether felony or misdemeanour, which is punishable in the UAE, regardless of whether it is committed within the State or in any other country in which it is also a criminal offence.

FATF has designated 21 (twenty-one) categories of predicate offences. Each of these categories of predicate offences has been criminalised in the legislative framework of the State. FIs are reminded that this is not an exhaustive list of predicate offences, but simply a convenient categorisation, since in the UAE according to the AML-CFT Law, even crimes that do not appear on this list, whether felonies or misdemeanours, can be predicate offences to money laundering.

Based on expert analysis of these categories conducted on behalf of the UAE’s Competent Authorities for the 2018 National Risk Assessment, the top (highest) threats to the State in relation to money laundering have been identified as: fraud, counterfeiting and piracy of products, illicit trafficking in narcotic drugs and psychotropic substances, and professional third-party money laundering.

Similarly, other (medium-high) threats of particular concern to the UAE in relation to money laundering have been identified as the categories of: insider trading and market manipulation, robbery and theft, illicit trafficking in stolen and other goods, forgery, smuggling (including in relation to customs and excise duties and taxes), tax crimes (related to direct taxes and indirect taxes), and terrorism (including terrorist financing).

While FIs should pay special attention to the most serious threats identified in the NRA and any topical risk assessment when performing their own ML/FT business risk assessments, they are reminded that their risk assessment operations should consider all categories of risk for applicability to their own particular circumstances.

3.7 Financing of Terrorism

(AML-CFT Law Articles 3.1, 4, 29.3, AML-CFT Decision Article 1)

The AML-CFT Law designates the financing of terrorism as a criminal offence, which is not subject to the statute of limitations. It defines the financing of terrorism as:

• Committing any act of money laundering, being aware that the proceeds are wholly or partly owned by a terrorist organisation or terrorist person or intended to finance a terrorist organisation, a terrorist person or a terrorism crime, even if it without the intention to conceal or disguise their illicit origin; or

• Providing, collecting, preparing or obtaining proceeds or facilitating their obtainment by others with intent to use them, or while knowing that such proceeds will be used in whole or in part for the commitment of a terrorist offense, or committing such acts on behalf of a terrorist organisation or a terrorist person while aware of their true background or purpose.

There are numerous risk factors that FIs should consider important when assessing their exposure to the risk of terrorist financing (see Section 4.1.1, Risk Factors), including geographic-, sector-, channel-, product-, service- and customer-specific risks.

In a 2019 report by MENAFATF, an assessment of the global threat posed by the financing of terrorism stated:

“The number, type, scope, and structure of terrorist actors and the global terrorism threat are continuing to evolve. Recently, the nature of the global terrorism threat has intensified considerably. In addition to the threat posed by terrorist organisations such as ISIL, Al-Qaeda and other groups, attacks in many cities across the globe are carried out by individual terrorists and terrorist cells ranging in size and complexity. Commensurate with the evolving nature of global terrorism, the methods used by terrorist groups and individual terrorists to fulfil their basic need to generate and manage funds is also evolving.

Terrorist organisations use funds for operations (terrorist attacks and pre-operational surveillance); propaganda and recruitment; training; salaries and member compensation; and social services. These financial requirements are usually high for large terrorist organisations, particularly those that aim to, or do, control territory. In contrast, the financial requirements of individual terrorists or small cells are much lower with funds primarily used to carry out attacks. Irrespective of the differences between terrorist groups or individual terrorists, since funds are directly linked to operational capability, all terrorist groups and individual terrorists seek to ensure adequate funds generation and management.”1

1 Social Media and Terrorism Financing: A joint project by Asia/Pacific Group on Money Laundering & Middle East and North Africa Financial Action Task Force, APG/MENAFATF, January 2019, p.4.

3.8 Financing of Illegal Organisations

(AML-CFT Law Articles 3.2, 4, 29.3, AML-CFT Decision Article 1)

Like the financing of terrorism, the AML-CFT Law designates the financing of illegal organisations as a criminal offence that is not subject to the statute of limitations. The Law defines the financing of illegal organisations as:

• Committing any act of money laundering, being aware that the proceeds are wholly or partly owned by an illegal organisation or by any person belonging to an illegal organisation or intended to finance such illegal organisation or any person belonging to it, even if without the intention to conceal or disguise their illicit origin.

• Providing, collecting, preparing, obtaining proceeds or facilitating their obtainment by others with intent to use such proceeds, or while knowing that such proceeds will be used in whole or in part for the benefit of an Illegal organisation or of any of its members, with knowledge of its true identity or purpose.

• When assessing their risk exposure to the financing of illegal organisations, FIs should pay special attention to the regulatory disclosure, accounting, financial reporting and audit requirements of organisations with which they conduct Business Relationships or transactions. This is particularly important where non-profit, community/social, or religious/cultural organisations are involved, especially when those organisations are based, or have significant operations, in jurisdictions that are unfamiliar or in which transparency or access to information may be limited for any reason.

3.9 The ML Phases

To identify, understand and accurately assess the ML/FT risks to which FIs are exposed at both the enterprise and business relationship levels, FIs should be aware of the three phases of money laundering. By determining for which ML/FT phase a certain product can be misused or the FI itself can be misused, will help the FI understand its specific inherent ML/FT risks. The paragraphs below describe the crime of money laundering as consisting of three distinct (though sometimes overlapping) phases:

Placement. In this phase, criminals attempt to introduce Funds or the Proceeds of Crime into the financial system using a variety of techniques or typologies (see Section 3.10, ML/FT Typologies).

Examples of placement transactions include the following:

• Blending of funds: Commingling of illegitimate funds with legitimate funds, such as placing the cash from illegal narcotics sales into cash-intensive, locally owned businesses. • Foreign exchange: Purchasing of foreign exchange with illegal funds. • Breaking up amounts: Placing cash in small amounts and depositing them into numerous bank accounts in an attempt to evade attention or reporting requirements. • Currency smuggling: Cross-border physical movement of cash or monetary instruments. • Loans: Repayment of legitimate loans using laundered cash.

Layering. Once the Funds or Proceeds are introduced, or placed, into the financial system, they can proceed to the next phase of the process; often, this is accomplished by placing the funds into circulation through formal financial institutions, and other legitimate businesses, both domestic and international.” In this layering phase, criminals attempt to disguise the illicit nature of the Funds or Proceeds of Crime by engaging in transactions, or layers of transactions, which aim to conceal their origin.

Examples of layering transactions include:

• Electronically moving funds from one country to another and dividing them into advanced financial options and/or markets; • Moving funds from one financial institution to another or within accounts at the same institution; • Converting the cash placed into monetary instruments; • Reselling high-value goods and prepaid access/stored value products; • Investing in real estate and other legitimate businesses; • Placing money in stocks, bonds or life insurance products; and • Using shell companies to obscure the ultimate beneficial owner and assets.

Integration. In this phase, criminals attempt to return, or integrate, their “laundered” Funds or the Proceeds of Crime back into the economy, or to use it to commit new criminal offences, through transactions or activities that appear to be legitimate.

A key objective for criminals engaged in money laundering—and therefore a key generic risk underlying the specific risks faced by FIs—is the exploitation of situations and factors (including products, services, structures, transactions, and geographic locations) which favour anonymity and complexity, thereby facilitating a break in the “paper trail” and concealment of the illicit source of the Funds.

Although the sizes of transactions related to the financing of terrorism and illegal organisations can be (much) smaller than those involved in money laundering operations, and some of the typologies and specific techniques used may differ, the overall principles and generic risks are the same. The terrorists and criminals involved in these acts attempt to exploit situations and factors favouring anonymity and complexity, in order to obscure and conceal the illicit source of the Funds, or the illicit destination or purpose for which they are intended, or both. FIs should remain careful that their services are not being used either directly or indirectly to facilitate Money Laundering or the Financing of Terrorism or Illegal Organisations in any of the three stages described above.

3.10 ML/FT Typologies

The methods used by criminals for money laundering, the financing of terrorism, and the financing of illegal organisations are continually evolving and becoming more sophisticated. It is therefore critical in combating these crimes for FIs to ensure that their personnel are kept up-to-date on the latest ML/FT trends and typologies.

There are numerous useful sources of research and information related to ML/FT typologies, including by the Supervisory Authorities, the FATF, MENAFATF and other FSRBs, the Egmont Group, and others. FIs should incorporate the regular review of ML/FT trends and typologies into their compliance training programmes (see Section 8.2, Staff Screening and Training), as well as into their risk identification and assessment procedures.

Examples of some of the key ML/FT typologies with which FIs should be familiar include (but are not limited to):

• Currency exchanges / cash conversion: used to assist with smuggling to another jurisdiction or to exploit low reporting requirements on currency exchange houses to minimize risk of detection – e.g., purchasing of travellers cheques to transport value to another jurisdiction. • Cash couriers / currency smuggling: concealed movement of currency to avoid transaction / cash reporting measures. • Structuring (smurfing): A method involving numerous transactions (deposits, withdrawals, transfers), often various people, high volumes of small transactions and sometimes numerous accounts to avoid detection threshold reporting obligations. • Use of credit cards, cheques, promissory notes, etc.: Used as instruments to access funds held in a financial institution, often in another jurisdiction. • Purchase of portable valuable commodities (gems, precious metals, etc.): A technique to purchase instruments to conceal ownership or move value without detection and avoid AML/CFT measures – e.g., movement of diamonds or gold to another jurisdiction. • Purchase of valuable assets (real estate, race horses, vehicles, etc.): Criminal proceeds are invested in high-value negotiable goods to take advantage of reduced reporting requirements to obscure the source of proceeds of crime. • Commodity exchanges (barter): Avoiding the use of money or financial instruments in value transactions to avoid AML/CFT measures - e.g., a direct exchange of heroin for gold bullion. • Use of wire transfers: to electronically transfer funds between financial institutions and often to another jurisdiction to avoid detection and confiscation. • Underground banking / unlicensed remittance services: Illegal mechanisms based on networks of trust used to remit monies, without the proper license or registration. Often work in parallel with the traditional banking sector and exploited by money launderers and terrorist financiers to move value without detection and to obscure the identity of those controlling funds. • Trade-based money laundering and terrorist financing: usually involves invoice manipulation and uses trade finance routes and commodities to avoid financial transparency laws and regulations. • Abuse of non-profit organizations (NPOs): May be used to raise terrorist funds, obscure the source and nature of funds and to distribute funds for terrorist activities. • Investment in capital markets: to obscure the source of proceeds of crime to purchase negotiable instruments, often exploiting relatively low reporting requirements. • Mingling (business investment): A key step in money laundering involves combining proceeds of crime with legitimate business monies to obscure the illegal source of the funds. • Use of shell companies/corporations: a technique to obscure the identity of persons controlling funds and exploit relatively low reporting requirements. • Use of offshore banks/businesses, including trust company service providers: to obscure the identity of persons controlling funds and to move monies away from interdiction by domestic authorities. • Use of nominees, trusts, family members or third parties, etc: to obscure the identity of persons controlling illicit funds. • Use of foreign bank accounts: to move funds away from interdiction by domestic authorities and obscure the identity of persons controlling illicit funds. • Identity fraud / false identification: used to obscure the identity of those involved in many methods of money laundering and terrorist financing. • Use “gatekeepers” professional services (lawyers, accountants, brokers, etc.): to obscure the identity of beneficiaries and the illicit source of funds. May also include corrupt professionals who offer ‘specialist’ money laundering services to criminals. • New Payment technologies: use of emerging payment technologies for money laundering and terrorist financing. Examples include cell phone-based remittance and payment systems. • Virtual assets: (VA) and related services have the potential to spur financial innovation and efficiency, but their distinct features also create new opportunities for money launderers, terrorist financiers, and other criminals to launder their proceeds or finance their illicit activities. FIs may refer to the FATF Recommendations that place AML/CFT requirements on Virtual Assets (VA) and Virtual Asset Service Providers (VASPs). The FATF has also issued a document on Guidance on Risk Based Approach to VAs and VASPs. FIs should be familiar with the AML/CFT risks of dealing with VAs and VASPs in accordance with the FATF guidance. • Life insurance products can be for instance be used for money laundering when they have saving or investment features which may include the options for full or partial withdrawals or early surrenders. • General insurance product: there are several cases where the early cancellation of policies with return of premium has been used to launder money.

○ A number of policies entered into by the same insurer/intermediary for small amounts and then cancelled at the same time; ○ Return premium being credited to an account different from the original account; ○ Requests for return premiums in currencies different from the original premium; ○ Regular purchase and cancellation of policies. • Overpayment of premiums: arranging for excessive numbers or excessively high values of insurance reimbursements by cheque or wire transfer to be made, in this method, the launderer may arrange for insurance of the legitimate assets and ‘accidentally’ but on a recurring basis, significantly overpay his premiums and request a refund for the excess.

The UAE FIU releases reports on Trends and Typologies of Money Laundering which is an analysis based on the information extracted from the suspicious transaction reports (STRs) filed by reporting entities. This is a very useful resource for FIs for understanding the prevalent typologies of ML and FT crimes as well as getting information on the latest trends on these crimes in the country. This report is released on the FIU’s GoAML System for STR reporting and therefore, is accessible to registered users of this system.

Links to some other official sources, which may be useful in keeping up-to-date with regard to ML/FT typologies, may be found in Appendix 11.2.

3.11 Sanctions against Persons Violating Reporting Obligations

(AML-CFT Law Articles 15, 24, 25)

The AML-CFT Law provides for the following sanctions against any Financial Institutions, their managers or their employees, who fail to perform, whether purposely or through gross negligence, their statutory obligation to report a suspicion of money laundering or the financing of terrorism or of illegal organisations:

• Imprisonment and fine of no less than AED100,000 and no more than AED1,000,000; or

• Any of these two sanctions.

According to Article 15 of the AML-CFT Law, the requirement to report is in the case of suspicion or reasonable grounds to suspect a Crime. It should also be noted that the transactions or funds that are the subject of the suspicion may represent only part of the proceeds of the criminal offence, regardless of their value.

Likewise, the AML-CFT Law provides for sanctions against anyone who warns or notifies a person of a suspicious transaction report or reveals that a transaction is under review or investigation by the Competent Authorities, as follows:

• Imprisonment for no less than six months and a penalty of no less than AED100,000 and no more than AED500,000; or

• Any of these two sanctions.

Part II—Identification and Assessment of ML/FT Risks

4. Identification and Assessment of ML/FT Risks

(AML-CFT Law Article 16.1; AML-CFT Decision Article 4.1)

Both the AML-CFT Law and the AML-CFT Decision provide that FIs may utilize a risk-based approach with respect to the identification and assessment of ML/FT risks.

FIs are obliged to assess and to understand the ML/FT risks to which they are exposed, and how they may be affected by those risks. Specifically, the AML-CFT Law provides that they shall:

“…continuously assess, document, and update such assessment based on the various risk factors established in the Implementing Regulation of this Decree-Law and maintain a risk identification and assessment analysis with its supporting data to be provided to the Supervisory Authority upon request.”

Furthermore, the AML-CFT Decision charges supervised institutions with:

“…Documenting risk assessment operations, keeping them up to date on on-going bases and making them available upon request.”

Guidance on these subjects is provided in the following sections.

4.1 Risk-Based Approach (RBA)

A risk-based approach (RBA) is central to the effective implementation of the AML/CFT legislation. It means that FIs identify, assess, and understand the ML/TF risks to which they are exposed, and implement the most appropriate mitigation measures. An RBA requires financial institutions to have systems and controls that are commensurate with the specific risks of money laundering and terrorist financing facing them. Assessing this risk is, therefore, one of the most important steps in creating a good AML/CFT compliance program and will enable FIs to focus their resources where the risks are higher. In this regard, FIs can take into account their business nature, size and complexity.

(AML-CFT Law Article 16.1; AML-CFT Decision Article 4.1-3)

Implicit in both the AML-CFT Law and the AML-CFT Decision is the well-established concept of a risk-based approach (RBA) to the identification and assessment of ML/FT risks. Specifically, the AML-CFT Law states that FIs should “identify crime risks within (their) scope of work” and should update their risk assessments on the basis of the various risk factors set out in the AML-CFT Decision. Likewise, the AML-CFT Decision states that FIs’ identification, assessment and understanding of the risks should be carried out “in concert with their business nature and size,” and that various risk factors should be considered in determining the level of mitigation required. The AML-CFT Decision further provides that enhanced due diligence should be performed in cases where high risks are identified, while simplified due diligence may be performed in certain cases where low risk is identified, unless there is a suspicion of ML/FT.

An RBA to AML/CFT means that FIs should identify, assess and understand the ML/TF risks to which they are exposed and take AML/CFT measures commensurate to those risks in order to mitigate them effectively. This will require an understanding of the ML/TF risk faced by UAE (national risks), risks by the sector and the FI as well as specific products and services, customer base, the capacity in which customers are operating, jurisdictions in which they operate , the delivery channel and the effectiveness of risk controls put in place.

The use of an RBA thus allows FIs to allocate their resources more efficiently and effectively, within the scope of the national AML/CFT legislative and regulatory framework, by adopting and applying preventative measures that are targeted at and commensurate with the nature of risks they face.

While there are limits to any risk-management approach, and no RBA can be considered as completely failsafe; there may be occasions where an FI has taken all reasonable measures to identify and mitigate ML/TF risks, but it is still used for ML/TF in isolated instances. FIs should nevertheless understand that a risk-based approach is not a justification for ignoring certain ML/FT risks, nor does it exempt them from taking reasonable and proportionate mitigation measures, even for risks that are assessed as low. Their statutory obligations require them to identify, assess and understand the level of (inherent) risks presented by their (types of) customers, products and services, transactions, geographic areas and delivery channels, and to be in a position to apply sufficient AML/CFT mitigation measures on a risk-appropriate basis at all times.

In order to do so, they should identify and assess their exposure to ML/FT risks on the basis of a variety of risk factors (see Section 4.1, Risk Factors), some of which are related to the nature, size, complexity and operational environment of their businesses, and others of which are customer- or relationship-specific. Furthermore, they should take reasonable and proportionate risk mitigation measures based on the severity of the risks identified.

Conducting an ML/TF business risk assessments can assist FIs to understand their risk exposure and the areas they should give priority in combating ML/FT. The extent of business-wide risks to which an FI is exposed may require different levels of AML/CFT resources and mitigation strategies.

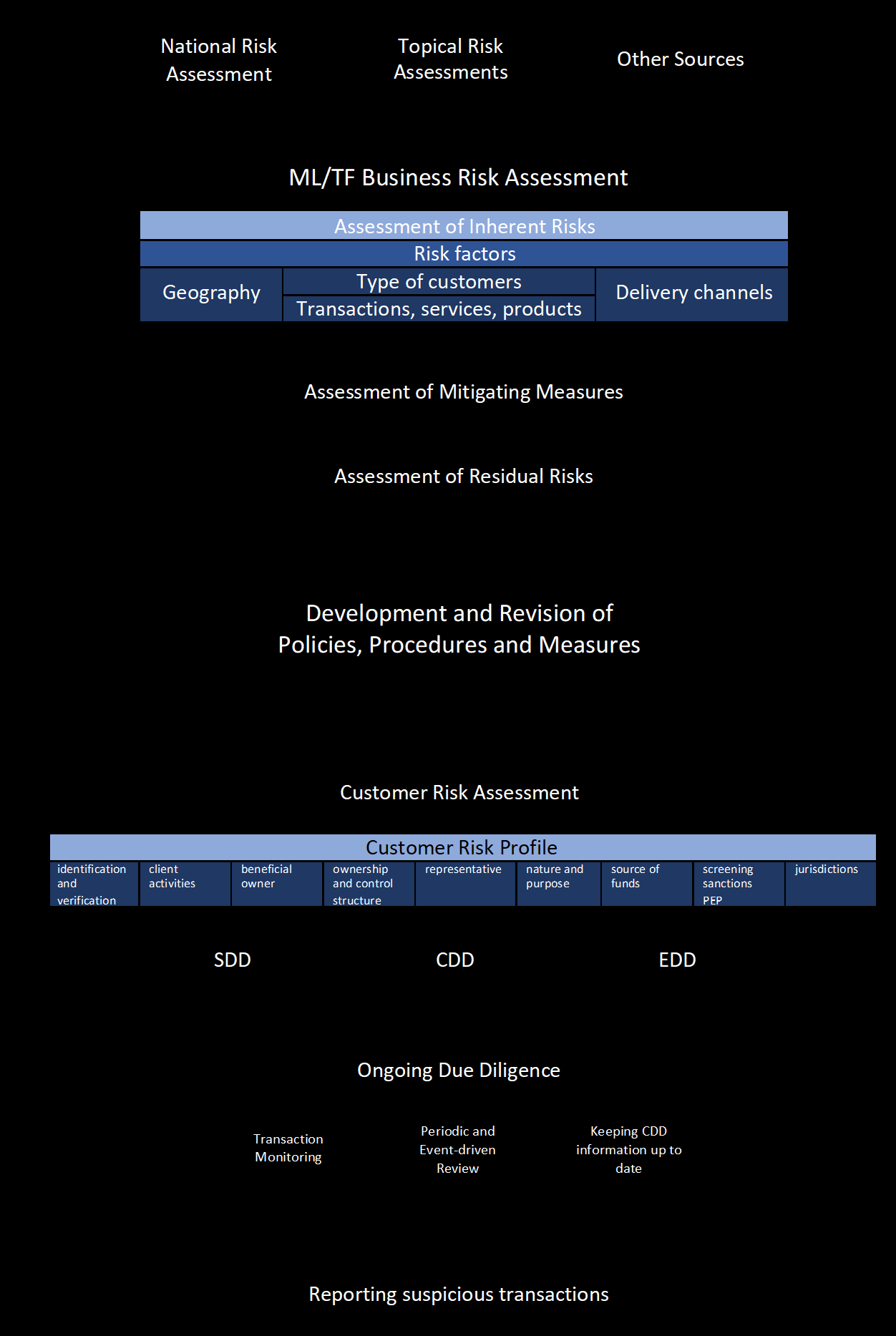

The following picture is a schematic overview of the RBA process from an ML/TF business risk assessments to developing policies, procedures and measures to CDD and the reporting of suspicious transactions.

4.1.1 Assessing Business-wide Risks

(AML-CFT Law Article 16.1; AML-CFT Decision Article 4.1)

An important first step in applying an RBA is to identify, assess and understand the ML/FT risks by way of an ML/FT risk assessment of the entire business. The purpose of such an ML/FT business risk assessment is to improve the effectiveness of ML/FT risk management, by identifying the inherent ML/FT risks faced by the enterprise as a whole, determining how these risks are effectively mitigated through internal policies, procedures and controls, and establishing the residual ML/FT risks and any gaps in the controls that should be addressed.

Thus, an effective ML/TF business risk assessment can allow FIs to identify gaps and opportunities for improvement in their framework of internal AML/CFT policies, procedures and controls, as well as to make informed management decisions about risk appetite, allocation of AML/CFT resources, and ML/FT risk-mitigation strategies that are appropriately aligned with residual risks.

The first step of conducting an ML/TF business risk assessment for FIs is to identify, assess and understand the inherent ML/FT risks (i.e., the risks that an FI is exposed to if there were no control measures in place to mitigate them) across all business lines and processes with respect to the following risk factors: customers, products, services and transactions, delivery channels, geographic locations, and any other risk factors.

With the inherent risks as a basis, the FI can determine the nature and intensity of risk mitigating controls to apply to the inherent risks. The level of inherent ML/FT risks influence the kinds and levels of AML/CFT resources and mitigation strategies which FIs require to put in place. The assessment of inherent ML/FT risks and of the effectiveness of the risk mitigation measures will result in a residual risk assessment, i.e., the risks that remain when effective control measures are in place. In case the residual risk falls outside the risk appetite of the FI, additional control measures will need to be implemented to ensure that the level of ML/FT risk is acceptable to the FI.

FIs may utilise a variety of models or methodologies to analyse their risks, in keeping with the nature and size of their businesses. FIs should decide on both the frequency and methodology of an ML/FT business risk assessment, including baseline and follow-up assessments, that are appropriate to their particular circumstances, taking into consideration the nature of the inherent and residual ML/FT risks to which they are exposed, as well as the results of the NRA and Topical Risk Assessments. In most cases, FIs should consider performing the ML/FT business risk assessment at least annually; however assessments that are more frequent or less frequent may be justified, depending on the particular circumstances. They should also decide on policies and procedures related to the periodic review of their ML/TF business risk assessment methodology, taking into consideration changes in internal or external factors. These decisions should be documented, approved by senior management, and communicated to the appropriate levels of the organisation.

As part of the model or methodology, FIs should consider including in their ML/FT risk assessment the following elements:

• Likelihood or probability of occurrence of identified inherent risks;

• Timing of identified inherent risks;

• Impact on the organisation of identified inherent risks.

The result of an effective ML/FT business risk assessment will be the classification of identified risks into different categories, such as high, medium, low, or some combination of those categories (such as medium-high, medium-low). Such classifications may assist FIs to prioritise their ML/FT risk exposures more effectively, so that they may determine the appropriate types and levels of AML/CFT resources needed, and adopt and apply reasonable and risk-proportionate mitigation measures.

4.1.2 Risk Factors

As part of the business-wide ML/TF risk assessment, a proper identification of risk factors is crucial to the effective assessment of ML/FT risk. Risks will often occur as combinations of these risk factors. A risk can for instance occur because of the interrelationship between a customer and the jurisdictions where the customer is from or is active, or because of the connection between a product and the delivery channel.

Identified risk factors are used for the accurate categorisation of inherent risks, as well as for the application of appropriate mitigation measures. At the enterprise level, this includes adopting and applying adequate policies, procedures, and controls to business processes (see Section 5.1, Internal Policies, Controls and Procedures). The policies, procedures, and controls will in turn address the risks at the individual customer level, including assigning appropriate risk classifications to customers and applying due diligence measures that are commensurate with the identified risks (see Section 6, Customer Due Diligence).

The AML-CFT Decision outlines several risk factors which FIs must consider, when identifying and assessing their ML/FT risk exposure. FIs may also consider a wide array of additional risk factors, utilising various sources, such as:

• ML/FT red-flag indicators;

• Input and information from relevant internal sources, including the designated AML/CFT compliance officer;

• Information from national sources, including the results of the NRA or any Topical Risk Assessment with regard to ML/FT trends and sectoral threats and notices or circulars from the relevant Supervisory Authorities;

• Information from publications of relevant international organisations, such as FATF, MENAFATF and other FSRBs, the Egmont Group, UNODC, and others. (Links to some of these sources may be found in Appendix 11.2.)

In keeping with the ever-evolving nature of ML/FT risks, and in order to ensure that FIs implement a model for conducting the ML/TF business risk assessment that is appropriate to the nature and size of their businesses, FIs should continuously update the risk factors which they consider, in order to reflect new and emerging ML/FT risks and typologies.

A good practice to assess the inherent risk factors, is for FIs to formulate risk scenarios and assess the likelihood that a scenario occurs and the impact should a scenario materialize. The likelihood can be assessed based on the number of times per year that a risk scenario can occur. The impact can be assessed based on the possible financial and reputational effects that can result if a scenario indeed occurs. In this way, the FI can determine the inherent risks of a risk factor.

When assessing the inherent risks, an FI should make an inventory of the customers it services, the products and services it offers, define the scope of business areas to assess, including business units, legal entities, divisions, countries and regions. For this, an FI should make use of up-to-date quantitative and qualitative information on for instance, the types and number of customers, the volume of operations for the types of customers, volume of business per product and services and geographic locations.

Examples with regard to some of the major risk factors that should be taken into account by FIs when conducting the ML/TF business risk assessment are provided in the sections below. Even though some of these risk factors will also be relevant for the risk assessment of an individual Customer or Business Relationship, for the ML/TF business risk assessment, FIs are reminded that they should take a holistic view when evaluating exposure to these categories of customers.

4.1.3 Customer Risk

The customer risk factors relate to types or categories of customers. Certain customer or business relationship categories pose a risk that should be taken into account when assessing the overall level of inherent customer risk. When identifying certain categories of customers as inherently high risk, FIs should also consider the results of the NRA or any Topical Risk Assessment, as well as information from official sources, including the Supervisory Authorities, the FIU, the FATF, MENAFATF and other FSRBs, the Egmont Group, etc.

When assessing the customer risk factors with respect to the business-wide ML/FT risk assessment, an FI can take into account:

• Type of customers: The risks related to retail customers in combination with their product/service needs may be different from those related to high net worth or corporate customers and their respective product/service needs. Likewise, the risks associated with resident customers may be different from those associated with non-resident customers.

• Customer base. FIs with small, homogenous customer bases may face different risks from those with larger, more diverse customer bases. Similarly, FIs targeting growing or emerging markets may face different customer risks than those with more established customer bases.

• Maturity of relationship. FIs that rely on more transactional, occasional, or one-off interactions with their customers may be exposed to different risks from institutions with more repetitive or long-term business relationships.

The specific customer risk factors that FIs should consider, include:

• Categories of business relationships with complex legal, ownership, or direct or indirect group or network structures, or with less transparency with regard to Beneficial Ownership, effective control, or tax residency, may pose different ML/FT risks than those with simpler legal/ownership structures or with greater transparency.

• Categories of Customers involved in highly regulated and supervised activities and those involved in activities that are unregulated.

• Customers associated with higher-risk persons or professions (for example, foreign PEPs and/or their companies), or those linked to sectors associated with higher ML/FT risks.

• Non-resident entities particularly those with connections to offshore and high risk jurisdictions.

• Professionals (e.g., lawyers, accountants and TCSPs) acting as introducer or intermediary on behalf of customers or groups of customers (whereby there is no direct contact with the customer).

• High net worth individuals.

• Respondent banks from high risk countries.

Some of these customer risk factors are also relevant when determining the customer risk classification of an individual customer and the type and extent of customer due diligence to be performed (see Section 6, Customer Due Diligence).

4.1.4 Geographic Risk

FIs should consider geographic ML/FT risk factors both from domestically and cross-border sources. These risks arise from: (i) the locations where the FI has offices, branches and subsidiaries and (ii) locations in which the customers reside or conduct their activities. Examples of some of these factors include:

• Regulatory/supervisory framework. Countries with stronger AML/CFT controls present a different level of risk than countries with weaker regulatory and supervisory frameworks, for instance countries identified by the FATF as jurisdictions with weak AML/CFT measures.

• International Sanctions. FIs should consider whether the countries or jurisdictions they deal with are the subject of international sanctions, such as targeted financial sanctions (TFS), UAE, OFAC, UN and EU restrictive measures, that could impact their ML/FT risk exposure and mitigation requirements.

• Reputation. FIs should consider whether the countries or jurisdictions they deal with are associated with higher or lower levels of ML/FT, corruption, and (lack of) transparency (particularly as regards financial and fiscal reporting, criminal and legal matters, and Beneficial Ownership, but also including such factors as freedom of information and the press).

• Combination with customers’ inherent risk factors. FIs should consider the countries risk in combination with customers risks, including principal residential or operating locations of customers.

4.1.5 Product-, Service-, Transaction-Related Risk

When assessing the inherent ML/FT risks associated with product, service, and transaction types, an FI should take stock of its lines of business, products and services that are more vulnerable to ML/FT abuse. FIs should assess the inherent ML/FT risks of abuse of the products and services by their customers taking into account a number of factors such as their ease for holding and transferring value or their complexity and transparency. Some of the risk factors that FIs should consider, among others, are:

• Typology. FIs should consider whether the product, service, or transaction type is associated with any established ML/FT typologies (see Section 3.10, ML/FT Typologies).

• Complexity. Products, services, or transaction types that favour complexity, especially when that complexity is excessive or unnecessary, can often be exploited for the purpose of money laundering and/or the financing of terrorism or illegal organisations. FIs should consider the conceptual, operational, legal, technological and other complexities of the product, service, or transaction type. Those with higher complexity or greater dependencies on the interactions between multiple systems and/or market participants may expose FIs to different types and levels of ML/FT risk than those with lower complexity or with fewer dependencies on multiple systems and/or market participants.

• Transparency and transferability. Situations that favour anonymity can often be exploited for the purpose of ML/FT. FIs should consider the level of transparency and transferability of ownership or control of products, services, or transaction types, particularly in respect of the ability to monitor the identities and the roles/responsibilities of all parties involved at each stage. Special attention should be given to products, services, or transaction types in which funds can be pooled or co-mingled, or in which multiple or anonymous parties can have authority over the disposition of funds, or for which the transferability of Beneficial Ownership or control can be accomplished with relative ease and/or with limited disclosure of information.

• Size/value. Products, services, or transaction types with different size or value parameters or limits may pose different levels of ML/FT risk.

4.1.6 Delivery Channel-Related Risk

Different delivery channels for the acquisition and management of customers and business relationships, as well as for the delivery of products and services, entail different types and levels of ML/FT risk.

When evaluating delivery channel-related risk, FIs should pay particular attention to those channels, whether related to customer acquisition and/or relationship management, or to product or service delivery, which have the potential to favour anonymity. Among others, these may include non-face-to-face channels (especially in cases where there are no safeguards in place such as electronic identification means), such as internet-, phone-, or other remote-access services or technologies; the use of third-party business introducers, intermediaries, agents or distributors; and the use of third-party payment, or other transaction intermediaries.

4.1.7 Other Risk Factors

Given the ever-evolving nature of ML/FT risks, new risks are constantly emerging, while existing ones may change in their relative importance due to legal or regulatory developments, changes in the marketplace, or as a result of new or disruptive products or technologies. For this reason, no list of risks can ever be considered as exhaustive.

Nevertheless, additional factors that may present specific risks are, e.g., the introduction of new products or services, new technologies or delivery processes or the establishment of new branches and subsidiaries locally and abroad.

In order to ensure, therefore, that FIs are in a position to review and update the ML/TF business risk assessment as well as mitigation measures, FIs should take into consideration the results of the NRA or any Topical Risk Assessment. They should also consult publications from official sources on a regular basis, including those of the relevant Supervisory Authorities, the FIU, the FATF, MENAFATF and other FSRBs, the Egmont Group, and others. Links to some of these sources may be found in Appendix 11.2.

Examples of some of the types of additional risk factors which FIs may consider in identifying and assessing their ML/FT risk exposure include:

• Novelty/innovation. FIs should consider the depth of experience with and knowledge of the product, service, transaction, or channel type. Products, services, transaction, or delivery channel types that are new to the market or to the enterprise may not be as well understood as, and may therefore pose a different level of ML/FT risk than, more established ones. Likewise, products, services, transaction, or delivery channel types which are unexpected or unusual with respect to a particular type of customer may indicate a different level of potential ML/FT risk exposure than would more traditional or expected product, service, transaction, or channel types in regard to that same type of customer.

• Cyber security/distributed networks. FIs may consider evaluating the degree to which their operational processes and/or their customers expose them to the risk of exploitation for the purpose of professional third-party money laundering and/or the financing of terrorism or of illegal organisations, through cyber-attacks or through other means, such as the use of distributed technology or social networks. An example of such a risk is the recent dramatic increase in the global incidence of so-called CEO fraud, in which fraudsters troll companies with phishing e-mails that are purportedly from the CEO or other senior executives, and attempt to conduct fraudulent transactions or obtain sensitive data that can be used for criminal purposes.

4.1.8 Assessing New Product and New Technologies Risks

As part of their obligation to update their ML/FT risk assessments on an ongoing basis, the AML-CFT Decision specifically requires FIs to “identify and assess the risks of money laundering and terrorism financing that may arise when developing new products and new professional practices, including means of providing new services and using new or under-development techniques for both new and existing products.”

FIs must complete the assessment of such risks, and take the appropriate risk management measures, prior to launching new products and services, practices or techniques, or technologies. In general, they should integrate these ML/FT risk assessment and mitigation requirements into their new product, service, channel, or technology development processes.

For the purpose of assessing the ML/FT risks associated with new products, services, practices, techniques, or technologies, FIs may consider utilising the same or similar risk assessment models or methodologies as those utilised for their ML/FT business risk assessments, updated as necessary for the particular circumstances. They should also document the new product, service, practice, technique, or technology risk assessments, in keeping with the nature and size of their businesses (see Section 4.6.1, Documentation, Updating and Analysis).

4.2 Risk Assessment Methodology and Documentation

(AML-CFT Law Article 16.1(a) and AML-CFT Decision Article 4.1)

A well-documented assessment of the identified inherent risk factors (see Section 4.1, Risk Factors) is fundamental to the adoption and effective application of reasonable and proportionate ML/FT risk-mitigation measures. Thus, the result of such an ML/TF business risk assessment allows for a systematic categorisation and prioritization of inherent and residual ML/FT risks, which in turn allows FIs to determine the types and appropriate levels of AML/CFT resources needed for mitigation purposes.

An effective ML/TF business risk assessment is not necessarily a complex one. The principle of a risk-based approach means that FIs’ risk assessments should be commensurate with the nature and size of their businesses. FIs with smaller or less complex business models may have simpler risk assessments than those of institutions with larger or more complex business models, which may require more sophisticated risk assessments.

4.2.1 Risk Assessment Methodology

(AML-CFT Decision Article 4.1(b))

The AML-CFT Decision obliges FIs to document their risk assessment operations. FIs may utilise a variety of models or methodologies in assessing their ML/FT risk. FIs should determine the type and extent of the risk assessment methodology that they consider to be appropriate for the size and nature of their businesses, and should document the rationale for these decisions.

To be effective, a risk assessment should be based on a methodology that:

• Is based on quantitative and qualitative data and information and makes use of internal meetings or interviews; internal questionnaires concerning risk identification and controls; review of internal audit reports;

• Reflects the FI’s management-approved AML/CFT risk appetite and strategy;

• Takes into consideration input from relevant internal sources, including input and views from the designated AML/CFT compliance officer and other relevant units like risk management and internal control;

• Takes into consideration relevant information (such as ML/FT trends and sectoral risks) from external sources, including the NRA or any Topical Risk Assessment, Supervisory and other Competent Authorities, and the FATF, MENAFATF and other FSRBs, the Egmont Group, and others where appropriate;

• Describes the weighting of risk factors, the classification of risks into different categories, and the prioritisation of risks.

• Evaluates the likelihood or probability of occurrence of identified ML/FT risks, and determining their timing and impact on the organization.

• Takes into account whether the AML/CFT controls are effective, specifically whether there are adequate controls to mitigate risks concerning customers, products, services, or transactions.

• Determines the effectiveness of the AML/CFT risk mitigating measures in place by using information such as audit and compliance reports or management information reports.

• Determines the residual risk as a result of the inherent risks and the effectiveness of the AML/CFT risk mitigating measures.

• Establishes based on the residual risk and the risk appetite, whether additional AML/CFT controls have to be put in place.

• Determines the rationale and circumstances for approving and performing manual interventions or exceptions to model-based risk weightings or classifications.

• Is properly documented and maintained, regularly evaluated and updated, and communicated to management and relevant personnel within the organisation.

• Is tested and audited for the effectiveness and consistency of the risk methodology and its output with regard to statutory obligations.

4.2.2 Documentation and Updating

(AML-CFT Law Article 16.1(a) and AML-CFT Decision Article 4.1(a)-(b))

Documentation

FIs are obliged to document their ML/TF business risk assessment, including methodology, analysis, and supporting data, and to make them available to the Supervisory Authorities upon request. FIs should incorporate into their documentation, the information used to conduct the ML/TF business risk assessment in order to demonstrate the effectiveness of their risk assessment processes. Examples of such information include, but are not limited to:

• Organization’s overall risk policies (for example, risk appetite statement, customer acceptance policy, and others, where applicable).

• ML/FT risk assessment model, methodology and procedures, including such information as organizational roles and responsibilities; process flows, timing and frequency; internal reporting requirements; and review, testing, and updating requirements.

• Risk factors identified, and input received from relevant internal sources, including the designated AML/CFT compliance officer.

• Details of the inherent and residual risk-factor analysis that constitutes the risk assessment.

The documentation measures taken by FIs should be reasonable and commensurate with the nature and size of their businesses.

Updating

FIs are obliged to keep their ML/TF business risk assessment up-to-date on an ongoing basis. In fulfilling this obligation, they should review and evaluate their ML/FT business risk assessment processes, models, and methodologies periodically, in keeping with the nature and size of their businesses. FIs should also update their ML/TF business risk assessment whenever they become aware of any internal or external events or developments which could affect their accuracy or effectiveness.