Book traversal links for C. Collateral

C. Collateral

C 52/2017 STA Effective from 1/12/2022a) Eligible financial collateral

95.The following collateral instruments are eligible for recognition in the simple approach:

- (i)Cash (as well as certificates of deposit or comparable instruments issued by the lending bank) on deposit with the bank which is incurring the counterparty exposure.

Note 1: Cash funded credit linked notes issued by the bank against exposures in the banking book which fulfil the criteria for credit derivatives will be treated as cash collateralised transactions.

Note 2: When cash on deposit, certificates of deposit or comparable instruments issued by the lending bank are held as collateral at a third-party bank in a noncustodial arrangement, if they are openly pledged/assigned to the lending bank and if the pledge/assignment is unconditional and irrevocable, the exposure amount covered by the collateral (after any necessary haircuts for currency risk) will receive the risk weight of the third-party bank);

- (ii)Gold;

- (iii)Debt securities rated by a recognised external credit assessment institution where these are either:

- ○Rated at least BB- when issued by sovereigns or PSEs that are treated as sovereigns by the Central Bank; or

- ○At least BBB- when issued by other entities (including banks and securities firms); or

- ○At least A-3/P-3 for short-term debt instruments.

- (iv)Debt securities not rated by a recognised external credit assessment institution where these are:

- ○Issued by a bank; and

- ○Listed on a recognised exchange; and

- ○Classified as senior debt; and

- ○All rated issues of the same seniority by the issuing bank must be rated at least BBB- or A-3/P-3 by a recognised external credit assessment institution; and

- ○The bank holding the securities as collateral has no information to suggest that the issue justifies a rating below BBB- or A-3/P-3 (as applicable); and

- ○The Central Bank is sufficiently confident about the market liquidity of the security.

- (v)Equities (including convertible bonds) that are included in a main index (a widely accepted index that ensures adequate liquidity, depth of market, and size of bid-ask spread).

- (vi)UCITS and mutual funds where:

- ○A price for the units is publicly quoted daily; and

- ○The UCITS/mutual fund is limited to investing in the instruments listed in this paragraph. However, the use or potential use by a UCITS/mutual fund of derivative instruments solely to hedge investments listed in this paragraph and the next paragraph shall not prevent units in that UCITS/mutual fund from being eligible financial collateral.

96.The following collateral instruments are eligible for recognition in the comprehensive approach:

- (i)All of the collateral instruments that are eligible for recognition in the Simple Approach, as outlined in the above at paragraph 95;

- (ii)Equities (including convertible bonds) which are not included in a main index but which are listed on a recognised exchange;

- (iii)UCITS/mutual funds which include such equities.

b) The Comprehensive Approach

Calculation of Adjusted exposure

97.For a collateralised transaction, the exposure amount after risk mitigation is calculated as follows:

where:

98.The exposure amount after risk mitigation shall be multiplied by the risk weight of the counterparty to obtain the risk-weighted asset amount for the collateralised transaction.

99.The treatment for transactions where there is a mismatch between the maturity of the counterparty exposure and the collateral is given in paragraphs 137 to 140.

100.Where the collateral is a basket of assets, the haircut on the basket will be

where:

| ai | = | The weight of the asset (as measured by units of currency) in the basket; |

| Hi | = | The haircut applicable to that asset. |

Standard supervisory haircuts

101.The following table sets the standard supervisory haircuts (assuming daily mark-to-market, daily re-margining and a 10-business day holding period), expressed as percentages:

| Issue rating for debt securities | Residual Maturity | Sovereigns (a) | Other issuers |

|---|---|---|---|

| AAA to AA-/A-1 | ≤ 1 year | 0.5 | 1 |

| >1 year, ≤ 5 years | 2 | 4 | |

| > 5 years | 4 | 8 | |

| A+ to BBB-/A-2/A-3/P-3 and unrated bank securities | ≤ 1 year | 1 | 2 |

| >1 year, ≤ 5 years | 3 | 6 | |

| > 5 years | 6 | 12 | |

| BB+ to BB- | All | 15 | |

| Gold | 15 | ||

Equities (including convertible bonds) listed on a recognized exchange, including main index equities | 25 | ||

| UCITS/Mutual funds | Highest haircut applicable to any security in which the fund can invest | ||

| Cash in the same currency (b) | 0 | ||

(a) includes multilateral development banks receiving a 0% risk weight.

(b) represents eligible cash collateral specified as 'Cash' as per item (i), in Paragraph 95.

102.The standard supervisory haircut for currency risk where exposure and collateral are denominated in different currencies is 8% (also based on a 10-business day holding period and daily mark-to-market).

103.For transactions in which the bank lends non-eligible instruments (e.g., noninvestment grade corporate debt securities), the haircut to be applied on the exposure must be the same as the one for equity traded on a recognised exchange.

Adjustment for different holding periods and non-daily mark-to-market or re-margining

104.For some transactions, depending on the nature and frequency of the revaluation and re-margining provisions, different holding periods are appropriate. The framework for collateral haircuts distinguishes between repo-style transactions (i.e., repo/reverse repos and securities lending/borrowing), “other capital-market-driven transactions” (i.e., OTC derivatives transactions and margin lending) and secured lending. In capital-market-driven transactions and repo-style transactions, the documentation contains re-margining clauses; in secured lending transactions, it generally does not.

105.The minimum holding period for various products or transactions is summarised in the table below:

| Transaction type | Minimum holding period | Condition |

|---|---|---|

| Repo-style transaction | Five business days | Daily re-margining |

| Other capital market transactions | Ten business days | Daily re-margining |

| Secured lending | Twenty business days | Daily re-margining |

106.When the frequency of re-margining or revaluation is longer than the minimum, the minimum haircut numbers shall be scaled up depending on the actual number of business days between re-margining or revaluation using the square root of time formula below:

![]()

where:

| H | = | Haircut; |

| HM | = | Haircut under the minimum holding period; |

| TM | = | Minimum holding period for the type of transaction; and |

| NR | = | Actual number of business days between re-margining for capital market transactions or revaluation for secured transactions. |

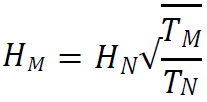

107.When a bank calculates the volatility on a TN day holding period which is different from the specified minimum holding period TM, the HM will be calculated using the square root of time formula:

where:

| TN | = | Holding period used by the bank for deriving HN; and |

| HN | = | Haircut based on the holding period TN |

For example, the 10-business day haircuts provided in the table under Paragraph 101 shall be the basis and this haircut shall be scaled up or down depending on the type of transaction and the frequency of re-margining or revaluation using the formula below:

![]()

| H | = | Haircut; |

| H10 | = | 10-business day standard supervisory haircut for instrument; |

| NR | = | Actual number of business days between re-margining for capital market transactions or revaluation for secured transactions; and |

| TM | = | Minimum holding period for the type of transaction. |

Conditions for zero Haircut on repo-style transactions with a core market participant

108.For repo-style transactions where the following conditions are satisfied, and the counterparty is a Core Market Participant (see definition in the next paragraph), banks may choose not to apply the haircuts specified in the Comprehensive Approach and may instead apply a haircut of zero. However, counterparties specified in 109 (iii), (iv), (v) and (vi) require prior approval from the Central Bank.

- (i)Both the exposure and the collateral are cash or a sovereign security or PSE security qualifying for a 0% risk weight in the standardised approach;

- (ii)Both the exposure and the collateral are denominated in the same currency;

- (iii)Either the transaction is overnight or both the exposure and the collateral are marked-to-market daily and are subject to daily re-margining;

- (iv)Following a counterparty’s failure to re-margin, the time that is required between the last mark-to-market before the failure to re-margin and the liquidation of the collateral is considered to be no more than four (4) business days. It is noted this does not require the bank to always liquidate the collateral but rather to have the capability to do so within the given time frame;

- (v)The transaction is settled across a settlement system proven for that type of transaction;

- (vi)The documentation covering the agreement is standard market documentation for repo-style transactions in the securities concerned;

- (vii)The transaction is governed by documentation specifying that if the counterparty fails to satisfy an obligation to deliver cash or securities or to deliver margin or otherwise defaults, then the transaction is immediately terminable; and

- (viii)Upon any default event, regardless of whether the counterparty is insolvent or bankrupt, the bank has the unfettered, legally enforceable right to immediately seize and liquidate the collateral for its benefit.

109.Core Market Participants are the following entities:

- (i)Sovereigns, central banks and Non-commercial PSEs;

- (ii)Banks and securities firms;

- (iii)Other financial companies (including insurance companies) eligible for a 20% risk weight in the standardised approach;

- (iv)Regulated mutual funds that are subject to capital or leverage requirements;

- (v)Regulated pension funds; and

- (vi)Recognised clearing organisations.

Treatment of repo-style transactions covered under master netting agreements

110.The effects of bilateral netting agreements covering repo-style transactions will be recognised on a counterparty-by-counterparty basis if the agreements are legally enforceable in each relevant jurisdiction upon the occurrence of an event of default and regardless of whether the counterparty is insolvent or bankrupt. In addition, netting agreements must:

- (i)Provide the non-defaulting party the right to terminate and close-out in a timely manner all transactions under the agreement upon an event of default, including in the event of insolvency or bankruptcy of the counterparty; and

- (ii)Provide for the netting of gains and losses on transactions (including the value of any collateral) terminated and closed out under it so that a single net amount is owed by one party to the other; and

- (iii)Allow for the prompt liquidation or setoff of collateral upon the event of default; and

- (iv)Be, together with the rights arising from the provisions required in (i) to (iii) above, legally enforceable in each relevant jurisdiction upon the occurrence of an event of default and regardless of the counterparty's insolvency or bankruptcy.

111.Netting across positions in the banking and trading book will only be recognized when the netted transactions fulfil both of the following two conditions:

- (i)All transactions are marked to market daily. It is noted that the holding period for the haircuts will depend as in other repo-style transactions on the frequency of margining; and

- (ii)The collateral instruments used in the transactions are recognised as eligible financial collateral in the banking book.

112.The formula in paragraphs 97 will be adapted to calculate the capital requirements for transactions with netting agreements.

113.For banks using the standard supervisory haircuts, the framework below will apply to take into account the impact of master netting agreements.

where:

| E* | = | The exposure value after risk mitigation; |

| E | = | Current value of the exposure; |

| C | = | The value of the collateral received; |

| Es | = | Absolute value of the net position in a given security; |

| Hs | = | Haircut appropriate to Es; |

| Efx | = | Absolute value of the net position in a currency different from the settlement currency; and |

| Hfx | = | Haircut appropriate for currency mismatch. |

114.The intention here is to obtain a net exposure amount after netting of the exposures and collateral and have an add-on amount reflecting possible price changes for the securities involved in the transactions and for foreign exchange risk if any. The net long or short position of each security included in the netting agreement will be multiplied by the appropriate haircut. All other rules regarding the calculation of haircuts stated in paragraphs under the comprehensive approach equivalently apply for banks using bilateral netting agreements for repo-style transactions.

Minimum conditions

115.For collateral to be recognised in the simple approach the collateral must be pledged for at least the life of the exposure and it must be marked to market and revalued with a minimum frequency of six months. Those portions of claims collateralised by the market value of recognised collateral receive the risk weight applicable to the collateral instrument. The risk weight on the collateralised portion will be subject to a floor of 20% except under the conditions specified in paragraphs 116 to 118. The remainder of the claim must be assigned to the risk weight appropriate to the counterparty. A capital requirement will be applied to banks on either side of the collateralised transaction: for example, both repos and reverse repos will be subject to capital requirements.

Exceptions to the risk weight floor

116.Transactions that fulfil the criteria outlined in paragraph 108 and are with a core market participant, as defined in paragraph 109; receive a risk weight of 0%. If the counterparty to the transactions is not a core market participant, the transaction must receive a risk weight of 10%.

117.OTC derivative transactions subject to daily mark-to-market, collateralised by cash and where there is no currency mismatch must receive a 0% risk weight. Such transactions collateralised by sovereign can receive a 10% risk weight.

118.The 20% floor for the risk weight on a collateralised transaction will not be applied and a 0% risk weight can be applied where the exposure and the collateral are denominated in the same currency, and either:

- (i)The collateral is cash on deposit as defined in item (i), namely Cash, in paragraph 95; or

- (ii)The collateral is in the form of sovereign and its market value has been discounted by 20%.

d) Collateralised OTC derivatives transactions

119.Under the SA-CCR Standard, the calculation of risk weighted assets for counterparty credit risk depends on replacement cost and an add-on for potential future exposure, and takes into account collateral in the manner specified in that Standard. The haircut for currency risk (Hfx) must be applied when there is a mismatch between the collateral currency and the settlement currency. Even in the case where there are more than two currencies involved in the exposure, collateral and settlement currency, a single haircut assuming a 10- business day holding period scaled up as necessary depending on the frequency of mark- to-market will be applied.