IV. Credit Risk Mitigation

A. Introduction and General Requirements

Introduction

57.Banks may use a number of techniques to mitigate the credit risks to which they are exposed. For example, exposures may be collateralised by first priority claims, in whole or in part with cash or securities, a loan exposure may be guaranteed by a third party, or a bank may buy a credit derivative to offset various forms of credit risk. Additionally, banks may agree to net loans owed to them against deposits from the same counterparty.

58.In this Standard, “counterparty” is used to denote a party to whom a bank has an on or off-balance sheet credit exposure. That exposure may, for example, take the form of a loan of cash or securities (where the counterparty would traditionally be called the borrower), of securities posted as collateral, of a commitment or of exposure under an OTC derivatives contract

General Requirements for legal certainty

59.The Central Bank recognizes certain credit risk mitigation techniques for regulatory capital purposes, provided that all documentation used in collateralised transactions and for documenting on-balance sheet netting, guarantees and credit derivatives are binding on all parties and legally enforceable in all relevant jurisdictions, and that banks have conducted sufficient legal review to verify this and have a well-founded legal basis to reach this conclusion, and undertake such further review as necessary to ensure continuing enforceability.

60.Where a bank has a single exposure covered either by more than one type of credit risk mitigation, or by differing maturities of protection provided by the same credit protection provider, the bank shall:

- (i)Subdivide the exposure into parts covered by each type or maturity of credit risk mitigation tool; and

- (ii)Calculate the risk-weighted assets for each part obtained in point (i) above separately in accordance with the risk weights applicable to each exposure category as described in the relevant section.

61.The comprehensive approach for the treatment of collateral (described further below from paragraph 85) shall also be applied to calculate the counterparty risk charges for OTC derivatives and repo-style transactions booked in the trading book.

62.No transaction in which CRM techniques are used shall receive a higher capital requirement than an otherwise identical transaction where such techniques are not used.

63.The effects of CRM shall not be double counted. Therefore, no additional supervisory recognition of CRM for regulatory capital purposes shall be granted on claims for which an issue-specific rating is used that already reflects that CRM. Principal-only ratings shall also not be allowed within the framework of CRM to claims for which an external credit assessment can be conducted.

64.Considering that, while the use of CRM techniques reduces or transfers credit risk, it simultaneously may increase other risks (residual risks), and that residual risks include legal, operational, liquidity and market risks, banks shall employ robust procedures and processes to control these risks, including strategy, consideration of the underlying credit, valuation, policies and procedures, systems, control of roll-off risks, and management of concentration risk arising from the bank’s use of CRM techniques and its interaction with the bank’s overall credit risk profile. Where these risks are not adequately controlled, the Central Bank may impose additional capital charges or take other supervisory actions under Pillar 2.

65.The banks shall also observe the Central Bank’s Pillar 3 requirements to obtain capital relief in respect of any CRM techniques.

B. Collateralised Transactions

66.A collateralised transaction is one in which:

- (i)Banks have a credit exposure or potential credit exposure; and

- (ii)Credit exposure or potential credit exposure is hedged in whole or in part by collateral posted by a counterparty or by a third party on behalf of the counterparty.

67.Where banks take eligible financial collateral (e.g., cash or securities, more specifically as per section IV C (a)), they are allowed to reduce their credit exposure to a counterparty when calculating their capital requirements to take account of the risk mitigating effect of the collateral.

68.Banks may opt for either the simple approach (described further in Section IV C(c)), which substitutes the risk weighting of the collateral for the risk weighting of the counterparty for the collateralised portion of the exposure (generally subject to a 20% floor), or for the Comprehensive Approach (described further in Section IV C(b)), which allows fuller offset of collateral against exposures, by effectively reducing the exposure amount by the value ascribed to the collateral.

69.Partial collateralisation is recognised in both approaches.

70.Mismatches in the maturity of the underlying exposure and the collateral shall only be allowed under the comprehensive approach.

71.Banks shall operate under either the simple approach or comprehensive approach, but not both approaches, in the banking book, but only under the comprehensive approach in the trading book.

72.Banks that intend to apply the comprehensive approach require prior approval from the Central Bank.

Minimum Conditions

73.The minimum conditions set out below must be met before capital relief will be granted in respect of any form of collateral under either the simple approach or comprehensive approach.

74.In addition to the general requirements for legal certainty set out above at paragraph 59 to 65, the legal mechanism by which collateral is pledged or transferred shall ensure that the bank has the right to liquidate or take legal possession of it, in a timely manner, in the event of the default, insolvency or bankruptcy (or one or more otherwise-defined credit events set out in the transaction documentation) of the counterparty (and, where applicable, of the custodian holding the collateral). Furthermore, banks shall take all steps necessary to fulfil those requirements under the law applicable to the bank’s interest in the collateral for obtaining and maintaining an enforceable security interest, e.g., by registering it with a registrar, or for exercising a right to net or set off in relation to title transfer collateral.

75.In order for collateral to provide protection, the credit quality of the counterparty and the value of the collateral must not have a material positive correlation (for example, securities issued by the counterparty - or by any related group entity - would provide little protection and so would be ineligible).

76.Banks shall have clear and robust procedures for the timely liquidation of collateral to ensure that any legal conditions required for declaring the default of the counterparty and liquidating the collateral are observed, and that collateral can be liquidated promptly.

77.Where the collateral is held by a custodian, banks shall take reasonable steps to ensure that the custodian segregates the collateral from its own assets.

78.A capital requirement shall be applied to a bank on either side of the collateralised transaction (for example, both repos and reverse repos shall be subject to capital requirements). Likewise, both sides of a securities lending and borrowing transaction shall be subject to explicit capital charges, as shall the posting of securities in connection with a derivative exposure or other borrowing.

79.Where a bank, acting as an agent, arranges a repo-style transaction (i.e., repurchase/reverse repurchase and securities lending/borrowing transactions) between a customer and a third party and provides a guarantee to the customer that the third party will perform on its obligations, then the risk to the bank shall be the same as if the bank had entered into the transaction as a principal. In such circumstances, a bank shall be required to calculate capital requirements as if it were itself the principal.

The simple approach

80.In the simple approach the risk weighting of the collateral instrument collateralising or partially collateralising the exposure shall be substituted for the risk weighting of the counterparty. Details of this framework are provided further below at section IV C (c).

The comprehensive approach

81.In the comprehensive approach, when taking collateral, banks shall calculate their adjusted exposure amount to a counterparty for capital adequacy purposes in order to take account of the effects of that collateral. Using haircuts, banks shall adjust both the amount of the exposure to the counterparty and the value of any collateral received in support of that counterparty to take account of possible future fluctuations in the value of either, occasioned by market movements (exposure amounts may vary, for example where securities are being lent.) This will produce volatility-adjusted amounts for both exposure and collateral. Unless either side of the transaction is cash, the volatility-adjusted amount for the exposure shall be higher than the exposure and for the collateral, it shall be lower.

82.Where the exposure and collateral are held in different currencies an additional downwards adjustment shall be made to the volatility adjusted collateral amount to take account of possible future fluctuations in exchange rates.

83.Where the volatility-adjusted exposure amount is greater than the volatility-adjusted collateral amount (including any further adjustment for foreign exchange risk), banks shall calculate their risk-weighted assets as the difference between the two multiplied by the risk weight of the counterparty. The framework for performing these calculations is set out further below in paragraph 97 to 100.

84.Banks shall use the standard supervisory haircuts and the parameters therein as set by the Central Bank. The use of own-estimate haircuts that rely on banks own internal estimates of market price volatility is prohibited.

85.The size of the individual haircuts shall depend on the type of instrument, type of transaction and the frequency of marking-to-market and re-margining (for example, repo style transactions subject to daily marking-to-market and to daily re-margining will receive a haircut based on a 5-business day holding period and secured lending transactions with daily mark-to-market and no re-margining clauses will receive a haircut based on a 20-business day holding period. These haircut numbers will be scaled up using the square root of time formula depending on the frequency of re-margining or marking-to-market).

86.For certain types of repo-style transactions (broadly speaking government bond repos) banks are permitted in certain cases not to apply the standard supervisory haircuts in calculating the exposure amount after risk mitigation. Paragraph 108 lists cases where such treatment is allowed.

87.The effect of master netting agreements covering repo-style transactions can be recognised for the calculation of capital requirements subject to the conditions specified in Paragraph 110.

On-balance sheet netting

88.Where banks have legally enforceable netting arrangements for loans and deposits they may calculate capital requirements on the basis of net credit exposures subject to the conditions in paragraphs 120.

Guarantees and credit derivatives

89.Where guarantees or credit derivatives are direct, explicit, irrevocable and unconditional, and the Central Bank is satisfied that banks fulfil certain minimum operational conditions relating to risk management processes, banks are allowed to take account of such credit protection in calculating capital requirements.

90.A range of guarantors and protection providers are recognized by the Central Bank. A substitution approach shall be applied. Thus only guarantees issued by or protection provided by entities with a lower risk weight than the counterparty will lead to reduced capital charges since the protected portion of the counterparty exposure is assigned the risk weight of the guarantor or protection provider, whereas the uncovered portion retains the risk weight of the underlying counterparty. Detailed operational requirements for the recognition of guarantees and credit derivatives are given below in paragraphs 122 to 128.

Maturity mismatch

91.Where the residual maturity of the CRM is less than that of the underlying credit exposure a maturity mismatch occurs.

92.Where there is a maturity mismatch and the CRM has an original maturity of less than one year, the CRM shall not be recognised for capital purposes. In other cases where there is a maturity mismatch, partial recognition shall be given to the CRM for regulatory capital purposes as detailed below in paragraphs 137 to 140.

93.Under the simple approach, such partial recognition is not allowed for collateral maturity mismatches.

Miscellaneous

94.The treatments for pools of credit risk mitigants and first- and second-to-default credit derivatives are given in paragraphs 141 to 145.

C. Collateral

a) Eligible financial collateral

95.The following collateral instruments are eligible for recognition in the simple approach:

- (i)Cash (as well as certificates of deposit or comparable instruments issued by the lending bank) on deposit with the bank which is incurring the counterparty exposure.

Note 1: Cash funded credit linked notes issued by the bank against exposures in the banking book which fulfil the criteria for credit derivatives will be treated as cash collateralised transactions.

Note 2: When cash on deposit, certificates of deposit or comparable instruments issued by the lending bank are held as collateral at a third-party bank in a noncustodial arrangement, if they are openly pledged/assigned to the lending bank and if the pledge/assignment is unconditional and irrevocable, the exposure amount covered by the collateral (after any necessary haircuts for currency risk) will receive the risk weight of the third-party bank);

- (ii)Gold;

- (iii)Debt securities rated by a recognised external credit assessment institution where these are either:

- ○Rated at least BB- when issued by sovereigns or PSEs that are treated as sovereigns by the Central Bank; or

- ○At least BBB- when issued by other entities (including banks and securities firms); or

- ○At least A-3/P-3 for short-term debt instruments.

- (iv)Debt securities not rated by a recognised external credit assessment institution where these are:

- ○Issued by a bank; and

- ○Listed on a recognised exchange; and

- ○Classified as senior debt; and

- ○All rated issues of the same seniority by the issuing bank must be rated at least BBB- or A-3/P-3 by a recognised external credit assessment institution; and

- ○The bank holding the securities as collateral has no information to suggest that the issue justifies a rating below BBB- or A-3/P-3 (as applicable); and

- ○The Central Bank is sufficiently confident about the market liquidity of the security.

- (v)Equities (including convertible bonds) that are included in a main index (a widely accepted index that ensures adequate liquidity, depth of market, and size of bid-ask spread).

- (vi)UCITS and mutual funds where:

- ○A price for the units is publicly quoted daily; and

- ○The UCITS/mutual fund is limited to investing in the instruments listed in this paragraph. However, the use or potential use by a UCITS/mutual fund of derivative instruments solely to hedge investments listed in this paragraph and the next paragraph shall not prevent units in that UCITS/mutual fund from being eligible financial collateral.

96.The following collateral instruments are eligible for recognition in the comprehensive approach:

- (i)All of the collateral instruments that are eligible for recognition in the Simple Approach, as outlined in the above at paragraph 95;

- (ii)Equities (including convertible bonds) which are not included in a main index but which are listed on a recognised exchange;

- (iii)UCITS/mutual funds which include such equities.

b) The Comprehensive Approach

Calculation of Adjusted exposure

97.For a collateralised transaction, the exposure amount after risk mitigation is calculated as follows:

where:

98.The exposure amount after risk mitigation shall be multiplied by the risk weight of the counterparty to obtain the risk-weighted asset amount for the collateralised transaction.

99.The treatment for transactions where there is a mismatch between the maturity of the counterparty exposure and the collateral is given in paragraphs 137 to 140.

100.Where the collateral is a basket of assets, the haircut on the basket will be

where:

ai = The weight of the asset (as measured by units of currency) in the basket; Hi = The haircut applicable to that asset.

Standard supervisory haircuts

101.The following table sets the standard supervisory haircuts (assuming daily mark-to-market, daily re-margining and a 10-business day holding period), expressed as percentages:

Issue rating for debt securities Residual Maturity Sovereigns (a) Other issuers AAA to AA-/A-1 ≤ 1 year 0.5 1 >1 year, ≤ 5 years 2 4 > 5 years 4 8 A+ to BBB-/A-2/A-3/P-3 and unrated bank securities ≤ 1 year 1 2 >1 year, ≤ 5 years 3 6 > 5 years 6 12 BB+ to BB- All 15 Gold 15 Equities (including convertible bonds) listed on a recognized exchange, including main index equities

25 UCITS/Mutual funds Highest haircut applicable to any security in which the fund can invest

Cash in the same currency (b) 0 (a) includes multilateral development banks receiving a 0% risk weight.

(b) represents eligible cash collateral specified as 'Cash' as per item (i), in Paragraph 95.

102.The standard supervisory haircut for currency risk where exposure and collateral are denominated in different currencies is 8% (also based on a 10-business day holding period and daily mark-to-market).

103.For transactions in which the bank lends non-eligible instruments (e.g., noninvestment grade corporate debt securities), the haircut to be applied on the exposure must be the same as the one for equity traded on a recognised exchange.

Adjustment for different holding periods and non-daily mark-to-market or re-margining

104.For some transactions, depending on the nature and frequency of the revaluation and re-margining provisions, different holding periods are appropriate. The framework for collateral haircuts distinguishes between repo-style transactions (i.e., repo/reverse repos and securities lending/borrowing), “other capital-market-driven transactions” (i.e., OTC derivatives transactions and margin lending) and secured lending. In capital-market-driven transactions and repo-style transactions, the documentation contains re-margining clauses; in secured lending transactions, it generally does not.

105.The minimum holding period for various products or transactions is summarised in the table below:

Transaction type Minimum holding period Condition Repo-style transaction Five business days Daily re-margining Other capital market transactions Ten business days Daily re-margining Secured lending Twenty business days Daily re-margining 106.When the frequency of re-margining or revaluation is longer than the minimum, the minimum haircut numbers shall be scaled up depending on the actual number of business days between re-margining or revaluation using the square root of time formula below:

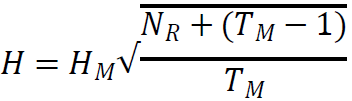

where:

H = Haircut; HM = Haircut under the minimum holding period; TM = Minimum holding period for the type of transaction; and NR = Actual number of business days between re-margining for capital market transactions or revaluation for secured transactions. 107.When a bank calculates the volatility on a TN day holding period which is different from the specified minimum holding period TM, the HM will be calculated using the square root of time formula:

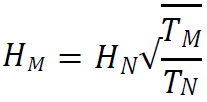

where:

TN = Holding period used by the bank for deriving HN; and HN = Haircut based on the holding period TN

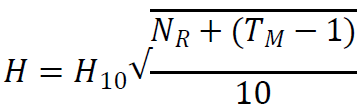

For example, the 10-business day haircuts provided in the table under Paragraph 101 shall be the basis and this haircut shall be scaled up or down depending on the type of transaction and the frequency of re-margining or revaluation using the formula below:

H = Haircut; H10 = 10-business day standard supervisory haircut for instrument; NR = Actual number of business days between re-margining for capital market transactions or revaluation for secured transactions; and TM = Minimum holding period for the type of transaction.

Conditions for zero Haircut on repo-style transactions with a core market participant

108.For repo-style transactions where the following conditions are satisfied, and the counterparty is a Core Market Participant (see definition in the next paragraph), banks may choose not to apply the haircuts specified in the Comprehensive Approach and may instead apply a haircut of zero. However, counterparties specified in 109 (iii), (iv), (v) and (vi) require prior approval from the Central Bank.

- (i)Both the exposure and the collateral are cash or a sovereign security or PSE security qualifying for a 0% risk weight in the standardised approach;

- (ii)Both the exposure and the collateral are denominated in the same currency;

- (iii)Either the transaction is overnight or both the exposure and the collateral are marked-to-market daily and are subject to daily re-margining;

- (iv)Following a counterparty’s failure to re-margin, the time that is required between the last mark-to-market before the failure to re-margin and the liquidation of the collateral is considered to be no more than four (4) business days. It is noted this does not require the bank to always liquidate the collateral but rather to have the capability to do so within the given time frame;

- (v)The transaction is settled across a settlement system proven for that type of transaction;

- (vi)The documentation covering the agreement is standard market documentation for repo-style transactions in the securities concerned;

- (vii)The transaction is governed by documentation specifying that if the counterparty fails to satisfy an obligation to deliver cash or securities or to deliver margin or otherwise defaults, then the transaction is immediately terminable; and

- (viii)Upon any default event, regardless of whether the counterparty is insolvent or bankrupt, the bank has the unfettered, legally enforceable right to immediately seize and liquidate the collateral for its benefit.

109.Core Market Participants are the following entities:

- (i)Sovereigns, central banks and Non-commercial PSEs;

- (ii)Banks and securities firms;

- (iii)Other financial companies (including insurance companies) eligible for a 20% risk weight in the standardised approach;

- (iv)Regulated mutual funds that are subject to capital or leverage requirements;

- (v)Regulated pension funds; and

- (vi)Recognised clearing organisations.

Treatment of repo-style transactions covered under master netting agreements

110.The effects of bilateral netting agreements covering repo-style transactions will be recognised on a counterparty-by-counterparty basis if the agreements are legally enforceable in each relevant jurisdiction upon the occurrence of an event of default and regardless of whether the counterparty is insolvent or bankrupt. In addition, netting agreements must:

- (i)Provide the non-defaulting party the right to terminate and close-out in a timely manner all transactions under the agreement upon an event of default, including in the event of insolvency or bankruptcy of the counterparty; and

- (ii)Provide for the netting of gains and losses on transactions (including the value of any collateral) terminated and closed out under it so that a single net amount is owed by one party to the other; and

- (iii)Allow for the prompt liquidation or setoff of collateral upon the event of default; and

- (iv)Be, together with the rights arising from the provisions required in (i) to (iii) above, legally enforceable in each relevant jurisdiction upon the occurrence of an event of default and regardless of the counterparty's insolvency or bankruptcy.

111.Netting across positions in the banking and trading book will only be recognized when the netted transactions fulfil both of the following two conditions:

- (i)All transactions are marked to market daily. It is noted that the holding period for the haircuts will depend as in other repo-style transactions on the frequency of margining; and

- (ii)The collateral instruments used in the transactions are recognised as eligible financial collateral in the banking book.

112.The formula in paragraphs 97 will be adapted to calculate the capital requirements for transactions with netting agreements.

113.For banks using the standard supervisory haircuts, the framework below will apply to take into account the impact of master netting agreements.

where:

E* = The exposure value after risk mitigation; E = Current value of the exposure; C = The value of the collateral received; Es = Absolute value of the net position in a given security; Hs = Haircut appropriate to Es; Efx = Absolute value of the net position in a currency different from the settlement currency; and Hfx = Haircut appropriate for currency mismatch.

114.The intention here is to obtain a net exposure amount after netting of the exposures and collateral and have an add-on amount reflecting possible price changes for the securities involved in the transactions and for foreign exchange risk if any. The net long or short position of each security included in the netting agreement will be multiplied by the appropriate haircut. All other rules regarding the calculation of haircuts stated in paragraphs under the comprehensive approach equivalently apply for banks using bilateral netting agreements for repo-style transactions.

Minimum conditions

115.For collateral to be recognised in the simple approach the collateral must be pledged for at least the life of the exposure and it must be marked to market and revalued with a minimum frequency of six months. Those portions of claims collateralised by the market value of recognised collateral receive the risk weight applicable to the collateral instrument. The risk weight on the collateralised portion will be subject to a floor of 20% except under the conditions specified in paragraphs 116 to 118. The remainder of the claim must be assigned to the risk weight appropriate to the counterparty. A capital requirement will be applied to banks on either side of the collateralised transaction: for example, both repos and reverse repos will be subject to capital requirements.

Exceptions to the risk weight floor

116.Transactions that fulfil the criteria outlined in paragraph 108 and are with a core market participant, as defined in paragraph 109; receive a risk weight of 0%. If the counterparty to the transactions is not a core market participant, the transaction must receive a risk weight of 10%.

117.OTC derivative transactions subject to daily mark-to-market, collateralised by cash and where there is no currency mismatch must receive a 0% risk weight. Such transactions collateralised by sovereign can receive a 10% risk weight.

118.The 20% floor for the risk weight on a collateralised transaction will not be applied and a 0% risk weight can be applied where the exposure and the collateral are denominated in the same currency, and either:

- (i)The collateral is cash on deposit as defined in item (i), namely Cash, in paragraph 95; or

- (ii)The collateral is in the form of sovereign and its market value has been discounted by 20%.

d) Collateralised OTC derivatives transactions

119.Under the SA-CCR Standard, the calculation of risk weighted assets for counterparty credit risk depends on replacement cost and an add-on for potential future exposure, and takes into account collateral in the manner specified in that Standard. The haircut for currency risk (Hfx) must be applied when there is a mismatch between the collateral currency and the settlement currency. Even in the case where there are more than two currencies involved in the exposure, collateral and settlement currency, a single haircut assuming a 10- business day holding period scaled up as necessary depending on the frequency of mark- to-market will be applied.

- (i)Cash (as well as certificates of deposit or comparable instruments issued by the lending bank) on deposit with the bank which is incurring the counterparty exposure.

D. On-Balance Sheet Netting

120.A bank may use the net exposure of loans and deposits as the basis for its capital adequacy calculation in accordance with the formula in Paragraph 97, where the bank:

- (i)Has a well-founded legal basis for concluding that the netting or offsetting agreement is enforceable in each relevant jurisdiction regardless of whether the counterparty is insolvent or bankrupt;

- (ii)Is able at any time to determine those assets and liabilities with the same counterparty that are subject to the netting agreement;

- (iii)Monitors and controls its roll-off risks; and

- (iv)Monitors and controls the relevant exposures on a net basis.

121.Assets (loans) are treated as exposure and liabilities (deposits) as collateral. The haircuts will be zero except when a currency mismatch exists. A 10-business day holding period will apply when daily mark-to-market is conducted and all the requirements stipulated under paragraphs 101, 107, and 137 to 140 will apply.

E. Guarantees and Credit Derivatives

a) Operational requirements

Operational requirements common to guarantees and credit derivatives

122.A guarantee (counter-guarantee) or credit derivative must represent a direct claim on the protection provider and must be explicitly referenced to specific exposures or a pool of exposures, so that the extent of the cover is clearly defined and incontrovertible. Other than non-payment by a protection purchaser of money due in respect of the credit protection contract it must be irrevocable; there must be no clause in the contract that would allow the protection provider unilaterally to cancel the credit cover or that would increase the effective cost of cover as a result of deteriorating credit quality in the hedged exposure (Note that the irrevocability condition does not require that the credit protection and the exposure be maturity matched; rather that the maturity agreed ex ante may not be reduced ex post by the protection provider. Paragraph 138 sets forth the treatment of call options in determining remaining maturity for credit protection). It must also be unconditional; there must be no clause in the protection contract outside the direct control of the bank that could prevent the protection provider from being obliged to pay out in a timely manner in the event that the original counterparty fails to make the payment(s) due.

Additional operational requirements for guarantees

123.In addition to the legal certainty requirements described in paragraph 59, in order for a guarantee to be recognised, the following conditions must be satisfied:

- (i)On the qualifying default/non-payment of the counterparty, the bank may pursue the guarantor for any monies outstanding under the documentation governing the transaction within a reasonable time period. The guarantor may make one lump sum payment of all monies under such documentation to the bank, or the guarantor may assume the future payment obligations of the counterparty covered by the guarantee. The bank must have the right to receive any such payments from the guarantor without first having to take legal actions in order to pursue the counterparty for payment;

- (ii)The guarantee is an explicitly documented obligation assumed by the guarantor; and

- (iii)Except as noted in the following sentence, the guarantee covers all types of payments the underlying obligor is expected to make under the documentation governing the transaction, for example notional amount, margin payments etc. Where a guarantee covers payment of principal only, interests and other uncovered payments must be treated as an unsecured amount in accordance with paragraph 136.

Additional operational requirements for credit derivatives

124.In order for a credit derivative contract to be recognised, the following conditions must be satisfied:

- (i)The credit events specified by the contracting parties must at a minimum cover:

- ○Failure to pay the amounts due under terms of the underlying obligation that are in effect at the time of such failure (with a grace period that is closely in line with the grace period in the underlying obligation);

- ○Bankruptcy, insolvency or inability of the obligor to pay its debts, or its failure or admission in writing of its inability generally to pay its debts as they become due, and analogous events; and

- ○Restructuring of the underlying obligation involving forgiveness or postponement of principal, interest or fees that results in a credit loss event (i.e., charge-off, specific provision or other similar debit to the profit and loss account). When restructuring is not specified as a credit event, refer to the next paragraph;

- (ii)If the credit derivative covers obligations that do not include the underlying obligation, item (vii) below governs whether the asset mismatch is permissible;

- (iii)The credit derivative shall not terminate prior to expiration of any grace period required for a default on the underlying obligation to occur as a result of a failure to pay, subject to the provisions of paragraph 137;

- (iv)Credit derivatives allowing for cash settlement are recognised for capital purposes insofar as a robust valuation process is in place in order to estimate loss reliably. There must be a clearly specified period for obtaining post-credit event valuations of the underlying obligation. If the reference obligation specified in the credit derivative for purposes of cash settlement is different than the underlying obligation, item (vii) below governs whether the asset mismatch is permissible;

- (v)If the protection purchaser’s right/ability to transfer the underlying obligation to the protection provider is required for settlement, the terms of the underlying obligation must provide that any required consent to such transfer may not be unreasonably withheld;

- (vi)The identity of the parties responsible for determining whether a credit event has occurred must be clearly defined. This determination must not be the sole responsibility of the protection seller. The protection buyer must have the right/ability to inform the protection provider of the occurrence of a credit event;

- (vii)A mismatch between the underlying obligation and the reference obligation under the credit derivative (i.e. the obligation used for purposes of determining cash settlement value or the deliverable obligation) is permissible if (i) the reference obligation ranks pari passu with or is junior to the underlying obligation, and (ii) the underlying obligation and reference obligation share the same obligor (i.e., the same legal entity) and legally enforceable cross-default or cross-acceleration clauses are in place; and

- (viii)A mismatch between the underlying obligation and the obligation used for purposes of determining whether a credit event has occurred is permissible if (i) the latter obligation ranks pari passu with or is junior to the underlying obligation, and (ii) the underlying obligation and reference obligation share the same obligor (i.e., the same legal entity) and legally enforceable cross-default or cross-acceleration clauses are in place.

125.When the restructuring of the underlying obligation is not covered by the credit derivative, but the other requirements in the previous paragraph are met, partial recognition of the credit derivative will be allowed. If the amount of the credit derivative is less than or equal to the amount of the underlying obligation, 60% of the amount of the hedge can be recognized as covered. If the amount of the credit derivative is larger than that of the underlying obligation, then the amount of eligible hedge is capped at 60% of the amount of the underlying obligation.

126.Only credit default swaps and total return swaps that provide credit protection equivalent to guarantees will be eligible for recognition. The exception stated in paragraph 127 below applies.

127.Where a bank buys credit protection through a total return swap and records the net payments received on the swap as net income, but does not record offsetting deterioration in the value of the asset that is protected (either through reductions in fair value or by an addition to reserves), the credit protection will not be recognised. The treatment of first-to-default and second-to-default products is covered separately in paragraphs 142 to 145.

128.Other types of credit derivatives will not be eligible for recognition at this time. Note that cash funded credit linked notes issued by the bank against exposures in the banking book which fulfil the criteria for credit derivatives will be treated as cash collateralised transactions.

b) Range of eligible guarantors (counter-guarantors)/protection providers

129.Credit protection given by the following entities will be recognised:

- (i)Sovereign entities (including the Bank for International Settlements, the International Monetary Fund, the European Central Bank and the European Community, as well as those MDBs eligible for 0% risk weight listed in paragraph 14), PSEs, banks (including other MDBs) and Securities Firms with a lower risk weight than the counterparty;

- (ii)Other entities rated A- or better by an eligible credit assessment institution. This would include credit protection provided by parent, subsidiary and affiliate companies when they have a lower risk weight than the obligor.

c) Risk weights

130.The protected portion is assigned the risk weight of the protection provider. The uncovered portion of the exposure is assigned the risk weight of the underlying counterparty.

131.Materiality thresholds on payments below which no payment is made in the event of loss are equivalent to retained first loss positions and must be deducted in full from the capital of the bank purchasing the credit protection.

Proportional cover

132.Where the amount guaranteed, or against which credit protection is held, is less than the amount of the exposure, and the secured and unsecured portions are of equal seniority, i.e., the bank and the guarantor share losses on a pro-rata basis capital relief will be afforded on a proportional basis: i.e., the protected portion of the exposure will receive the treatment applicable to eligible guarantees/credit derivatives, with the remainder treated as unsecured.

Tranched cover

133.Where the bank transfers a portion of the risk of an exposure in one or more tranches to a protection seller or sellers and retains some level of risk of the loan and the risk transferred and the risk retained are of different seniority, banks may obtain credit protection for either the senior tranches (e.g., second loss portion) or the junior tranche (e.g., first loss portion). In this case, the rules as set out in the Securitisation chapter below will apply.

d) Currency mismatches

134.Where the credit protection is denominated in a currency different from that in which the exposure is denominated — i.e., there is a currency mismatch — the amount of the exposure deemed to be protected will be reduced by the application of a haircut HFX, i.e.

where:

G = Nominal amount of the credit protection; HFX = Haircut appropriate for currency mismatch between the credit protection and underlying obligation. 135.The appropriate haircut based on a 10-business day holding period (assuming daily marking-to-market) will be applied. Banks using the supervisory haircuts shall apply 8%. The haircut value of 8% must be scaled up using the square root of time formula, depending on the frequency of revaluation of the credit protection as described in paragraphs 106.

e) Sovereign guarantees and counter-guarantees

136.Portions of claims guaranteed by the UAE sovereign, where the guarantee is denominated in AED and the exposure is funded in AED are risk weighted at 0%. A claim may be covered by a guarantee that is indirectly counter-guaranteed by a sovereign. Such a claim may be treated as covered by a sovereign guarantee provided that:

- (i)The sovereign counter-guarantee covers all credit risk elements of the claim;

- (ii)Both the original guarantee and the counter-guarantee meet all operational requirements for guarantees, except that the counter-guarantee need not be direct and explicit to the original claim; and

- (iii)The Central Bank is satisfied that the cover is robust and that no historical evidence suggests that the coverage of the counter-guarantee is less than effectively equivalent to that of a direct sovereign guarantee.

F. Maturity Mismatches

137.For the purposes of calculating risk-weighted assets, a maturity mismatch occurs when the residual maturity of a hedge is less than that of the underlying exposure.

a) Definition of maturity

138.The maturity of the underlying exposure and the maturity of the hedge must both be defined conservatively. The effective maturity of the underlying must be gauged as the longest possible remaining time before the counterparty is scheduled to fulfil its obligation, taking into account any applicable grace period. For the hedge, embedded options which may reduce the term of the hedge must be taken into account so that the shortest possible effective maturity is used. Where a call is at the discretion of the protection seller, the maturity will always be at the first call date. If the call is at the discretion of the protection buying bank but the terms of the arrangement at origination of the hedge contain a positive incentive for the bank to call the transaction before contractual maturity, the remaining time to the first call date will be deemed to be the effective maturity (For example, where there is a step-up in cost in conjunction with a call feature or where the effective cost of cover increases over time even if credit quality remains the same or increases, the effective maturity will be the remaining time to the first call).

b) Risk weights for maturity mismatches

139.As outlined in paragraph 95, hedges with maturity mismatches are only recognized when their original maturities are greater than or equal to one year. As a result, the maturity of hedges for exposures with original maturities of less than one year must be matched to be recognised. In all cases, hedges with maturity mismatches will no longer be recognised when they have a residual maturity of three months or less.

140.When there is a maturity mismatch with recognised credit risk mitigants (collateral, on-balance sheet netting, guarantees and credit derivatives) the following adjustment will be applied.

where:

Pa = Value of the credit protection adjusted for maturity mismatch; P = Credit protection (e.g., collateral amount, guarantee amount) adjusted for any haircuts; t = min (T, residual maturity of the credit protection arrangement) expressed in years; and T = min (5, residual maturity of the exposure) expressed in years.

G. Other Items Related to the Treatment of CRM Techniques

a) Treatment of pools of CRM techniques

141.In the case where a bank has multiple CRM techniques covering a single exposure (e.g. a bank has both collateral and guarantee partially covering an exposure), the bank will be required to subdivide the exposure into portions covered by each type of CRM technique (e.g. portion covered by collateral, portion covered by guarantee) and the risk-weighted assets of each portion must be calculated separately. When credit protection provided by a single protection provider has differing maturities, they must be subdivided into separate protection as well.

b) First-to-default credit derivatives

142.There are cases where a bank obtains credit protection for a basket of reference names and where the first default among the reference names triggers the credit protection and the credit event also terminates the contract. In this case, the bank may recognize regulatory capital relief for the asset within the basket with the lowest risk-weighted amount, but only if the notional amount is less than or equal to the notional amount of the credit derivative.

143.With regard to the bank providing credit protection through such an instrument, if the product has an external credit assessment from an eligible credit assessment institution, the risk weight applied to securitisation tranches will be specified in the Securitisation Standard. If the product is not rated by an eligible external credit assessment institution, the risk weights of the assets included in the basket will be aggregated up to a maximum of 1250% and multiplied by the nominal amount of the protection provided by the credit derivative to obtain the risk-weighted asset amount.

c) Second-to-default credit derivatives

144.In the case where the second default among the assets within the basket triggers the credit protection, the bank obtaining credit protection through such a product will only be able to recognise any capital relief if first-default-protection has also been obtained or when one of the assets within the basket has already defaulted.

145.For banks providing credit protection through such a product, the capital treatment is the same as in paragraph 143, with one exception. The exception is that, in aggregating the risk weights, the asset with the lowest risk weighted amount can be excluded from the calculation.