Book traversal links for 4.3.2.3. Legal Persons – Common Situations

4.3.2.3. Legal Persons – Common Situations

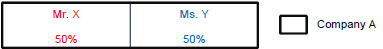

Effective from 7/6/2021In many cases, identifying the beneficial owners of a legal person customer will be a straightforward process. A customer may be directly owned by one or two individuals:

In such cases, an LFI is obliged to identify and to verify the identity of both individuals, Mr. X and Ms. Y.

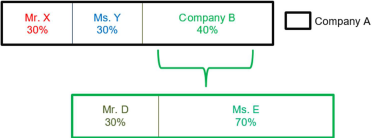

Legal persons may have more complex ownership structures, however, in which other legal persons are involved in the ownership chain. In such cases, LFIs must continue up the chain until they identify an individual:

In this situation, the owners of Company A are as follows:

| Owner | Share | Ownership Type |

| Mr. X | 30% | Direct |

| Ms. Y | 30% | Direct |

| Ms. E | 28% | Indirect - Ms E owns 70% of Company B, which in turn owns 40% of Company A |

| Mr. D | 12% | Indirect - Mr. D owns 30% of Company B, which in turn owns 40% of Company A |

Mr. X, Ms. Y, and Ms. E must all be identified under UAE law, as they own at least 25% of Company A. Mr. D owns 12%, so he is not required to be identified. But the LFI should make a risk-based decision as to whether to identify him.

Illicit actors may seek to use complex ownership structures to hide the fact that they own 25% or more of the customer. This is why it is important for LFIs to use a risk-based approach and to be confident that, at the end of the process, they fully understand who controls their customer.

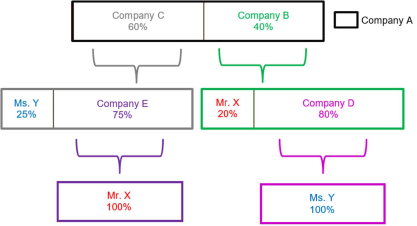

In this situation, although it at first appears that Ms. Y and Mr. X each own less than 25% of Company A, in fact between them they own 100% of the company. Their ownership interests can be calculated as follows:

Mr. X:

| • | 20% of Company B, which owns 40% of Company A: 20% of 40% is 8%; plus | |||

| • | 100% of Company E, which owns 75% of Company C, which owns 60% of Company A: 100% of 75% of 60% is 45%. | |||

| • | Mr. X owns 53% of Company A. | |||

Ms. Y:

| • | 25% of Company C, which owns 60% of Company A: 25% of 60% is 15%; plus | |||

| • | 100% of Company D, which owns 80% of Company B, which owns 40% of Company A: 100% of 80% of 40% is 32%. | |||

| • | Ms. Y owns 47% of Company A. | |||

Both Mr. X and Ms. Y must be identified under UAE law. In addition, LFIs should be aware that Mr. X and Ms. Y are likely associated parties and should question whether there is a legitimate economic purpose for the ownership structure of Company A.