Book traversal links for B. Approaches for Risk-Weighted Assets

B. Approaches for Risk-Weighted Assets

C 52/2017 STA Effective from 1/12/202226.Securitisation exposures are risk-weighted under one of two available approaches for securitisation, the Securitisation External Ratings-Based Approach (SEC-ERBA) or the Standardized Approach (SEC-SA). A bank must use SEC-ERBA if the exposure has an external credit assessment that meets the operational requirements for an external credit assessment, or an inferred rating that meets the operational requirements for inferred ratings. If a bank cannot use the SEC-ERBA, the bank must use the SEC-SA. Banks that are unable to apply either approach a securitisation exposure must assign such an exposure a risk weight of 1250%.

1.Calculation of Attachment and Detachment Points

27.Both the SEC-ERBA and the SEC-SA rely on the identification of attachment and detachment points for each securitisation tranche, which are decimal values between zero and one that capture the pool-loss conditions under which a securitisation exposure would experience losses due to the credit performance of the underlying pool of exposures.

28.The attachment point (A) represents the threshold (as a fraction of the pool’s total exposure) at which losses within the underlying pool would first be allocated to the securitisation exposure. The attachment point is calculated as:

(i) the outstanding balance of all underlying assets in the securitisation

minus

(ii) the outstanding balance of all tranches that rank senior or pari passu to the tranche that contains the securitisation exposure of the bank (including the exposure itself)

divided by

(ii) the outstanding balance of all underlying assets in the securitisation.

29.The detachment point (D) represents the threshold at which losses within the underlying pool result in a total loss of principal for the tranche in which a securitisation exposure resides. The detachment point is calculated as:

(i) the outstanding balance of all underlying assets in the securitisation

minus

(ii) the outstanding balance of all tranches that rank senior to the tranche that contains the securitisation exposure of the bank

divided by

(ii) the outstanding balance of all underlying assets in the securitisation.

30.Both A and D must be no less than zero.

31.For the calculation of A and D: (i) overcollateralization and funded reserve accounts must be recognized as tranches; and (ii) the assets forming these reserve accounts must be recognized as underlying assets. A bank can recognize only the loss-absorbing part of the funded reserve accounts that provide credit enhancement for this purpose. Unfunded reserve accounts, such as those to be funded from future receipts from the underlying exposures (e.g. unrealized excess spread) and assets that do not provide credit enhancement like pure liquidity support, currency or interest-rate swaps, or cash collateral accounts related to these instruments must not be included in the above calculation of A and D. Banks should take into consideration the economic substance of the transaction and apply these definitions conservatively.

2.External Ratings-Based Approach (SEC-ERBA)

32.For securitisation exposures that are externally rated, or for which a rating can be inferred as described below, risk-weighted assets under the SEC-ERBA will be determined by multiplying securitisation exposure amounts by the appropriate risk weights determined from Tables 1 and 2, provided that the following operational criteria for the use of external ratings are met:

- a.The external credit assessments must take into account and reflect the entire amount of credit risk exposure the bank has with regard to all payments owed to it.

- b.The external credit assessments must be from an eligible external credit assessment institution (ECAI) which is also approved by the Central Bank.

- c.The rating must be published in an accessible form, such as on a public website or in a periodically distributed paper publication. Loss and cash flow analysis as well as sensitivity of ratings to changes in the underlying rating assumptions should be publicly available.

- d.Eligible ECAIs must have a demonstrated expertise in assessing securitisations, which may be evidenced by strong market acceptance.

33.A bank may infer a rating for an unrated position from an externally rated “reference exposure” for purposes of the SEC-ERBA provided that the following operational requirements are satisfied:

- a.The reference securitisation exposure must rank pari passu or be subordinate in all respects to the unrated securitisation exposure. Credit enhancements, if any, must be taken into account when assessing the relative subordination of the unrated exposure and the reference securitisation exposure.

- b.The maturity of the reference securitisation exposure must be equal to or longer than that of the unrated exposure.

- c.The inferred rating must be updated on an ongoing basis to reflect any subordination of the unrated position or changes in the external rating of the reference securitisation exposure.

- d.The external rating of the reference securitisation exposure must satisfy the general requirements for recognition of external ratings as defined in this Standard.

34.Where CRM is provided to specific underlying exposures or to the entire pool by an eligible guarantor and the CRM is reflected in the external credit assessment of a securitisation exposure, banks should use the risk weight associated with that external credit assessment. In order to avoid any double-counting, no additional capital recognition is permitted. If the CRM provider is not recognized as an eligible guarantor, banks should treat the covered securitisation exposures as unrated.

35.In the situation where a credit risk mitigant solely protects a specific securitisation exposure within a given structure (e.g., an asset-backed security tranche) and this protection is reflected in the external credit assessment, the bank must treat the exposure as if it is unrated and then apply the CRM treatment specified in the Central Bank’s Standard for Credit Risk.

36.A bank is not permitted to use any external credit assessment for risk-weighting purposes where the assessment is based at least partly on unfunded support provided by the bank (such as a letter of credit provided by the bank that enhance the credit quality of the securitisation). If a bank buys ABCP where it provides an unfunded securitisation exposure extended to the ABCP program (e.g., liquidity facility or credit enhancement), and that exposure plays a role in determining the credit assessment on the ABCP, the bank must treat the ABCP as if it were not rated. The bank must continue to hold capital against the other securitisation exposures it provides (e.g., against the liquidity facility and/or credit enhancement).

37.For exposures with short-term ratings, or when an inferred rating based on a short-term rating is available, the risk weights in Table 1 apply unless otherwise notified by the Central Bank.

Table 1: SEC-ERBA risk weights for short-term ratings2

| External credit assessment | A-1/P-1 | A-2/P-2 | A-3/P-3 | All other ratings |

| Risk weight | 15% | 50% | 100% | 1250% |

38.For exposures with long-term ratings, or with an inferred rating based on a long-term rating, risk weights are determined according to Table 2, after adjustment for tranche maturity as specified below and, for non-senior tranches, tranche thickness as specified below (unless otherwise notified by the Central Bank).

Table 2: SEC-ERBA risk weights for long-term ratings

(Subject to adjustment for tranche maturity and tranche thickness)

| Rating | Senior | Non-senior (thin) tranche | ||

| Tranche maturity (MT) | Tranche maturity (MT) | |||

| 1 year | 5 years | 1 year | 5 years | |

| AAA | 15% | 20% | 15% | 70% |

| AA+ | 15% | 30% | 15% | 90% |

| AA | 25% | 40% | 30% | 120% |

| AA– | 30% | 45% | 40% | 140% |

| A+ | 40% | 50% | 60% | 160% |

| A | 50% | 65% | 80% | 180% |

| A– | 60% | 70% | 120% | 210% |

| BBB+ | 75% | 90% | 170% | 260% |

| BBB | 90% | 105% | 220% | 310% |

| BBB– | 120% | 140% | 330% | 420% |

| BB+ | 140% | 160% | 470% | 580% |

| BB | 160% | 180% | 620% | 760% |

| BB– | 200% | 225% | 750% | 860% |

| B+ | 250% | 280% | 900% | 950% |

| B | 310% | 340% | 1050% | 1050% |

| B– | 380% | 420% | 1130% | 1130% |

| CCC+/CCC/CCC– | 460% | 505% | 1250% | 1250% |

| Below CCC– | 1250% | 1250% | 1250% | 1250% |

39.To account for tranche maturity, banks shall use tranche maturity (MT) calculated as described below to derive the risk weight through linear interpolation between the risk weights for one year and five years from the table.

40.To account for tranche thickness, for non-senior tranches banks must multiply the risk weight derived from the table by a factor of 1-(D-A). However, the resulting risk weight must be no less than half the risk weight derived directly from the table based on maturity.

41.The risk weight is subject to a floor of 15%. In addition, the resulting risk weight should never be lower than the risk weight corresponding to a senior tranche of the same securitisation with the same rating and maturity.

Tranche maturity (MT)

42.Tranche maturity is a tranche’s remaining effective maturity in years, calculated in one of the following two ways, subject to a floor of one year and a cap of five years:

- (a)Weighted-average maturity, calculated as the weighted-average maturity of the contractual cash flows of the tranche:

where:

CFt denotes the cash flows (principal, interest payments and fees) contractually payable by the borrower in period t; or

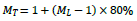

- (b)Legal maturity, based on final legal maturity of the tranche as follows:

where ML is the final legal maturity of the tranche in years.

43.Banks have discretion to choose either method to calculate tranche maturity. However, under the weighted-average maturity method, contractual payments must be unconditional and must not be dependent on the actual performance of the securitized assets. If such unconditional contractual payment dates are not available, the bank must use the legal maturity calculation.

44.When determining the maturity of a securitisation exposure, banks should take into account the maximum period of time they are exposed to potential losses from the securitized assets. In cases where a bank provides a commitment, the bank should calculate the maturity of the securitisation exposure resulting from this commitment as the sum of the contractual maturity of the commitment and the longest maturity of the assets to which the bank would be exposed after a draw has occurred. If those assets are revolving, banks should use the longest contractually possible remaining maturity of assets that might be added during the revolving period, rather than the longest maturity of the assets currently in the pool. An exception applies for credit protection instruments that are only exposed to losses that occur up to the maturity of that instrument. In such cases, a bank is allowed to apply the contractual maturity of the credit protection and is not required to look through to the protected position.

3.Standardized Approach (SEC-SA)

45.Under the SEC-SA, a bank calculates risk weights using a supervisory formula and the following bank-supplied inputs:

W : the ratio of delinquent underlying exposures to total underlying exposures in the securitisation pool;

KSA : the capital charge that would apply to the underlying exposures had they not been securitized;

A : the tranche attachment point as defined above; and

D : the tranche detachment point as defined above.

46.KSA is the weighted-average capital charge of the entire portfolio of underlying exposures, calculated as 8% multiplied by the average risk weight of the underlying pool exposures. The average risk weight is the total risk-weighted asset amount divided by the sum of the underlying exposure amounts. This calculation should take into account the effects of any credit risk mitigation applied to the underlying exposures (either individually or to the entire pool). KSA is expressed as a decimal between zero and one; that is, a weighted-average risk weight of 100% means that KSA would equal 0.08.

47.For structures involving an SPE, banks should treat all of the SPE’s exposures related to the securitisation as exposures in the pool, including assets in which the sPE may-have invested such as reserve accounts or cash collateral accounts, and claims against counterparties resulting from interest swaps or currency swaps. A bank can exclude exposures from the calculation if the bank can demonstrate to the Central Bank that the risk does not affect its particular securitisation exposure or that the risk is immaterial, for example because it has been mitigated.

48.In the case of funded synthetic securitisations, any proceeds of the issuances of credit-linked notes or other funded obligations of the sPE that serve as collateral for the repayment of the securitisation exposure in question, and which the bank cannot demonstrate to the Central Bank are immaterial, must be included in the calculation of KSA if the default risk of the collateral is subject to the tranched loss allocation.

49.In cases where a bank has set aside a specific provision or has a non-refundable purchase price discount on an exposure in the pool, KSA must be calculated using the gross amount of the exposure without the specific provision and/or non-refundable purchase price discount.

50.The variable W equals the ratio of the sum of the nominal amount of delinquent underlying exposures to the nominal amount of underlying exposures. Delinquent underlying exposures are defined as underlying exposures that are 90 days or more past due, subject to bankruptcy or insolvency proceedings, in the process of foreclosure, held as real estate owned, or in default, where default is defined within the securitisation deal documents.

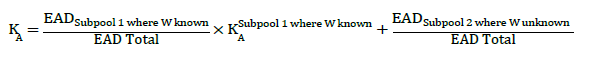

51.The inputs KSA and W are used as inputs to calculate KA, as follows:

![]()

52.If a bank does not know the delinquency status of the entire pool, the bank should adjust the calculation of KA as follows, using the relevant nominal amounts of exposures in the pool (denoted EAD below):

However, if the portion of the pool for which the bank does not know the delinquency status exceeds 5 percent of the total pool, the securitisation exposure must be risk weighted at 1250%.

53.The capital requirement per unit of the securitisation exposure under the SEC-SA is:

![]()

54.The supervisory parameter ρ is set equal to 1 for a securitisation exposure that is not a resecuritisation exposure. (See below for the case of resecuritisation exposures.)

55.The risk weight assigned to a securitisation exposure when applying the SEC-SA is calculated as follows:

- •When D for a securitisation exposure is less than or equal to KA, the exposure must be assigned a risk weight of 1250%.

- •When A for a securitisation exposure is greater than or equal to KA, the risk weight of the exposure, expressed as a percentage, is 12.5×K.

When A is less than KA and D is greater than KA, the applicable risk weight is a weighted average of 1250% and 12.5×K according to the following formula:

![]()

56.The risk weight for market-risk hedges such as currency or interest rate swaps shall be inferred from a securitisation exposure that is pari passu to the swaps or, if such an exposure does not exist, from the next subordinated tranche.

57.The SEC-SA risk weights are subject to a floor risk weight of 15%. Moreover, when a bank applies the SEC-SA to an unrated junior exposure in a transaction where the more senior tranches (exposures) are rated and no rating can be inferred for the junior exposure, the resulting risk weight under SEC-SA for the junior unrated exposure shall not be lower than the risk weight for the next more senior rated exposure.

2 The rating designations used in this an all other tables are for illustrative purposes only, and do not indicate any preference for, or endorsement of, any particular external assessment system.