Book traversal links for A. Standardised Approach

A. Standardised Approach

C 52/2017 GUI Effective from 1/4/202133.Consider a bank applying the SEC-SA to a securitisation exposure for which the underlying pool of assets has a required capital ratio of 9% under the standardised approach to credit risk. Suppose that the delinquency rate is unknown for 1% of the exposures in the underlying pool, but for the remaining 99% of the pool the delinquency rate is known to be 6%. The bank holds an investment of 100 million in a tranche that has an attachment point of 5% and a detachment point of 25%. Finally, assume that the pool does not itself contain any securitisation exposures, so the exposure is not a resecuritisation.

34.In this example, KSA is given at 9%. To adjust for the known delinquency rate on the pooled assets, the bank computes an adjusted capital ratio:

(1 − W) × KSA + (W × 0.5) = 0.94 × 0.09 + 0.06 × 0.5 = 0.1146

35.This calculated capital ratio must be further adjusted for the fact that the delinquency rate is unknown for a small portion (1%) of the underlying asset pool:

KA = 0.99 × 0.1146 + 0.01 = 0.1235

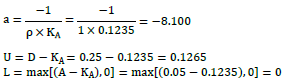

36.Next, the bank applies the supervisory formula to calculate the capital required per unit of securitisation exposure, using the values of the attachment point A, the detachment point D, the calculated value of KA, and the appropriate value of the supervisory parameter ρ, and noting that D>KA:

where:

Note that because this is not a resecuritisation exposure, the appropriate value of the supervisory calibration parameter rho is 1 (ρ=1).

37.Substituting the values of a, U, and L into the supervisory formula gives:

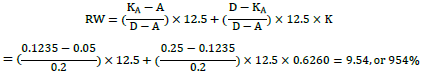

38.This tranche represents a case in which the attachment point A is less than KA but the detachment point D is greater than KA. Thus, according to the Standards, the risk weight for the bank’s exposure is calculated as a weighted average of 12.5 and 12.5×K:

39.With a tranche risk weight of 954%, the bank’s risk-weighted asset amount for this securitisation would be 954% of the 100 million investment, or 954 million. If, for example, the bank chose to apply a capital ratio of 13% to this exposure, then the bank’s required capital would be 13% of 954 million, or approximately 85 million, on the investment of 100 million in this securitisation tranche.