IV. Examples

A. CVA Capital and RWA with No Hedging

For this example, a bank has only two derivatives counterparties, Galaxy Financial with a AA credit rating, and Solar Systems with a BB credit rating. The bank computes counterparty credit risk (CCR) exposure as 800 for Galaxy, and 200 for Solar, following the requirements of the CCR Standards. The bank uses the standardised approach rather than the simple alternative to compute CVA capital and RWA.

The bank calculates the weighted average maturity for exposures to Galaxy at 3 years, and for Solar 1 year. In this example, the bank has no eligible hedges for CVA risk for either counterparty.

Example: Derivatives Portfolio for the Bank

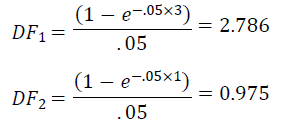

# Counterparty Name Credit Rating CCR Exposure Maturity 1 Galaxy Financial AA 800 3 years 2 Solar Systems BB 200 1 year The bank must compute the supervisory discount factor, DFi, for each of the two counterparties. Using the formula in the Standards, the calculations are:

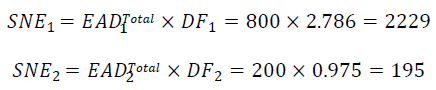

Using these supervisory discount factors, the bank calculates single-name exposure for each counterparty, taking into account the fact that there are no eligible CVA hedges:

The bank must also determine the appropriate risk weights for each of these single-name exposures. Because Galaxy is rated AA, the appropriate risk weight is 0.7% from Table 1 of the Standards. Solar is rated BB, so the corresponding risk weight is 2.0%. That is, W1=0.007, and W2=0.02.

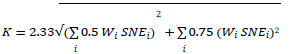

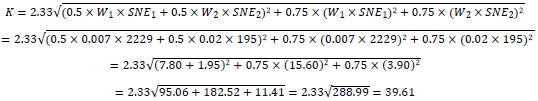

The bank’s calculation of CVA capital must use the formula in the Standards:

Substituting in the relevant values for Galaxy and Solar, the calculation is:

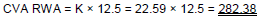

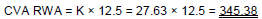

In the final step, the bank must compute RWA for CVA using the multiplicative factor of 12.5 as required in the Standards:

CVA RWA = K × 12.5 = 39.61 × 12.5 = 495.16

B. CVA Capital and RWA with a Single-Name Hedge

The bank from the previous example has the same portfolio, but in this example enters into a CDS with a third party that provides protection on Galaxy Financial, to protect against a potential increase in credit spreads that would reduce the fair value of transactions with Galaxy if Galaxy’s credit quality deteriorates. The notional value of the CDS is 400, with a maturity of 2 years. Thus, the calculation must now take into account the impact of an eligible single-name CVA hedge, with H1=400 and Mh=2.

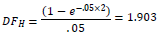

The bank must compute the supervisory discount factor for the CVA hedge:

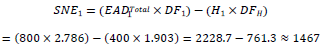

The presence of the CVA hedge for Galaxy changes. Galaxy’s SNE calculation:

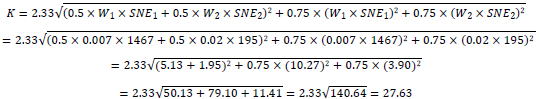

The remainder of the computations proceed as before, with the new vaue for SNE1:

In the final step, the bank computes RWA for CVA using the multiplicative factor of 12.5 as required in the Standards:

This example illustrates the impact of CVA risk mitigation, as the presence of the eligible CVA hedge reduces CVA capital and RWA compared to the previous example with no hedging.

C. CVA Capital and RWA with an Index Hedge

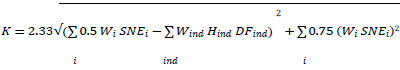

The bank from the previous example has the same portfolio, including the single-name hedge of Galaxy Financial, but now enters into an index CDS that provides credit spread protection against a basket of twenty named entities. The notional value of the index CDS is 300, with a maturity of 1.5 years. The bank’s calculation of CVA capital now takes into account the impact of an eligible index hedge, which reduces systematic CVA risk. The relevant form of the calculation from the Standards is:

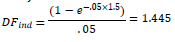

Because the bank has only one index hedge, the summation for index hedges inside the calculation has only a single (Wind Hind DFind) term. As stated above, the notional value of the hedge is Hind=300. The bank needs to calculate the appropriate supervisory discount factor for the index CDS, based on the maturity Mind=1.5 years:

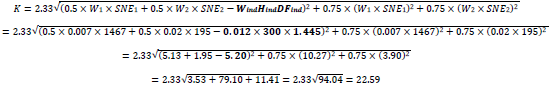

To determine the risk weight, the bank must determine the credit rating for each of the twenty reference names in the index basket, the corresponding risk weight for each rating (from Table 1 in the Standards), and the weighted average of those risk weights using the relative notional values of the component names for the weights. Suppose that through this process of analysis, the bank determines that the weighted average is 1.2% (slightly worse than BBB). As a result, Wind=0.012. The impact of risk mitigation from the index CDS enters the calculation through the term:

WindHindDFind = 0.012 × 300 × 1.445 = 5.20

The bank can now calculate CVA capital, taking into account the impact of the index hedge that mitigates systematic risk. Many of the relevant values are unchanged from the previous example, but there is the addition of the index hedge effect on systematic CVA risk:

As before, the bank computes RWA for CVA using the multiplicative factor of 12.5as required in the Standards: