Book traversal links for B. CVA Capital and RWA with a Single-Name Hedge

B. CVA Capital and RWA with a Single-Name Hedge

C 52/2017 GUI Effective from 1/4/2021The bank from the previous example has the same portfolio, but in this example enters into a CDS with a third party that provides protection on Galaxy Financial, to protect against a potential increase in credit spreads that would reduce the fair value of transactions with Galaxy if Galaxy’s credit quality deteriorates. The notional value of the CDS is 400, with a maturity of 2 years. Thus, the calculation must now take into account the impact of an eligible single-name CVA hedge, with H1=400 and Mh=2.

The bank must compute the supervisory discount factor for the CVA hedge:

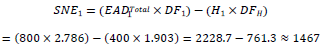

The presence of the CVA hedge for Galaxy changes. Galaxy’s SNE calculation:

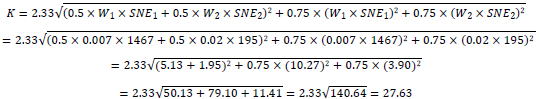

The remainder of the computations proceed as before, with the new vaue for SNE1:

In the final step, the bank computes RWA for CVA using the multiplicative factor of 12.5 as required in the Standards:

![]()

This example illustrates the impact of CVA risk mitigation, as the presence of the eligible CVA hedge reduces CVA capital and RWA compared to the previous example with no hedging.