Book traversal links for A. CVA Capital and RWA with No Hedging

A. CVA Capital and RWA with No Hedging

C 52/2017 GUI Effective from 1/4/2021For this example, a bank has only two derivatives counterparties, Galaxy Financial with a AA credit rating, and Solar Systems with a BB credit rating. The bank computes counterparty credit risk (CCR) exposure as 800 for Galaxy, and 200 for Solar, following the requirements of the CCR Standards. The bank uses the standardised approach rather than the simple alternative to compute CVA capital and RWA.

The bank calculates the weighted average maturity for exposures to Galaxy at 3 years, and for Solar 1 year. In this example, the bank has no eligible hedges for CVA risk for either counterparty.

Example: Derivatives Portfolio for the Bank

| # | Counterparty Name | Credit Rating | CCR Exposure | Maturity |

| 1 | Galaxy Financial | AA | 800 | 3 years |

| 2 | Solar Systems | BB | 200 | 1 year |

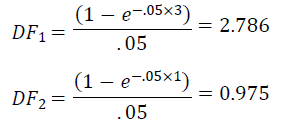

The bank must compute the supervisory discount factor, DFi, for each of the two counterparties. Using the formula in the Standards, the calculations are:

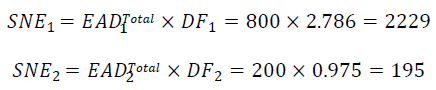

Using these supervisory discount factors, the bank calculates single-name exposure for each counterparty, taking into account the fact that there are no eligible CVA hedges:

The bank must also determine the appropriate risk weights for each of these single-name exposures. Because Galaxy is rated AA, the appropriate risk weight is 0.7% from Table 1 of the Standards. Solar is rated BB, so the corresponding risk weight is 2.0%. That is, W1=0.007, and W2=0.02.

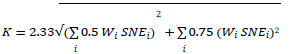

The bank’s calculation of CVA capital must use the formula in the Standards:

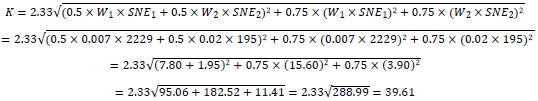

Substituting in the relevant values for Galaxy and Solar, the calculation is:

In the final step, the bank must compute RWA for CVA using the multiplicative factor of 12.5 as required in the Standards:

CVA RWA = K × 12.5 = 39.61 × 12.5 = 495.16