Book traversal links for Maturity Factor

Maturity Factor

C 52/2017 STA Effective from 1/12/202228.Banks must determine a maturity factor (MF) for each transaction for use in calculations of effective notional amounts, with the specific calculation method for MF depending on whether the derivative transaction is margined or un-margined.

29.For un-margined transactions, the maturity factor must be set equal to 1.0, unless the remaining maturity of the derivative transaction is less than one year. If the remaining maturity is less than one year, the maturity factor for an un-margined transaction is computed as the square root of the remaining maturity expressed in years, on a business-day-count basis, as follows:

![]()

30.If an un-margined transaction has a remaining maturity of 10 business days or less, the bank must set the maturity factor equal to the square root of (10/250).

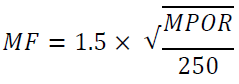

31.For margined transactions, the maturity factor MF must be based on the margin period of risk (MPOR) appropriate for the margining agreement containing the transaction, measured in days, and computed as follows:

32.The bank must determine MPOR based on the terms of the margined transaction, subject to the following minimums:

- a)At least ten business days for non-centrally-cleared derivative transactions subject to daily margin agreements.

- b)At least five business days for centrally cleared derivative transactions subject to daily margin agreements that clearing members have with their clients.

- c)At least twenty business days for netting sets consisting of 5000 or more transactions that are not centrally cleared.

33.The bank must double the MPOR for netting sets that have experienced more than two margin call disputes over the previous two calendar quarters if those disputes were not resolved within a period corresponding to the MPOR that would otherwise be applicable.

Allocation of Transactions to Hedging Sets

34.Banks must allocate every transaction within each netting set to a hedging set according to the following rules for each asset class:

- a)Interest Rate Derivatives: A hedging set must be created for each set of interest rate derivatives that reference interest rates of the same currency. Interest rate derivative hedging sets are further subdivided into maturity categories, as described below. In interest rate hedging sets, full offset is recognized between long and short positions within one maturity category, and partial offset across maturity categories. Note that the number of interest rate hedging sets may differ between different netting sets, depending on the number of distinct currencies.

- b)Foreign Exchange Derivatives: A hedging set consists of derivatives that reference the same currency pair. Full offset is recognized between long and short positions in any currency pair. Note that the number of foreign exchange hedging sets may vary between different netting sets.

- c)Credit Derivatives: All credit derivatives should be allocated to a single hedging set. Full offset is recognized between long and short positions referencing the same entity (name or index) within the hedging set.

- d)Equity Derivatives: All equity derivatives should be allocated to a single hedging set. Full offset is recognized between long and short positions referencing the same entity (name or index) within the hedging set.

- e)Commodity Derivatives: In the commodity asset class, separate hedging sets are used for energy, metals, agriculture, and other commodities. Full offset of long and short positions is recognized between derivatives referencing the same commodity type, while PFE add-on calculations provide partial offset between different commodity types within the same commodity hedging set.

35.Basis transactions and volatility transactions must form separate hedging sets within their respective asset classes.

- a)All basis transactions in a netting set that belong to the same asset class and reference the same pair of risk factors form a single hedging set, and follow the hedging set aggregation rules for the relevant asset class. The bank must treat each pair of risk factors as a separate hedging set.

- b)The bank must place all volatility transactions in a netting set into a distinct hedging set within the corresponding asset class, according to the rules of that asset class. For example, all equity volatility transactions within a netting set form a single volatility hedging set within that netting set.

Add-on for Interest Rate Derivatives

36.For interest rate derivatives, banks must assign each contract to one of three maturity categories based on the remaining life of the contract:

- •Maturity Category 1: Less than one year

- •Maturity Category 2: From one year to five years

- •Maturity Category 3: Greater than five years

37.The bank must then calculate the effective notional amount for each interest rate derivative hedging set (that is, for the set of interest rate derivatives in any single currency) by summing across transactions within a maturity category the product of the adjusted notional amount of the transaction, the maturity factor for the transaction, and the supervisory delta adjustment. That is, for each individual interest rate derivative within a maturity category in a single hedging set, the bank must calculate:

and then sum that product across all interest rate derivatives in one maturity category in that hedging set to get the effective notional amount.

38.For each interest rate hedging set, the result will be three effective notional amounts, one for each maturity category: D1 for Category 1, D2 for Category 2, and D3 for Category 3. The bank may then combine these effective notional amounts from each maturity category using the following formula:

![]()

39.As an alternative, the bank may choose to combine the effective notional values as the simple sum of the absolute values for each of the three maturity categories within a hedging set, which has the effect of ignoring potential offsets. That is, as an alternative to the calculation above, the bank may calculate:

40.Regardless of the approach used to combine the effective notional amounts, the bank must multiply the result of the calculation by the supervisory factor for the interest rate asset class from Table 2, and sum across all interest rate hedging sets to calculate the aggregate add-on for the interest rate asset class.

Add-on for Foreign Exchange Derivatives

41.For foreign exchange derivatives, banks must calculate the effective notional amount for each hedging set (that is, for the set of foreign exchange derivatives referencing a single currency pair) by summing across transactions within a hedging set the product of the adjusted notional amount of the transaction, the maturity factor for the transaction, and the supervisory delta adjustment. That is, for each individual foreign exchange derivative in a single hedging set (that is, referencing a single currency pair), the bank must calculate:

and then sum that product across all foreign exchange derivatives in that hedging set to get the effective notional amount for the hedging set.

42.The bank must multiply the absolute value of the resulting effective notional amount for each hedging set (each currency pair) by the supervisory factor for the foreign exchange asset class from Table 2, and sum across all foreign exchange hedging sets to calculate the aggregate add-on for the foreign exchange asset class.

Add-on for Credit Derivatives

43.For credit derivatives, banks must calculate the effective notional amount for each entity (that is, for each set of credit derivatives referencing a single name or credit index) by summing, across all credit derivative transactions that reference that entity, the product of the adjusted notional amount of the transaction, the maturity factor for the transaction, and the supervisory delta adjustment. That is, for each individual credit derivative referencing any single entity, the bank must calculate:

for each transaction and then sum that product across all credit derivatives that reference that entity to get the effective notional amount for the entity.

44.The bank must calculate the entity-level add-on by multiplying the result of this calculation by the appropriate supervisory factor from Table 2, depending on the rating of the entity (for single-name derivatives) or depending on whether the index is investment grade or speculative grade (for index derivatives).

45.For credit derivatives that reference unrated single-name entities, the bank should use the Supervisory Factor corresponding to BBB rated entities. However, where the entity has an elevated risk of default, banks should use the Supervisory Factor corresponding to BB rated entities. For credit index entities, the classification into investment grade or speculative grade should be determined based on the credit quality of the majority of the individual components of the index.

46.The bank must use the entity-level add-ons to calculate the add-on for the credit derivative hedging set. This is done through a calculation based on the use of supervisory correlation factors from Table 2. Specifically, the bank must calculate the add-on for the credit derivative hedging set by calculating:

![]()

where Ai is the entity-level add-on for one entity (each “i” is a different entity, either single-name or index), and

ρi is the supervisory correlation (either 0.5 or 0.8) for that entity.

47.Note that credit derivatives that are basis or volatility transactions must be treated in separate hedging sets within the credit derivatives asset class, with adjustments to supervisory factors as required under this Standard. In that case, the add-on for the credit derivatives asset class is the sum of the hedging set add-on calculated above, plus add-ons for any basis or volatility hedging sets.

Add-on for Equity Derivatives

48.For equity derivatives, banks must calculate the effective notional amount for each entity (that is, for each set of equity derivatives referencing a single name or equity index) by summing, across all equity derivatives transactions that reference that entity, the product of the adjusted notional amount of the transaction, the maturity factor for the transaction, and the supervisory delta adjustment. That is, for each individual equity derivative referencing any single entity, the bank must calculate:

for each transaction and then sum that product across all equity derivatives that reference that entity to get the effective notional amount for the entity.

49.The bank must calculate the entity-level add-on by multiplying the result of this calculation by the appropriate supervisory factor from Table 2.

50.The bank must use the entity-level add-ons to calculate the add-on for the equity derivative hedging set. This is done through a calculation based on the use of supervisory correlation factors from Table 2 for single-name equities and equity indexes. Specifically, the bank must calculate the add-on for the equity derivative hedging set by calculating:

![]()

where,

Ai is the entity-level add-on for one entity (each “i” is a different entity, either single-name or index), and

ρi is the supervisory correlation for that entity from Table 2.

51.Note that equity derivatives that are basis or volatility transactions must be treated in separate hedging sets within the equity derivatives asset class, with adjustments to supervisory factors as required under this Standard. In that case, the add-on for the equity derivatives asset class is the sum of the hedging set add-on calculated above, plus add-ons for any basis or volatility hedging sets.

Add-on for Commodity Derivatives

52.For the commodity asset class, a bank must assign each commodity derivative to one of the four hedging sets: energy, metals, agriculture, or other. The bank should also define one or more commodity types within each hedging set, and assign each derivative transaction to one of those commodity types. Long and short trades within a single commodity type can be fully offset.

53.The bank must establish appropriate governance processes for the creation and maintenance of the list of defined commodity types that are used for CCR calculations. These types should have clear definitions stated in written policies, and independent internal review or validation processes should ensure that the commodity types are applied properly. Internal review and validation processes also should determine that commodities grouped as a single type are in fact reasonably similar. Only commodity types established through adequately controlled internal processes may be used.

54.Banks must calculate the effective notional amount for each commodity type (that is, for each set of commodity derivatives that reference commodities of the same type) by summing, across all transactions that reference that commodity type, the product of the adjusted notional amount of the transaction, the maturity factor for the transaction, and the supervisory delta adjustment. That is, for each individual commodity derivative referencing any single commodity type, the bank must calculate:

for each transaction and then sum that product across all commodity derivatives that reference that commodity type to get the effective notional amount for the commodity type.

55.The bank must calculate the add-on for each commodity type by multiplying the result of this calculation by the appropriate supervisory factor from Table 2.

56.The bank must use the add-ons for each commodity type to calculate the add-on for each hedging set (energy, metals, agriculture, and other). This is done through a calculation using the supervisory correlation factor for commodity derivatives. Specifically, the bank must calculate the add-on for each of the four commodity derivative hedging sets by calculating:

![]()

where ρ is the supervisory correlation factor for commodity derivatives,

and Ai is the add-on for one commodity type within the hedging set (each “i” is a different commodity type within a given hedging set).

57.Note that commodity derivatives that are basis or volatility transactions must be treated in separate hedging sets within the commodity derivatives asset class, with adjustments to supervisory factors as required under this Standard.

58.The add-on for the commodity derivatives asset class is the sum of the four hedging set add-ons as calculated above (some of which may be zero if the bank has no derivatives within one of the four hedging sets), plus corresponding add-ons for any basis or volatility hedging sets.

59.Commodity hedging sets have been defined in this Standard without regard to other potentially important characteristics of commodities, such as location and quality. For example, the energy hedging set contains commodity types such as crude oil, electricity, natural gas, and coal. The Central Bank may require a bank to use more refined definitions of commodity types if the Central Bank determines that the bank is significantly exposed to the basis risk of different products within any bank-defined commodity type.